4 Gas Distribution Stocks to Watch Amid Dull Industry Prospects

Natural Gas Distribution companies offer services to transport natural gas from the region of production to millions of consumers across the United States. The utilities under the Zacks Utility Gas Distribution industry control miles of underground pipeline network to provide natural gas services to the customers. The rising demand for clean, burning natural gas will create more opportunities for natural gas distribution companies.

Atmos Energy Corporation ATO, with its widespread transmission and distribution lines and interstate pipelines, and significant investments in infrastructure development projects, is poised to benefit as natural gas production volumes are expected to increase in the 2023-2024 time frame. Steady investments and expanding infrastructure in crucial production regions should drive the performance of MDU Resources Group MDU, Sempra Energy SRE and NewJersey Resources NJR.

About the Industry

The shale revolution has substantially increased natural gas production. Its clean-burning nature steadily boost demand for natural gas from all customer groups. Natural gas distribution pipelines are vital in delivering natural gas from intrastate and interstate transmission pipelines to consumers through small-diameter pipelines. The natural gas network in the United States has nearly 2.3 million miles of underground distribution pipelines. Major concerns for the industry are aging infrastructure and rising investment costs required to upgrade and maintain the vast network of pipelines due to the hike in interest rates. Competition from other clean energy sources can lower demand for natural gas and, consequently, for pipelines.

Factors Shaping the Future of the Gas Distribution Industry

Aging Distribution Infrastructure: The existing U.S. natural gas distribution pipelines are aging. Leakage or breakage in these old cast iron and bare steel pipelines may disrupt services. Natural gas distribution utilities currently provide services to over 80 million customers in the United States. Per a report from Business Roundtable, replacing the old pipelines will cost around $270 billion. Per Playbook.Aga.org, the natural gas utilities invest nearly $32 billion each year to improve the distribution network's safety. To lower the possibility of service interruption, the Department of Energy announced $33 million in funding for 10 projects involved in natural gas pipeline retrofitting to rehabilitate existing cast iron and bare steel pipes. The Rapid Encapsulation of Pipelines Avoiding Intensive Replacement or the REPAIR program will ensure the minimum extension of the service life of distribution pipelines by 50 years and lower the replacement cost of old pipelines by nearly 10 to 20 times per mile. Currently, pipe excavation and replacement costs can go up to $10 million per mile. The rising interest rates will increase the overall project financing cost for the utilities compared with what these companies have enjoyed in the past two years.

Production and Export Volumes of Gas to Increase: The short-term energy outlook released by the EIA indicates that domestic dry natural gas production will grow to 103 billion cubic feet per day (Bcf/d) in 2023 and increase 1.06% year over year to 104.1 Bcf/d in 2024. The increase in gas production volumes has improved from earlier forecasts of EIA due to strong volumes from the Permian region. Export volumes are expected to increase in 2023 and 2024, providing much relief to natural gas transporters. EIA expects U.S. gross liquefied natural gas (LNG) export volumes to increase nearly 12% year over year to 11.9 Bcf/d in 2023, and exports are expected to increase 12.2% to 13.31 Bcf/d in 2024. Per the Playbook.AGA.org the United States will reach peak export capacity of 20 Bcf/d by 2025. This indicates the need for more pipelines to send the LNG to the export terminals.

Fresh Investments Create Demand: The clean-burning nature and wide availability across the United States are driving demand for natural gas. The distribution network will continue to transport natural gas to nearly 75 million customers in all parts of the United States. With three new LNG export terminals being developed in the United States, there should be increased demand for natural gas pipeline services to transfer the gas from production areas to these terminals. Per EIA, once completed, the three new LNG projects will increase the combined export capacity by 5.7 Bcf/d by 2025. Per the Playbook.AGA.org, one residential customer signs up for natural gas service every minute and 80 businesses add natural gas service each day. As production and demand for natural gas increase, more pipelines will be required to safely transfer the commodity to end-users.

Zacks Industry Rank Indicates Bleak Prospects

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates dull near-term prospects. The Zacks Utility Gas Distribution industry — a 13-stock group within the broader Zacks Utilities sector — currently carries a Zacks Industry Rank #156, which places it in the bottom 37% of the 246 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the bottom 50% of the Zacks-ranked industries results from a negative earnings outlook for the constituent companies in aggregate. Since Dec 31, 2022, earnings estimates have gone down by 11.3% to $3.20 per share.

Before we present a few Gas Distribution stocks that you may want to consider for your portfolio, let’s look at the industry’s recent stock-market performance and valuation picture.

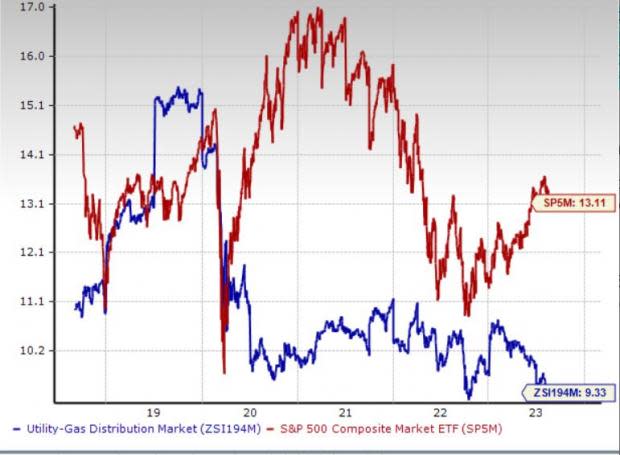

Industry Lags Sector and S&P 500

The Gas Distribution industry has lost wider than the sector and underperformed the Zacks S&P 500 composite over the past year. The stocks in this industry have collectively lost 16.6% in the same time frame compared with the Utility sector’s fall of 16.3%. The Zacks S&P 500 composite has gained 9.3% in the same time frame.

One-Year Price Performance

Gas Distribution Industry's Current Valuation

Since utility companies have a lot of debt on their balance sheets, the EV/EBITDA (Enterprise Value/ Earnings before Interest Tax Depreciation and Amortization) ratio is commonly used to value them.

The industry is trading at a trailing 12-month EV/EBITDA of 9.33X compared with the S&P 500’s 13.11X and the sector’s 17.85X. Over the past five years, the industry traded at a high of 15.45X, a low of 9.19X, and a median of 10.59X.

Utility Gas Industry vs. S&P 500 (Past Five yrs)

Utility Gas Industry vs. Sector (Past Five yrs)

4 Gas Distribution Stocks to Keep a Close Watch On

Below are four stocks that have been witnessing positive earnings estimate revisions. Two out of the four natural gas distribution stocks mentioned presently carry a Zacks Rank #2 (Buy). The other two carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

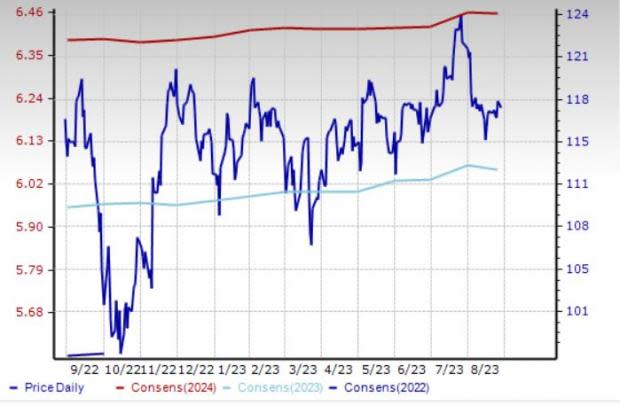

Atmos Energy Corporation: This Dallas, TX-based company is engaged in the regulated natural gas distribution and storage business. Atmos Energy plans to invest $2.8 billion in fiscal 2023 and has planned more investments through fiscal 2027. The stock currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for ATO’s fiscal 2023 earnings has moved 0.3% higher to $6.05 per share over the past 60 days. In the past three months, the stock has gained 3.5% against the industry’s decline of 4.3%. The long-term earnings (three to five years) growth rate is pegged at 7.3%.

Price and Consensus: ATO

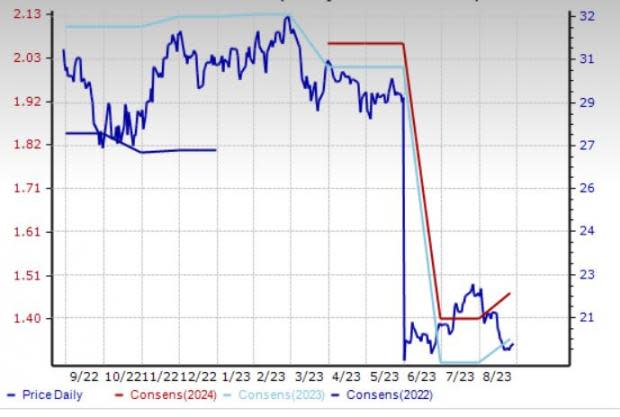

MDU Resources Group: This Bismarck, ND-based company provides value-added natural resource products and related services to its customers. The company recently spun off its construction materials subsidiary, Knife River Corporation, and focuses solely on its energy delivery business. The company has planned $528.3 million in capital investments in 2023 to strengthen its gas distribution operations further.

The Zacks Consensus Estimate for MDU’s 2023 earnings has moved 4.6% higher to $1.36 per share over the past 60 days. The stock currently carries a Zacks Rank #2. The current dividend yield of MDU is 4.4%. The long-term earnings growth rate is pegged at 5.8%.

Price and Consensus: MDU

Sempra Energy: This San Diego, CA-based company efficiently serves a population of 21.1 million, covering an area of 24,000 square miles. In the period from 2023-2026, the company aims to invest $40 billion to strengthen its existing operations. The stock currently carries a Zacks Rank #3.

The Zacks Consensus Estimate for SRE’s third-quarter 2023 earnings has moved 1% higher to 99 cents per share over the past 60 days The long-term earnings growth rate is pegged at 4.9% and the dividend yield is 3.33%. SRE’s stock has reported an average positive surprise of 9.81% in the trailing past four quarters.

Price and Consensus: SRE

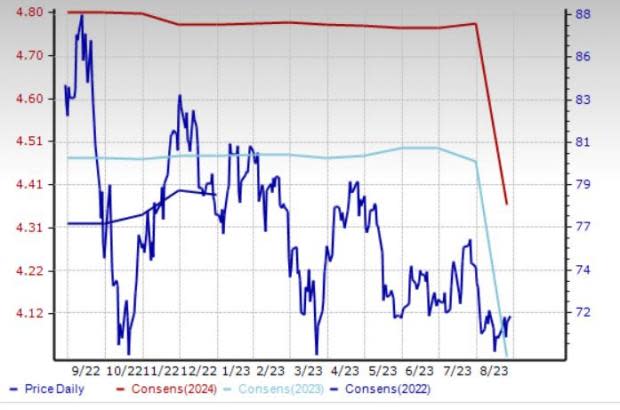

New Jersey Resources: This Wall, NJ-based company provides regulated gas distribution and retail and wholesale energy services to its customers. New Jersey Resources has plans to invest $1.1-$1.4 billion in the fiscal 2023-2024 period.

The Zacks Consensus Estimate for NJR’s fourth-quarter 2023 earnings has moved 1% higher to 97 cents per share over the past 60 days. The stock currently carries a Zacks Rank #3. Its long-term earnings growth rate is pegged at 6%, and its current dividend yield is 3.7%. NJR reported an average positive surprise of 120.8% in the last four quarters.

Price and Consensus: NJR

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Atmos Energy Corporation (ATO) : Free Stock Analysis Report

Sempra Energy (SRE) : Free Stock Analysis Report

MDU Resources Group, Inc. (MDU) : Free Stock Analysis Report

NewJersey Resources Corporation (NJR) : Free Stock Analysis Report