4 Medical Product Stocks to Buy Amid Industry Challenges

The Zacks Medical – Products industry continues to face supply-chain constraints, increased material costs and a shortage of workers. Although the companies have seen a sales recovery in 2023, the ongoing headwinds are hurting margins. The lower demand for COVID-19-related products is affecting the revenues negatively.

The budgetary constraints in U.S. hospitals and a soft Chinese market are impeding revenue growth. Revenues are expected to grow from the recovery in demand for surgeries and procedures, new products and expansion into new markets. An earlier-than-expected demand for respiratory products is also boosting sales. The industry players are raising prices to cope with the higher costs.

Industry participants like Koninklijke Philips PHG,Neogen NEOG, Haemonetics HAE and Prestige Consumer PBH have adapted to changing consumer preferences, and the majority of them are witnessing a rise in share price. These companies also carry a favorable Zacks Rank.

Industry Description

The industry includes companies providing medical products and cutting-edge technologies for healthcare services. These companies are primarily focused on research and development and primarily cater to vital therapeutic areas like cardiovascular, nephrology, and urology devices.

The strengthening of the dollar and labor shortage are hurting sales. Supply-chain disruptions following lockdowns across several countries, notably China, continue to persist, affecting the availability of certain materials used to develop medical-related products like semiconductor chips. Recent inflationary pressure and labor shortages weigh on the industry players’ gross and operating margins. The trend is likely to persist in 2024, albeit weaker. However, rising demand for medical procedures and cost-cutting initiatives are likely to drive performance.

Major Trends Shaping the Future of the Medical Products Industry

AI, Medical Mechatronics & Robotics: The rising adoption of minimally-invasive robot-assisted surgeries, self-automated home-based care, use of IT in facilitating quick and improved patient care, and the shift of the payment system to a value-based model underscore the growing influence of AI in the Medical Products space. In fact, mechatronics — a high-end technology incorporating electronics, machine learning and mechanical engineering — is rapidly becoming a defining characteristic of the space. Several companies have shown substantial prowess in AI, robotics and medical mechatronics.

Advancements in robot-assisted surgical platforms continue to be crucial with respect to minimally-invasive surgery that helps in reducing the trauma associated with open surgery. With respect to Mechatronics, the benefits of the same have been demonstrated in the form of 3D printing, which has altered the face of the medical devices industry. Currently, 3D printing is being used to print stem cells, blood vessels, heart tissues, prosthetic organs and skin.

Rising Demand for IVD: The COVID-19 outbreak led to a rise in global demand for diagnostic testing kits in order to curb the spread of the virus. Testing became the need of the hour and led to a shift in the pipeline of IVD products, with a large number of rapid, point-of-care devices going into development. Diagnostic kit-makers not only received emergency use authorization from the FDA but also bolstered production to aid testing shortages. The industry players anticipate significant demand for rapid diagnostic testing in the future as well and are poised to capitalize on the same.

Emerging Markets Hold Promise: Given the rising medical awareness and economic prosperity, emerging economies have been witnessing solid demand for medical products. An aging population, relaxed regulations, cheap skilled labor, increasing wealth and government focus on healthcare infrastructure make these markets extremely lucrative for global medical device players.

Zacks Industry Rank

The Zacks Medical Products industry falls within the broader Zacks Medical sector.

It currently carries a Zacks Industry Rank #186, which places it in the bottom 26% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all member stocks, indicates bright near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

Before we present a few medical product stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Performance

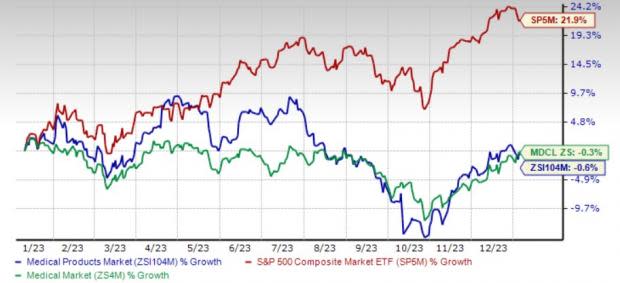

The industry has underperformed its own sector and the Zacks S&P 500 Composite in the past year.

Stocks in this industry have collectively lost 0.6% compared with the Zacks Medical sector’s decline of 0.3%. The S&P 500 has increased 21.9% in the same time frame.

One-Year Price Performance

Industry's Current Valuation

On the basis of the forward 12-month price-to-earnings (P/E), which is commonly used for valuing medical stocks, the industry is currently trading at 19.4X compared with the S&P 500’s 18.6X and the sector’s 22.9X.

Over the last five years, the industry has traded as high as 30X and as low as 18.9X, with the median being at 23.5X, as the charts show.

Price-to-Earnings Forward Twelve Months (F12M)

Price-to-Earnings Forward Twelve Months (F12M)

4 Promising Medical Product Stocks

Koninklijke Philips is a focused health technology company with presence in highly attractive segments that offer significant potential for growth and margin expansion. The company reports a major portion of its revenues under three business segments — Diagnosis & Treatment business, Connected Care business and Personal Health business.

PHG’s focus on enhancing patient safety and quality, strengthening supply-chain reliability, and establishing a simplified, more agile operating model is benefiting its productivity initiatives. The company’s order book remains healthy. Its top-line growth is expected to benefit in the coming quarters, driven by its AI-supported solutions that will aid in providing fast and virtual diagnosis.

However, Personal Health business in the coming quarters is expected to be negatively impacted by lower consumer demand and geopolitical tensions. On its third-quarter earnings call in October, Philips raised its 2023 guidance and now expects 6-7% comparable sales growth and an Adjusted EBITA margin of 10-11%, with free cash flow at the upper end of the target range of €0.7-€0.9 billion. Currently, the company carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

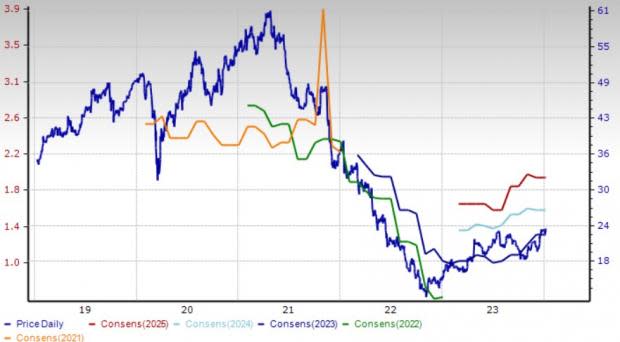

For this Netherlands-based company, the Zacks Consensus Estimate for 2023 revenues is pegged at $19.83 billion. The consensus mark for earnings is pinned at $1.33 per share. The company delivered a trailing four-quarter average earnings surprise of 53.7%.

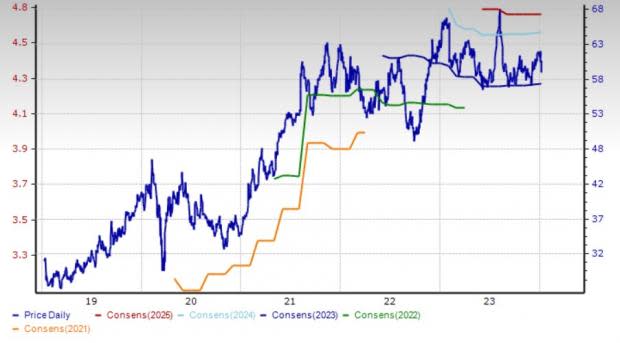

Price and Consensus: PHG

Neogen develops and markets food and animal safety products. Its Food Safety division markets culture media and diagnostic test kits to detect foodborne bacteria, natural toxins, food allergens, drug residues, plant diseases and sanitation concerns. It operates under two business segments — Food Safety and Animal Safety. During the first quarter of fiscal 2024, the company’s legacy Food Safety business performed well, particularly in core product lines of allergen, natural toxin and microbiological testing. The Animal Safety business, however, experienced continued destocking, with channel inventory levels reaching multi-year lows.

Neogen is benefiting from core growth in Food Safety and strong prospects in Animal Safety despite the near-term challenges of lower volumes and inventory levels in end markets. NEOG is making progress with the transition manufacturing arrangement for the flagship Petrifilm product line, simultaneously emphasizing continued innovation to capitalize on the leading market position. NEOG expanded its Reveal portfolio with the addition of quantitative assays for the detection of histamine in fish and dry animal proteins and for DON and Aflatoxin in grains and grain byproducts. All these developments bode well for the stock.

However, escalated operating costs and core revenue decline due to continued destocking by large veterinary distributors are concerning. Following the first-quarter results, Neogen continues to anticipate full-year revenues in the band of $955-$985 million. NEOG expects capital expenditures to be approximately $130 million, which includes approximately $100 million related specifically to the integration of the former 3M Food Safety Division.

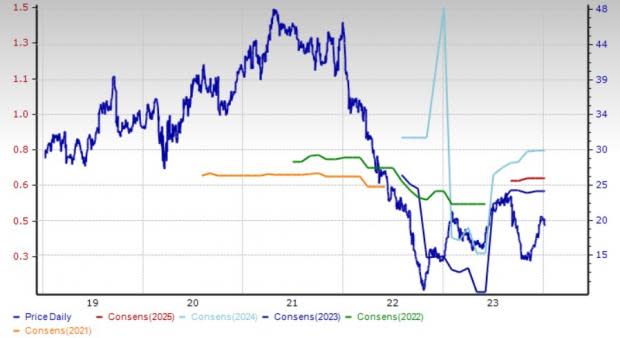

For this Lansing, MI-based company, the Zacks Consensus Estimate for fiscal 2024 revenues indicate a year-over-year improvement of 16.8%. The consensus estimate for earnings indicates a rise of 5.4%. It delivered a trailing four-quarter earnings surprise of 126.52%, on average. Presently, the company carries a Zacks Rank of 2.

Price and Consensus: NEOG

Haemonetics provides blood management solutions to customers encompassing blood and plasma collectors, hospitals and global health care providers. The company’s portfolio consists of integrated devices, information management, and consulting services. Haemonetics ended the second quarter of fiscal 2024 on a mixed note, wherein its earnings beat the Zacks Consensus Estimate but revenues missed the same.

In the second quarter, the company continued to strengthen its momentum and industry leadership, delivering growth while broadening its global presence. Further, the raised 2024 outlook instills optimism in the stock.

Haemonetics’ consistent growth performance over the past few quarters reflects its strategic focus on establishing leading positions in high-growth markets to generate solid financial returns. Setting the standard in global plasma collection solutions, NexSys PCS with Persona is enabling customers to safely meet end-market demand and lower their cost per liter. An evolving Hospital portfolio looks highly promising. Currently, the company carries a Zacks Rank #2.

However, the decrease in adjusted operating expenses as a percentage of revenues during the reported quarter due to operating leverage and lower freight costs remains a concern. The uncertain economic scenario continues to pose a challenge for Haemonetics. Following strong second-quarter results, the company expects total GAAP revenue growth in the range of 7-9% on a reported basis (earlier guidance was 6-9%) for fiscal 2024. Organic revenue growth is anticipated to be 8-10% (earlier guidance was 7-10%).

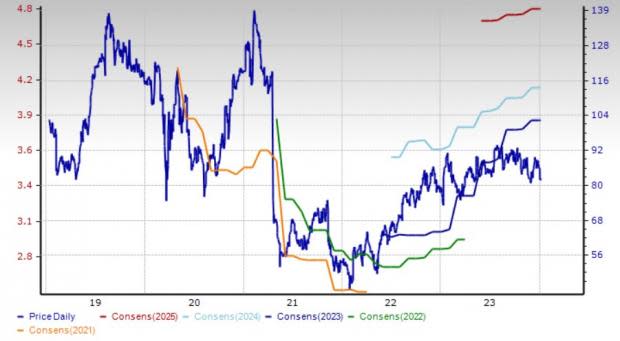

For this Bostom, MA-based company, the Zacks Consensus Estimate for fiscal 2024 revenues is pegged at $1.27 billion. The consensus mark for earnings is pinned at $3.89 per share. The company delivered a trailing four-quarter average earnings surprise of 16.08%.

Price and Consensus: HAE

Prestige Consumer owns and markets a diverse portfolio of well-recognized consumer brands, a few of which date back to more than 100 years. The products are further supported by significant marketing, which is designed to enhance sales growth and long-term profitability across major and core brands. Some of the company’s core brands are Monistat, Summer's Eve, Nix, TheraTears and Dramamine.

Prestige Consumer’s diverse portfolio of brands serves as a strong testament to delivering record revenues and consistent EBITDA margins. A disciplined business strategy across all brands has helped expand its leading share and grow with retailers. The company’s numerous brand-building strategies focus on driving long-term category growth, chipping away the volatility of any one category or brand. Besides, continued investments in fast-growing channels, such as e-commerce, are aiding strong consumption trends. Both the gross and adjusted operating margins expanded during the second quarter of fiscal 2024, which is highly promising. Currently, the company carries a Zacks Rank #2.

However, loss of sales following the strategic exit of private labels is likely to hurt revenues going forward. During the second-quarter earnings call, Prestige Consumer maintained the total revenue growth guidance to 1-2% on an organic basis. The company expects fiscal 2024 diluted EPS in the range of $4.27-$4.32.

For this Irvington, NY-based company, the Zacks Consensus Estimate for fiscal 2024 revenues implies an improvement of 2.5%, year over year. The consensus estimate for earnings indicates a rise of 2.8%. It delivered a trailing four-quarter earnings surprise of 2.7%, on average. Presently, the company has a Zacks Rank #2.

Price and Consensus: PBH

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Koninklijke Philips N.V. (PHG) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Prestige Consumer Healthcare Inc. (PBH) : Free Stock Analysis Report

Neogen Corporation (NEOG) : Free Stock Analysis Report