4 Paper and Related Products Stocks to Watch in the Thriving Industry

The Zacks Paper and Related Products industry is set to benefit from increased packaging needs, driven by rising e-commerce activities. Sustained demand from consumer-oriented sectors, such as food, beverages, and healthcare, lends further support. The industry's growth is propelled by the escalating consumer inclination toward paper as an environmentally friendly packaging choice amid rising environmental awareness.

Key players, such as Suzano SUZ, International Paper IP, Klabin KLBAY and Sappi SPPJY, are well-positioned to capitalize on these trends as they continue to position themselves favorably in the evolving market landscape.

About the Industry

The Zacks Paper and Related Products industry comprises companies that manufacture and sell paper and paper products. The industry is highly diversified in terms of products, ranging from graphic paper and packaging paper to absorbent hygiene products. Graphic papers, which include printing and writing papers, and newsprint, are utilized for communication purposes. The industry provides packaging solutions for liquid, food, pharmaceutical, beauty, household, commercial and industrial products. It also produces fluff and specialty pulps utilized in absorbent hygiene products, tissues and paper products. The industry caters to a wide array of industries, including food and beverage, farming, home and personal care, health, retail, e-commerce, and transport. Industry players meet customers’ shipping, storage and display requirements with sustainable solutions.

Major Trends Shaping the Future of the Paper and Related Products Industry

E-commerce & Consumer Products to Support Packaging Demand: The industry’s significant exposure to consumer-focused markets, such as food, beverages and healthcare, ensures steady earnings growth. With the rise of e-commerce, packaging has gained the utmost importance, as it helps maintain the integrity of the product and withstand the complexities of delivery. According to Statista, global e-commerce sales were $5.8 trillion in 2023, and this figure is expected to reach $8 trillion by 2027, with a CAGR of 8.4%. This presents a major growth opportunity for the Paper and Related Products industry. In 2022, e-commerce accounted for nearly 19% of retail sales worldwide and this share is expected to increase to 25% by 2027. The United States is expected to lead the retail e-commerce development, with a CAGR forecast of 11.82% over 2024-2028. The current valuation of the U.S e-commerce market is $843 billion U.S. dollars and it is anticipated to surpass the $1-trillion mark in 2026. India and Mexico are expected to follow suit, seeing a CAGR of 11.79% and 11.71%, respectively.

Sustainability Acts as the Key: Increasing demand for sustainable packaging options and eco-friendly packaging solutions will support the paper market in the days ahead. The paper industry has already begun incorporating recycled content into production methods. By maximizing recycling, the industry will be able to implement environmentally and economically sustainable production methods. Investment in breakthrough technologies will propel the demand for high-quality paper products.

Pricing Actions, Improving Efficiency to Offset Cost Inflation: The industry is witnessing rising costs of transportation, chemical and fuel, and supply-chain headwinds. Therefore, industry players are increasingly focusing on pricing actions and cost reduction, and resorting to automation in manufacturing to boost productivity and efficiency.

Digitization Hurts Graphic Paper Demand: The transition to digital media has been eroding the graphic-paper market for some time. Paperless communication, increased use of email, less print advertising, more electronic billing and fewer catalogs have collectively contributed to the decline in demand for graphic paper. Consequently, the companies have been converting their machines to produce packaging and specialty papers.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Paper and Related Products industry is a 12-stock group within the broader Basic Materials sector. The industry currently carries a Zacks Industry Rank #30, which places it in the top 12% of the 252 Zacks industries.

The group’s Zacks Industry Rank, basically the average of the Zacks Rank of all the member stocks, indicates bullish prospects in the near term. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Before we present a few Paper and Related Products stocks that investors can keep an eye on, it is worth looking at the industry’s stock-market performance and its valuation picture.

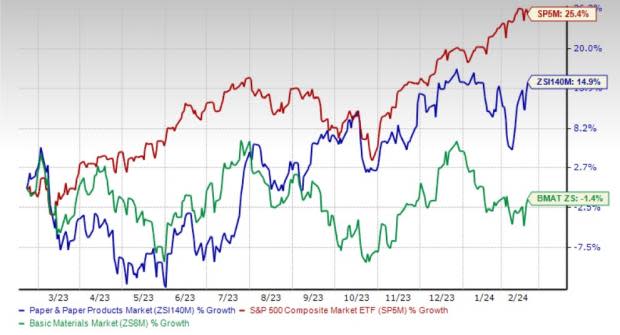

Industry Versus S&P 500 & Sector

The Paper and Related Products industry has outperformed the sector but lagged the S&P 500 over the past year. The stocks in this industry have gained 14.9%, while the Basic Materials sector has lost 1.4%. The S&P 500 has grown 25.4% in the said time frame.

One-Year Price Performance

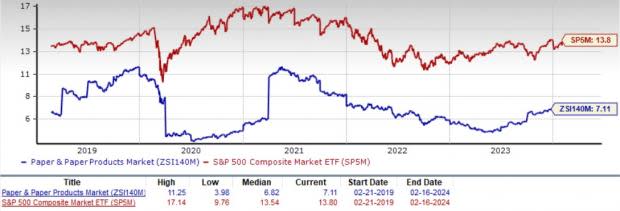

Industry's Current Valuation

On the basis of the trailing 12-month EV/EBITDA ratio, a commonly-used multiple for valuing Paper and Related Products companies, we see that the industry is currently trading at 7.11X compared with the S&P 500’s 13.80X and the Basic Material sector’s trailing 12-month EV/EBITDA of 11.01X. This is shown in the charts below.

Enterprise Value/EBITDA (EV/EBITDA) Ratio (TTM)

Enterprise Value/EBITDA (EV/EBITDA) Ratio (TTM)

Over the last five years, the industry traded as high as 11.25X and as low as 3.98X, the median being 6.82X.

4 Paper and Related Products Stocks to Watch

Suzano: With the acquisition of Kimberly-Clark’s tissue assets in Brazil in 2023, the company has become the leader in the domestic toilet tissue market. The deal added the Neve brand to SUZ’s portfolio and a plant with an annual capacity of 130,000 tons in Mogi das Cruzes (São Paulo), among other assets. The company continues to focus on digital transformation initiatives and invest in its portfolio of innovative products. Suzano’s $2.8-billion Cerrado Project, which is likely to commence production in June 2024, is expected to boost its current pulp production capacity by 20%. It will be the world’s largest plant with a single eucalyptus pulp production line. SUZ recently announced a slew of projects that will boost its production capacity and enhance its operational efficiency. These include a R$520-million investment to replace a biomass boiler and a R$650-million planned spending for the construction of a tissue paper mill in Espírito Santo. Suzano also announced investments of R$490 million to produce fluff pulp from eucalyptus wood (Eucafluff), with a nominal annual production capacity of 340 tons.

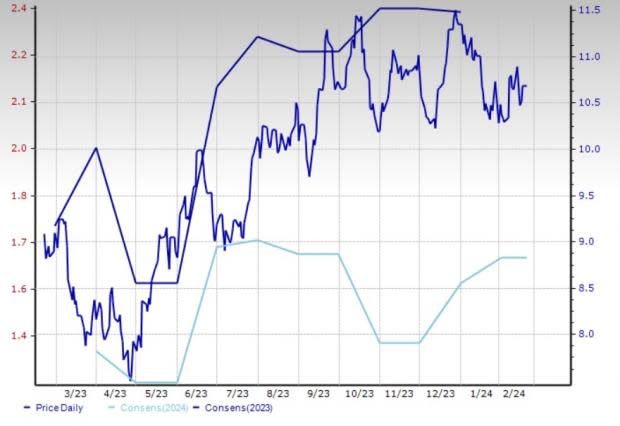

The Zacks Consensus Estimate for 2024 for the Salvador, Brazil-based integrated pulp and paper producer has moved up 4% in the past 60 days. Suzano currently sports a Zacks Rank #1 (Strong Buy).

You can see the complete list of today’s Zacks #1 Rank stocks here.

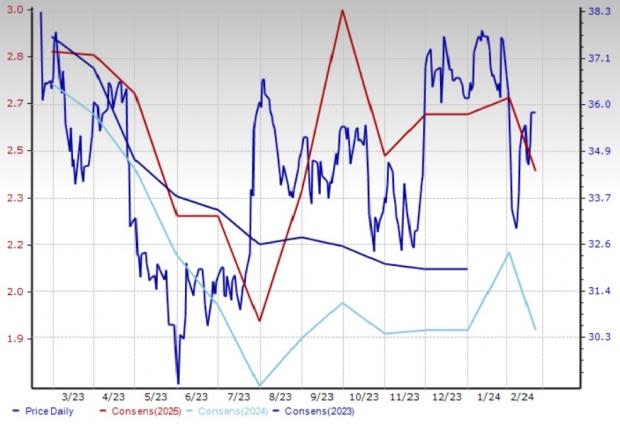

Price & Consensus: SUZ

Klabin: In the fourth quarter of 2023, the company achieved a total sales volume of 961,000 tons, driven by a 10% increase in the pulp segment and an 11% rise in paperboard sales. Higher paperboard sales volume reflects the ramp-up of Paper Machine 28. In September 2023, KLBAY inaugurated the Puma II project with R$12.9 billion invested in the installation of two paper machines — MP27 and MP28 — with a total annual production capacity of 910,000 tons of paper. The MP28 machine also marked Klabin’s debut in the white paperboard market, reinforcing the expansion of its product portfolio. Klabin recently announced the acquisition of Arauco’s forest operation, which concludes forest expansion for the Puma II Project. With this deal, the company will be able to achieve its 75% self-sufficiency target in wood in Paraná. The company’s efforts to improve efficiency in its operations will also aid results. KLBAY shares have gained 6% in the past six months.

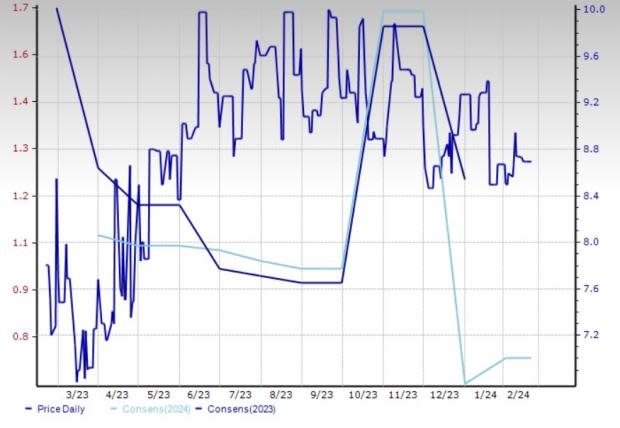

The Zacks Consensus Estimate for the São Paulo, Brazil-based company’s fiscal 2024 earnings has moved up 11.8% over the past 60 days. Klabin currently carries a Zacks Rank #2 (Buy).

Price & Consensus: KLBAY

Sappi: The demand for dissolving pulp has been positive, supported by sustained high operating rates for viscose staple fiber and a recovery in pricing for alternative textile fibers, such as cotton. The company is progressing well in its Thrive25 strategic program. This entails focusing on growing its dissolving pulp capacity, expanding packaging and specialty papers in all regions, and reducing exposure to the graphic paper markets. Its ongoing restructuring actions are expected to yield significant cost savings. SPPJY is also focusing on maintaining financial health and progressing toward attaining a net debt target of $1 billion. It is striving to drive operational excellence by improving its cost position and production efficiencies.

Johannesburg, South Africa-based Sappi has an estimated long-term earnings growth of 13.6%. The Zacks Consensus Estimate for the company’s 2024 earnings has moved up 29.6% over the past 60 days. The company currently carries a Zacks Rank #2.

Price: SPPJY

International Paper: The company is adding capacity to its existing plants and investing in plants that will help it capitalize on the demand for corrugated and containerboard packaging, going forward. This will aid the Industrial Paper segment. In the Global cellulose fibers segment, demand for fluff is expected to pick up, considering the essential role that absorbent personal care products play in meeting consumer needs. The company realized $260 million of year-over-year incremental earnings improvement in 2023, outperforming the target of $125-$150 million for the year. This was achieved by streamlining the organization, cutting overhead spending, leveraging advanced technology and data analytics to improve efficiencies and lowering costs across its large system of mills and box plants. The same target range is projected for 2024 as well. The company’s efforts to reduce debt levels appear encouraging. Mergers and acquisitions are the key strategies for IP to strengthen its packaging business.

This Memphis, TN-based entity has a trailing four-quarter earnings surprise of 19.4%, on average. The Zacks Consensus Estimate for IP’s 2024 earnings has been unchanged over the past 60 days. International Paper currently carries a Zacks Rank #3 (Hold).

Price & Consensus: IP

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Suzano S.A. Sponsored ADR (SUZ) : Free Stock Analysis Report

International Paper Company (IP) : Free Stock Analysis Report

Klabin SA (KLBAY) : Free Stock Analysis Report

Sappi Ltd. (SPPJY) : Free Stock Analysis Report