4 High-Quality Companies With Low Shiller Price-Earnings Ratios

As investors continue grappling with escalating coronavirus fears, four stocks with strong balance sheets and are trading below the 20-year average Shiller price-earnings ratio of the Standard & Poor's 500 Index are Grupo Aeroportuario del Sureste SAB de CV (NYSE:ASR), Biogen Inc. (NASDAQ:BIIB), Curtiss-Wright Corp. (NYSE:CW) and Intel Corp. (NASDAQ:INTC) according to the All-in-One Screener, a GuruFocus Premium feature.

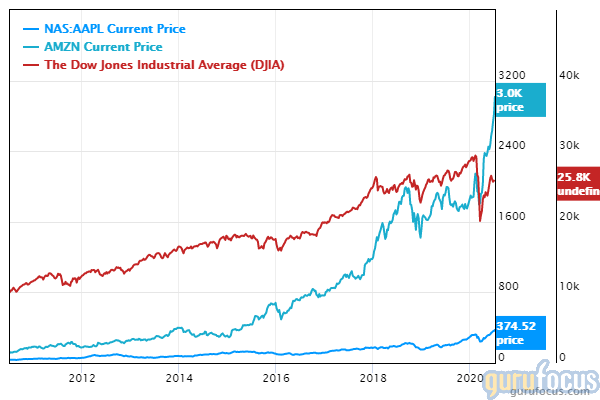

Dow kicks off week with fireworks despite surging coronavirus cases over the holiday weekend

On Monday, the Dow Jones Industrial Average closed at 26,287.03, up 459.67 points from last Thursday's close of 25,827.36.

Shares of Apple Inc. (NASDAQ:AAPL), the top holding of Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway Inc. (NYSE:BRK.A)(NYSE:BRK.B), closed at $373.85, up 2.68% from the previous close of $364.11. Additionally, shares of Amazon.com Inc. (NASDAQ:AMZN) closed at $3,057.04, topping $3,000 for the first time in the company's history and up 5.77% from the previous close of $2,890.03.

Jeff Saut, chief investment strategist at Capital Wealth Management, said on CNBC's "Squawk Box" that the U.S. economy "is doing [much better] than" what most economists think, adding that the markets could propel further in the fall. Saut's comments come on the heels of the World Health Organization's report that new coronavirus cases around the globe exceeded 200,000 on Saturday, a record increase, including over 130,000 new cases in the Americas.

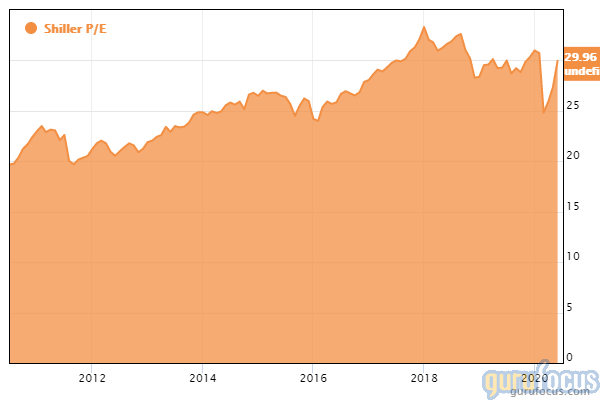

Markets remain significantly overvalued according to Buffett and Shiller valuations

Buffett's favorite market indicator, which captures the ratio of the Wilshire 5000 full cap index to U.S. gross domestic product, reached 150%, up 1.3% from the July 1 reading of 148.7% and 6% from the June 1 reading of 144%. Likewise, Yale professor Robert Shiller's cyclically-adjusted price-earnings ratio for the S&P 500 stood at 29.7, approximately 15.1% higher than the 20-year-average of 25.8.

GuruFocus started computing in June implied market returns assuming that market valuations reverse in the long run to a 20-year average ratio. The implied market return is 0.4% per year over the next eight years based on Buffett's market indicator and 3.3% per year over the next eight years based on Shiller's market indicator.

As such, investors can find good investing opportunities among stocks with the strength to weather volatile market swings driven by the coronavirus pandemic. The Screener listed several companies with high financial strength, profitability and business predictability, as well as a Shiller price-earnings ratio less than the market average of approximately 26.

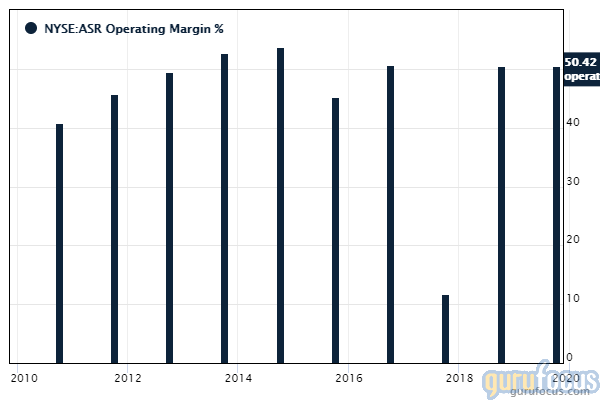

Grupo Aeroportuario del Sureste

Under its government-granted concession, Grupo Aeroportuario del Sureste operates nine airports in southeast Mexico, one airport in Puerto Rico and six in Costa Rica. GuruFocus ranks the Mexico City-based company's profitability 9 out of 10 on several positive investing signs, which include a four-star predictability rank, a high Piotroski F-score of 7 and an operating margin that is outperforming 98% of global competitors.

Gurus with holdings in Grupo Aeroportuario del Sureste include Jim Simons (Trades, Portfolio)' Renaissance Technologies and Jeremy Grantham (Trades, Portfolio)'s GMO.

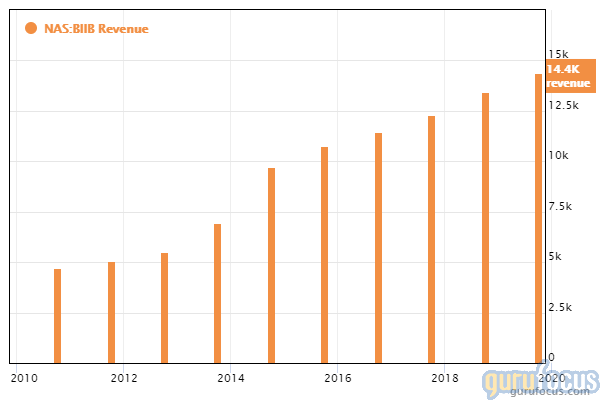

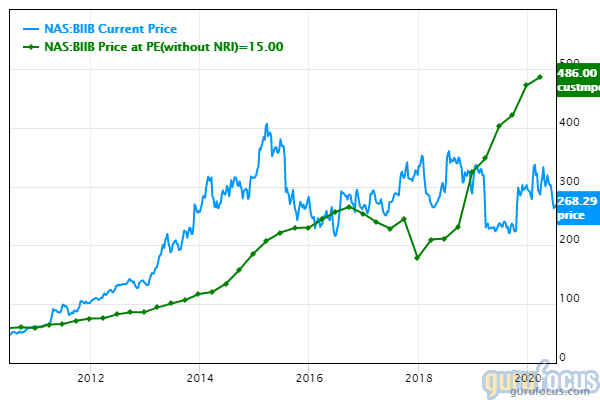

Biogen

Biogen develops a wide range of drugs for multiple sclerosis and cancer. GuruFocus ranks the Cambridge, Massachusetts-based company's profitability 10 out of 10 on several positive investing signs, which include a high Piotroski F-score of 8, a five-star business predictability rank and an operating margin that has increased approximately 2.10% per year on average over the past five years and is outperforming over 98% of global competitors.

Biogen's valuation ranks 9 out of 10 on the back of price-earnings and price-to-free-cash-flow ratios near 10-year lows and that outperform over 88% of global drug manufacturers. Additionally, the company's Shiller price-earnings ratio of 18.34 outperforms nearly 70% of global competitors.

Berkshire owns 643,022 shares of Biogen as of the March-quarter filing date. Other gurus with holdings in Biogen include PRIMECAP Management (Trades, Portfolio) and the Vanguard Health Care Fund (Trades, Portfolio).

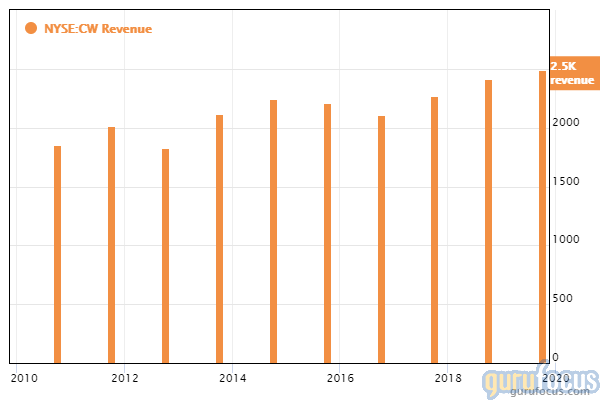

Curtiss-Wright

Curtiss-Wright delivers engineered products and services to commercial, defense, power generation and other industrial markets. GuruFocus ranks the Davidson, North Carolina-based company's profitability 8 out of 10 on several positive investing signs, which include a 4.5-star business predictability rank, a return on assets that outperforms over 86% of global competitors and an operating margin that has increased approximately 4.60% per year over the past five years.

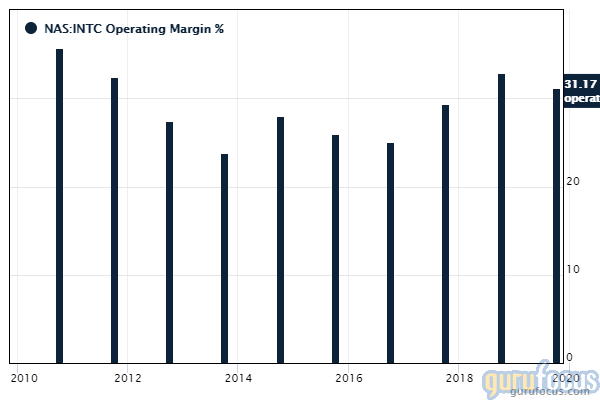

Intel

Intel designs and manufactures microprocessors for the global personal computer and data center markets. GuruFocus ranks the Santa Clara, California-based company's profitability 9 out of 10 on several positive investing signs, which include a high Piotroski F-score of 7, a four-star business predictability rank and an operating margin that has increased approximately 4.10% per year on average over the past five years and is outperforming over 97% of global competitors.

Disclosure: The author is long Apple, Biogen and Intel. Any mention of holdings in this article reflect information as of the March filing and do not include any trades made during the second quarter. Per Securities and Exchange Commission regulations, the deadline for portfolio reports is 45 days after the quarter ends.

Read more here:

Warren Buffett's Market Indicator Nears 150% Ahead of Independence Day

5 Russian and Asian Energy Stocks With High Profitability, Business Predictability

Spiros Segalas' Top 5 Buys in the 2nd Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.