4 Must-Buy Technology Stocks Amid Current Market Volatility

The technology sector has been resilient so far this year despite continued macroeconomic and geopolitical headwinds. With a year-to-date (YTD) rise of 16.8%, the tech-laden Nasdaq Composite has outperformed The Dow Jones Industrial Average and the S&P 500 index’s increase of 0.4% and 7%, respectively.

Technology stocks have more than 50% of weightage in the Nasdaq Composite index. Technology Select Sector SPDR XLK, the most important component of the broad market index, has returned 21.4% YTD.

With persistent inflationary pressure and weakening demand, the fears of recession have not subsided yet. The ongoing Russia-Ukraine war along with economic and financial sanctions imposed by the United States and European Union to punish Russia continue to result in market turmoil.

However, technology companies have been focusing on cost-cutting measures to improve profitability and stay afloat amid these turbulent times. The strategies have boosted investors’ confidence, thereby boosting their share prices.

In addition, the long-term growth prospects of these companies look promising owing to the continued digital transformations. The accelerated deployment of 5G technology — the next-generation wireless revolution — is likely to spur further growth. Apart from this, blockchain, Internet of Things, autonomous vehicles, AR/VR and wearables offer significant growth opportunities.

The latest forecast for worldwide IT spending by Gartner is a positive for tech stocks. Despite the ongoing macroeconomic and geopolitical challenges, the independent research firm forecasts worldwide IT spending to increase 2.4% year over year to $4.5 trillion in 2023.

Therefore, investors should look for fundamentally strong technology stocks that could sustain market jitters and ensure solid portfolio returns.

However, it is difficult to pick such multi-faceted stocks from a plethora of investment opportunities.

Here the Growth Style Score comes in handy. The Growth Style Score condenses all the essential metrics from a company’s financial statements to get a true sense of the quality and sustainability of its growth.

With the help of Zacks Stock Screener, we have zeroed in on four technology stocks — Asure Software ASUR, Broadcom AVGO Fortinet FTNT and Microchip Technology MCHP — which look promising based on their encouraging Zacks Rank and Growth Score.

These stocks have a favorable combination of a Growth Score of A or B and a Zacks Rank #1 (Strong Buy) or #2 (Buy), thus offering solid investment opportunities.

Our Picks

Asure Software is a cloud computing firm that offers business clients the chance to modernize everything from human capital management (HCM) and time & attendance solutions to payroll and taxes. The stock currently sports a Zacks Rank #1 and has a Growth Score of A. You can see the complete list of today’s Zacks #1 Rank stocks here.

Asure Software’s strategic initiative to become a pure software-as-a-service HCM company is aiding its top-line growth. The company’s focus on driving innovation for its HCM solutions is helping it expand its footprint in the HCM market.

New client additions and continued focus on cross-selling to existing clients are driving Asure Software’s revenues. The company’s differentiated employee strategy, measurement capabilities and comprehensive product offerings are helping it win new customers.

The Zacks Consensus Estimate for 2023 earnings has been revised upward by 25% in the past 60 days to 35 cents per share, which calls for an increase of 133.3% on a year-over-year basis. Moreover, the long-term earnings growth rate is pegged at 25%.

Asure Software Inc Price and Consensus

Asure Software Inc price-consensus-chart | Asure Software Inc Quote

Broadcom is a premier designer, developer and global supplier of a broad range of semiconductor devices with a focus on complex digital and mixed signal complementary metal oxide semiconductor- based devices and analog III-V-based products.

Broadcom is benefiting from strong demand for its networking solutions, PON fiber and cable modems. The strong adoption of Broadcom’s server storage solutions by hyperscalers, acceleration in 5G deployment, production ramp-up and an increase in radio frequency content are driving top-line growth. Additionally, the robust adoption of Wi-Fi 6 and Wi-Fi 6E for access gateways, courtesy of solid demand from homes, enterprises, telcos and other service providers, is expected to continue driving revenue growth in the broadband end market.

The company carries a Zacks Rank #2 and has a Growth Score of B. The Zacks Consensus Estimate for fiscal 2023 earnings has been revised upward by 2.7% to $41.38 per share in the past 30 days, suggesting a 9.9% year-over-year increase. The long-term earnings growth expectation for the company is 13.1%.

Broadcom Inc. Price and Consensus

Broadcom Inc. price-consensus-chart | Broadcom Inc. Quote

Fortinet is benefiting from rising demand for security and networking products amid growing hybrid working trend. This Zacks Rank #2 company is also benefiting from robust growth in Fortinet Security Fabric, cloud and Software-defined Wide Area Network offerings.

Continued deal wins, especially those of high value, are a key driver. Higher IT spending on cybersecurity is further expected to aid Fortinet to grow faster than the security market. Focus on enhancing its unified threat management portfolio through product development and acquisitions is a tailwind for Fortinet.

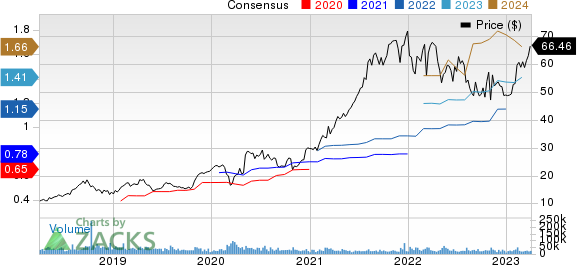

The Zacks Consensus Estimate for 2023 earnings has moved a penny northward to $1.41 per share in the past seven days. The stock has a Growth Score of B and has an estimated long-term earnings growth rate of 18%.

Fortinet, Inc. Price and Consensus

Fortinet, Inc. price-consensus-chart | Fortinet, Inc. Quote

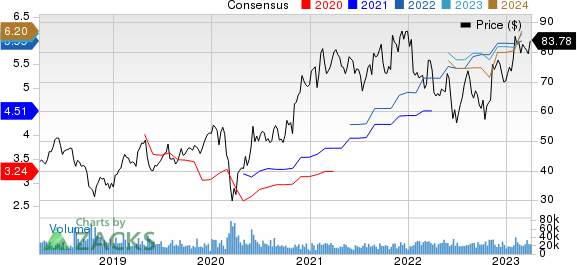

Microchip is riding on consistent strength in its analog and microcontroller businesses. The company’s dominance in 8,16 and 32-bit microcontrollers is driving top-line growth.

Strategic acquisitions like Microsemi and Atmel have expanded its product portfolio. This Zacks Rank #2 company is gaining from strong demand across industrial, automotive, aerospace and defense, data center, and communications infrastructure end markets. Its collaboration with the likes of Amazon Web Services is a positive.

Currently, Microchip has a Growth Score of A. The Zacks Consensus Estimate for fiscal 2024 earnings has moved 8 cents north in 60 days’ time to $6.00 per share. The long-term earnings growth rate is pegged at 16.9%.

Microchip Technology Incorporated Price and Consensus

Microchip Technology Incorporated price-consensus-chart | Microchip Technology Incorporated Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microchip Technology Incorporated (MCHP) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Fortinet, Inc. (FTNT) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

Technology Select Sector SPDR ETF (XLK): ETF Research Reports