4 Hospital Stocks in Focus Amid Improving Industry Trends

Hospital companies are now enjoying improving market conditions following several quarters of hardships in the form of labor shortages and rising costs. The easing staffing challenges are boosting hospitals' margins. Seniors are now undergoing delayed elective surgeries, increasing patient days and occupancies, boosting Zacks Medical-Hospital industry players' revenues. However, growing competition in this market remains a common theme. Technological innovations and implementations are expected to provide companies with a competitive edge and improve efficiency. Industry players like HCA Healthcare Inc. HCA, Universal Health Services Inc. UHS, Tenet Healthcare Corporation THC and Community Health Systems, Inc. CYH are expected to benefit from these developments.

Industry Overview

The Zacks Medical-Hospital industry comprises for-profit hospital companies that provide healthcare through different types of hospitals, such as acute care, rehabilitation and psychiatric. These hospital entities are engaged in internal medicine, general surgery, cardiology, oncology, neurosurgery, orthopedics and obstetrics, telehealth services, mental health care and diagnostic and emergency services. Revenues of these companies depend on inpatient occupancy levels, medical and ancillary services ordered by physicians and provided to patients, and the volume of outpatient procedures. These hospital companies receive payments for patient services from the government under the Medicare program, Medicaid or similar programs, managed care plans (including plans offered through the American Health Benefit Exchanges), private insurers and directly from patients.

4 Key Trends Defining Hospital Industry's Future

Growing Patient Volumes: With declining pandemic-related constraints, seniors are now undergoing delayed elective procedures. Pent-up demand for procedures like hip and knee surgeries is likely to drive patient volumes. Growth in deferred procedures, admissions, outpatient surgeries and Medicare reimbursements are expected to support hospital companies' revenues. However, inflationary pressures and financial constraints can force some patients to delay addressing certain non-emergency medical needs. The benefits of the Affordable Care Act and similar safety nets can provide patients with some respite, which can help them navigate tough times.

Expanding Elderly Population: Advancements in science, nutrition and healthcare will enable the senior population to witness constant growth. Over the long run, this will likely expand the demand for hospital services. The U.S. Census Bureau's revised report suggests that people above 65 years are projected to be one of the fastest-growing segments of the nation's population, signaling an advancement from 17% in 2020 to 21% in 2030. By 2034, older adults are predicted to outnumber children, which will be the first in U.S. history. The median age of the country grew by 0.2 years to 38.9 years during the 2021-2022 period. The change in demographic and the rising incidence of diseases are expected to be industry drivers. Also, the increasing number of people signing up for healthcare plans through the Affordable Care Act indicates fewer challenges to visiting hospitals in the future.

Technological Advancements: Technological improvements, innovations and wider adoption will continue to support hospital players. This should optimize hospitals' services, minimize unnecessary costs and elevate the patient experience. The COVID-19 pandemic triggered the adoption of telehealth and telemedicine services, which are expected to rise in the future as well. The companies are leveraging artificial intelligence (AI) and automation, along with real-time analytics, to provide quality care. AI helps improve clinical workflow management and medical diagnosis that hospitals utilize, which will limit patients' waiting time and reduce their treatment costs.

Climbing Expenses: Despite implementing cost-curbing efforts, the rising patient volumes are likely to increase operating costs. Rising prices of hospital supplies due to inflationary pressures will keep margins under pressure. Also, growth-project investments will keep expenses elevated, affecting the bottom line in the short run. However, improving labor shortages and staffing challenges will continue to provide hospital companies some breathing room. Also, contract renegotiations with suppliers and vendors will provide an impetus.

Zacks Industry Rank Depicts Promising Scenario

The group’s Zacks Industry Rank, which is the average of the Zacks Rank of all member stocks, indicates bright near-term prospects. The Zacks Medical-Hospital industry, which is housed within the broader Zacks Medical sector, currently carries a Zacks Industry Rank #114, which places it in the top 45% of nearly 250 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than two to one.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of a positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are optimistic about this group’s earnings growth potential.

Before we present the stocks that you may want to buy or watch, let’s take a look at the industry’s recent stock market performance and valuation picture.

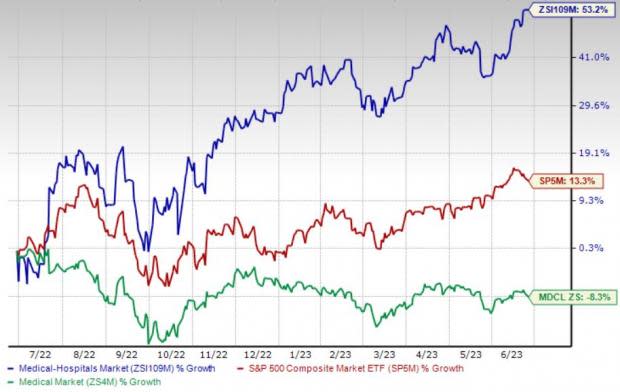

Industry Outperforms S&P 500 & Sector

The Zacks Medical-Hospital industry has fared better than the Zacks S&P 500 composite, as well as its broader sector over the past year. During this period, the stocks in this industry have gained 53.2% compared with the S&P 500’s rise of 13.3%. The Zacks Medical sector declined 8.3% during this time.

One-Year Price Performance

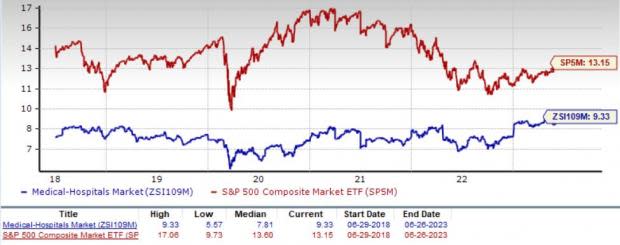

Industry's Current Valuation

On the basis of the trailing 12-month EV/EBITDA (Enterprise Value/ Earnings Before Interest Tax Depreciation and Amortization) ratio, which is commonly used for valuing hospital stocks, the industry trades at 9.33X compared with the S&P 500’s 13.15X and the sector’s 8.60X.

Over the past five years, the industry has traded as high as 9.33X and as low as 5.57X, with a median of 7.81X, as the charts below show.

EV/EBITDA Ratio (Past 5 Years)

4 Stocks Worth Your Attention

Below we have presented one stock with a Zacks Rank #2 (Buy) and three stocks with a Zacks Ranks #3 (Hold) from the Medical-Hospital industry. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

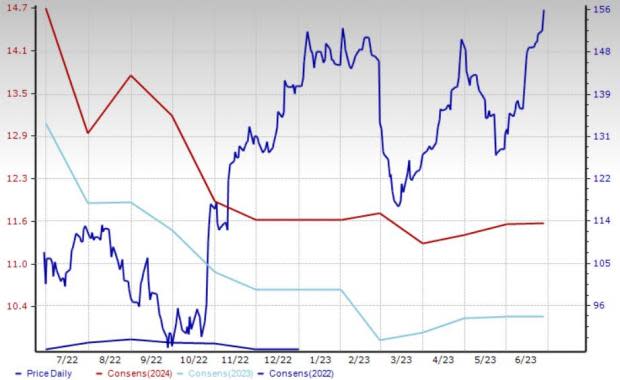

HCA Healthcare: The company provides services via surgery centers, free-standing emergency rooms, physician clinics and urgent care centers. Its prudent acquisitions enable it to persistently expand its network across several markets, increase patient volumes and add more hospitals to its portfolio. Its telemedicine business line is likely to continue increasing the top line. HCA Healthcare also focuses on boosting shareholders’ value with dividend hikes and repurchases.

The Zacks Consensus Estimate for the company’s 2023 EPS indicates 7.2% year-over-year growth. The consensus mark for its revenues in 2023 signals a 5.3% increase from a year ago. HCA Healthcare beat earnings estimates thrice in the past four quarters and missed once, the average surprise being 9%. It currently carries a Zacks Rank #2. Shares of the company have jumped 69.4% over the past year.

Price & Consensus: HCA

Universal Health Services: The company operates acute care facilities, and outpatient and behavioral health care units. It focuses on behavioral indications like autism, eating disorders, sexual trauma and disorderliness in the military through its patriot support program. UHS has been gaining traction from expanding business. Its plans to add new capacities in hospitals in important markets of Texas and California to address strong acute care demand are likely to be major tailwinds. It has a strong share buyback plan in place to boost shareholder value.

The Zacks Consensus Estimate for Universal Health’s 2023 bottom line indicates 4% year-over-year growth. The consensus mark for its revenues in 2023 signals a 5.4% increase from a year ago. UHS beat earnings estimates in all the past four quarters, the average surprise being 5.6%. It currently has a Zacks Rank #3. Shares of the company have gained 45.8% in the past year.

Price & Consensus: UHS

Tenet Healthcare Corporation: The company provides diversified healthcare services, primarily through general hospitals and related healthcare units. THC has made several acquisitions, and formed strategic partnerships and alliances to augment the scale of business, operating capacity and geographical footprint. Tenet Healthcare’s performance has been aided by USPI Holding Company’s (Ambulatory Care) operations. It also benefits from contractual rate increases in the Conifer unit.

The Zacks Consensus Estimate for THC’s 2023 bottom line is pegged at $5.71 per share, which improved 3.3% over the past 60 days. The consensus mark for its revenues in 2023 signals a 4.5% increase from the prior year. Tenet Healthcare beat earnings estimates in all the past four quarters, the average surprise being 49.4%. It currently has a Zacks Rank #3. Shares of the company have gained 40.2% over the past year.

Price & Consensus: THC

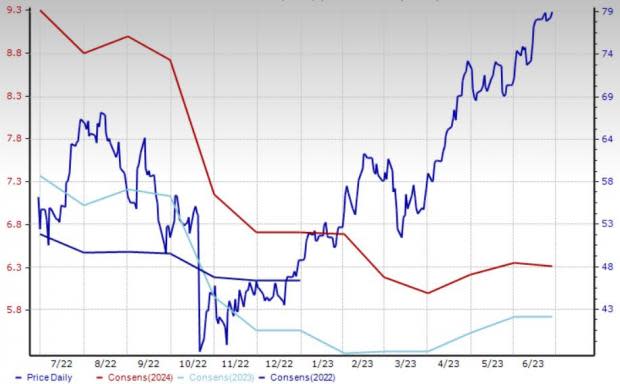

Community Health Systems: It is a leading operator of general acute care hospitals and outpatient facilities in communities across the United States. The company bolsters its diversified portfolio by adding new beds, surgery centers, making prudent acquisitions and creating alliances. It has de novo and expansion projects in the growth pipeline for inpatient facility development, as well as service line expansion projects for cardiac, neuroscience, and post-acute & specialty. Community Health also does not shy away from divesting non-core assets to boost profitability.

The Zacks Consensus Estimate for CYH’s 2023 bottom line indicates a 52.2% improvement from a year ago. The consensus mark for its revenues in 2023 signals 1.3% growth from the prior year. Community Health has witnessed one upward estimate revision over the past 30 days against none in the opposite direction. It currently has a Zacks Rank #3. Shares of the company have gained 5% in the past year.

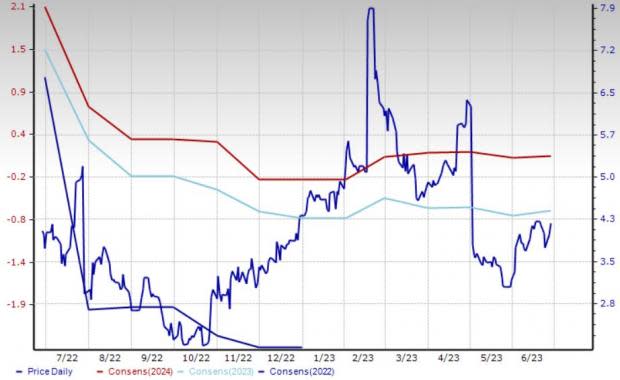

Price & Consensus: CYH

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

HCA Healthcare, Inc. (HCA) : Free Stock Analysis Report

Universal Health Services, Inc. (UHS) : Free Stock Analysis Report

Tenet Healthcare Corporation (THC) : Free Stock Analysis Report

Community Health Systems, Inc. (CYH) : Free Stock Analysis Report