These 4 Measures Indicate That GoDaddy (NYSE:GDDY) Is Using Debt Extensively

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies GoDaddy Inc. (NYSE:GDDY) makes use of debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for GoDaddy

How Much Debt Does GoDaddy Carry?

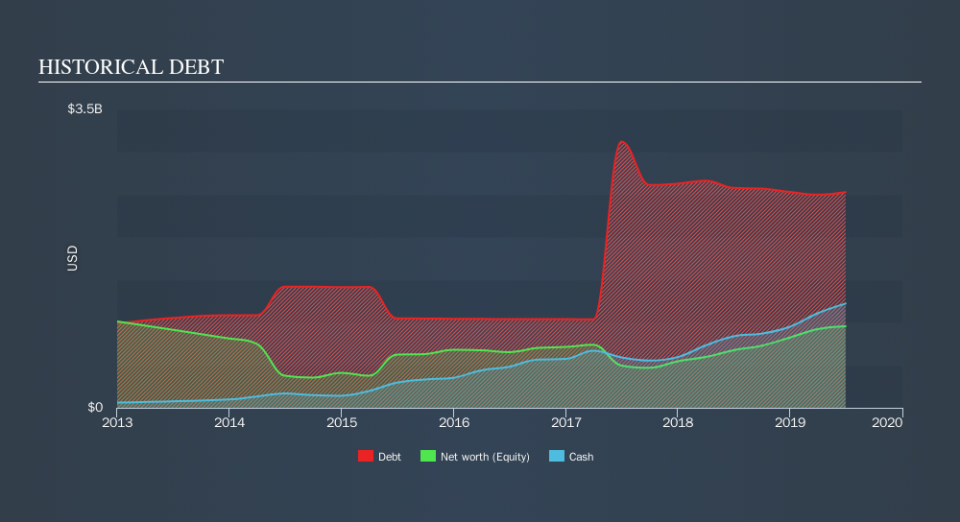

The chart below, which you can click on for greater detail, shows that GoDaddy had US$2.53b in debt in June 2019; about the same as the year before. However, it also had US$1.22b in cash, and so its net debt is US$1.31b.

How Strong Is GoDaddy's Balance Sheet?

We can see from the most recent balance sheet that GoDaddy had liabilities of US$2.02b falling due within a year, and liabilities of US$3.47b due beyond that. Offsetting this, it had US$1.22b in cash and US$24.8m in receivables that were due within 12 months. So its liabilities total US$4.25b more than the combination of its cash and short-term receivables.

GoDaddy has a very large market capitalization of US$11.8b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While we wouldn't worry about GoDaddy's net debt to EBITDA ratio of 3.9, we think its super-low interest cover of 1.1 times is a sign of high leverage. In large part that's due to the company's significant depreciation and amortisation charges, which arguably mean its EBITDA is a very generous measure of earnings, and its debt may be more of a burden than it first appears. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. Worse, GoDaddy's EBIT was down 27% over the last year. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if GoDaddy can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, GoDaddy actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

GoDaddy's EBIT growth rate and interest cover definitely weigh on it, in our esteem. But its conversion of EBIT to free cash flow tells a very different story, and suggests some resilience. Taking the abovementioned factors together we do think GoDaddy's debt poses some risks to the business. While that debt can boost returns, we think the company has enough leverage now. Given our hesitation about the stock, it would be good to know if GoDaddy insiders have sold any shares recently. You click here to find out if insiders have sold recently.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.