4 Paper and Related Products Stocks to Watch Amid Industry Challenges

The Zacks Paper and Related Products industry has been impacted by weak packaging demand of late, as customer spending has been muted due to inflationary pressures. Nevertheless, increasing packaging requirements due to the rising trend in e-commerce activities and steady demand from consumer-oriented end markets, such as food and beverages, and healthcare, will support the industry. The growing preference for paper as a sustainable and eco-friendly packaging option due to environmental concerns will act as a key driver.

Players like Suzano SUZ, International Paper Company IP, Klabin KLBAY and Sylvamo SLVM are likely to gain from the above-mentioned trends.

Industry Description

The Zacks Paper and Related Products industry comprises companies that manufacture and sell paper and paper products. The industry is highly diversified in terms of products, ranging from graphic paper and packaging paper to absorbent hygiene products. Graphic papers, which include printing and writing papers, and newsprint, are utilized for communication purposes. The industry provides packaging solutions for liquid, food, pharmaceutical, beauty, household, commercial and industrial products. It also produces fluff and specialty pulps utilized in absorbent hygiene products, tissues and paper products. The industry caters to a wide array of industries, including food and beverage, farming, home and personal care, health, retail, e-commerce, and transport. The industry players meet customers’ shipping, storage and display requirements with sustainable solutions.

Major Trends Shaping the Future of the Paper and Related Products Industry

Low Consumer Spending, High Costs Act as Near-Term Woes: The current inflationary pressures have been affecting consumers, leading to a lower demand for goods. This has impacted packaging demand, as consumer priorities have shifted toward non-discretionary goods and services. Customers have been trying to lower their elevated inventories, impacting packaging demand. The companies in the industry had to cut down production levels to align with customer demand. Moreover, the industry is witnessing rising costs for transportation, chemical and fuel, and supply-chain headwinds. Thus, industry players are increasingly focusing on pricing actions and cost reduction, and resorting to automation in manufacturing to boost productivity and efficiency.

Digitization Hurts Paper Demand: The transition to digital media has been eroding the graphic paper market for some time now. The same remains a persistent threat to the industry. Paperless communication, the increased use of email, less print advertising, more electronic billing and fewer catalogs dented graphic paper demand. Consequently, the industry is resorting to machine conversions into packaging and specialty papers. Paper consumption in schools, offices and businesses took a hit from the pandemic-led shutdowns. However, the demand picked up on the reopening of schools and offices.

E-commerce & Consumer Products to Support Packaging Demand: The industry’s considerable exposure to consumer-oriented end markets, including food and beverages, and healthcare, ensures steady growth in earnings. With e-commerce, packaging gained the utmost importance, as it has to maintain the integrity of the product and be durable to withstand the complexity involved in delivering the product. Per Statista, global e-commerce revenues are projected to witness a CAGR of 11.2% from 2023 to 2027, representing a major growth opportunity for the industry. In 2022, e-commerce accounted for nearly 19% of retail sales worldwide. The same is expected to be 25% by 2027. India is expected to lead retail e-commerce development, seeing a CAGR of 14.11% between 2023 and 2027, closely followed by Brazil, Argentina and Turkey, with growth of 14.07%, 13.63% and 13.57%, respectively.

Zacks Industry Rank Indicates Dull Prospects

The Zacks Paper and Related Products industry is an 11-stock group within the broader Basic Materials sector. The industry currently carries a Zacks Industry Rank #189, which places it in the bottom 25% of the 251 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bleak prospects in the near term. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually losing confidence in this group's earnings growth potential. Year to date, the industry's earnings estimates for 2023 have moved down 11%, and the same for 2024 has declined 45%.

Before we present a few Paper and Related Products stocks that investors can consider, it is worth looking at the industry’s stock-market performance and valuation picture.

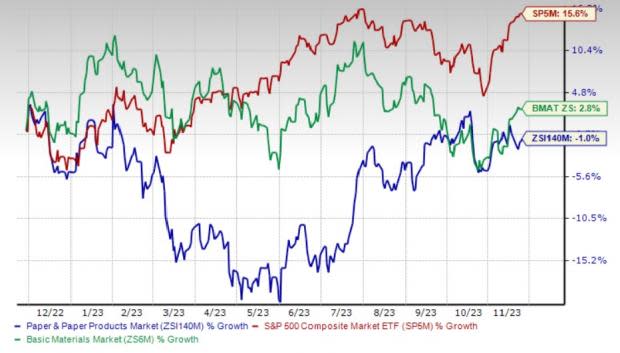

Industry Versus Broader Market

The Paper and Related Products industry has underperformed the S&P 500 and the sector over the past year. The stocks in this industry have dropped 1%, while the Basic Materials sector has risen 2.8%. The S&P 500 composite has grown 15.6% during this time frame.

One-Year Price Performance

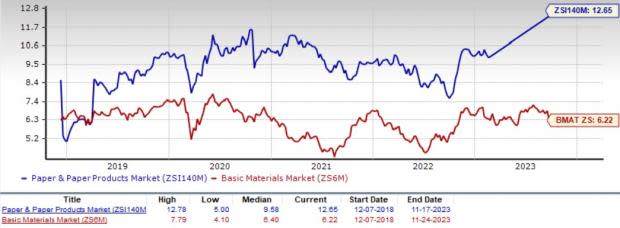

Industry's Current Valuation

On the basis of the forward 12-month EV/EBITDA ratio, a commonly-used multiple for valuing Paper and Related Products companies, we see that the industry is currently trading at 12.65X compared with the S&P 500’s 10.92X and the Basic Material sector’s forward 12-month EV/EBITDA of 7.01X. This is shown in the charts below.

Enterprise Value/EBITDA (EV/EBITDA) Ratio (F12M)

Enterprise Value/EBITDA (EV/EBITDA) Ratio (F12M)

Over the last five years, the industry has traded as high as 12.78X and as low as 5.00X, with the median being 9.58X.

4 Paper and Related Products Stocks to Consider

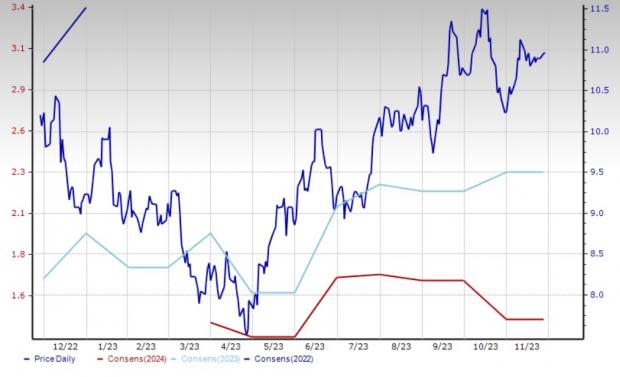

Klabin: In the third quarter, the company’s pulp sales totaled 426 thousand tons — the second-highest volume since the startup of the Puma Unit in Parana. Adjusted EBITDA per ton in the paper and packaging business grew 7% in the first nine months of 2023 from the same period last year. This was mainly driven by the company’s efforts to improve efficiency in its operations. In September 2023, it inaugurated the Puma II project that marked the expansion of its Puma Unit in Ortigueira, Paraná. Puma II is the largest investment in the company’s history, with R$12.9 billion invested in the installation of two new paper machines — MP27 and MP28 — both operational and with a total annual production capacity of 910,000 tons of paper. The MP28 machine also marks Klabin’s debut in the white paperboard market, reinforcing the expansion of its product portfolio. Apart from boosting production capacity, this project has improved the quality of the company’s products through its cutting-edge technology. The company’s shares have gained 6% in the past six months.

Headquartered in São Paulo, Brazil, Klabin has a long-term estimated earnings growth of 6.3%. The company is Brazil’s largest producer and exporter of packaging paper and sustainable solutions in paper packaging, and the country’s only producer to offer solutions in hardwood, softwood and fluff pulp. The Zacks Consensus Estimate for fiscal 2023 earnings has moved up 72% over the past 60 days. The company currently flaunts a Zacks Rank #1 (Strong Buy).

You can see the complete list of today’s Zacks #1 Rank stocks here.

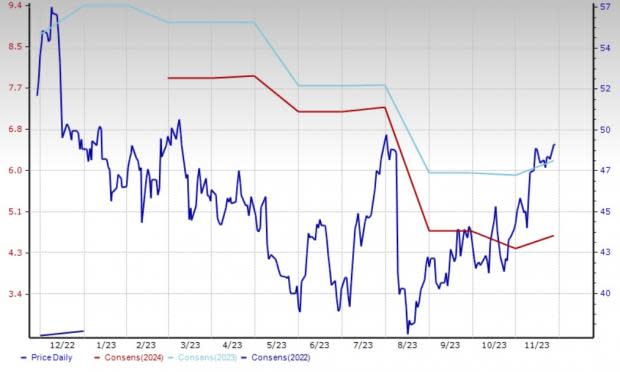

Price & Consensus: KLBAY

Suzano: With the acquisition of Kimberly-Clark’s tissue assets in Brazil earlier this year, the company has become the leader in the domestic toilet tissue market. The deal added the Neve brand to SUZ’s portfolio and a plant with an annual capacity of 130,000 tons in Mogi das Cruzes (São Paulo), among other assets. The company continues to focus on digital transformation initiatives and invest in its portfolio of innovative products. Suzano’s $2.8-billion Cerrado Project, which is likely to commence production in June 2024, is expected to boost its current pulp production capacity by 20%. It will be the world’s largest plant with a single eucalyptus pulp production line. SUZ recently announced a slew of projects that will boost its production capacity and enhance its operational efficiency. These include a R$520-million investment to replace a biomass boiler and a R$650-million planned spending for the construction of a tissue paper mill in Espírito Santo. Suzano also announced investments of R$490 million to produce fluff pulp from eucalyptus wood (Eucafluff), with a nominal annual production capacity of 340 tons. Backed by these developments, the stock has risen 20% in the past six months.

The Zacks Consensus Estimate for 2023 for the Salvador, Brazil-based integrated pulp and paper producer has moved up 5% in the past 60 days. The company has a long-term estimated earnings growth rate of 7% and currently carries a Zacks Rank #3 (Hold).

Price & Consensus: SUZ

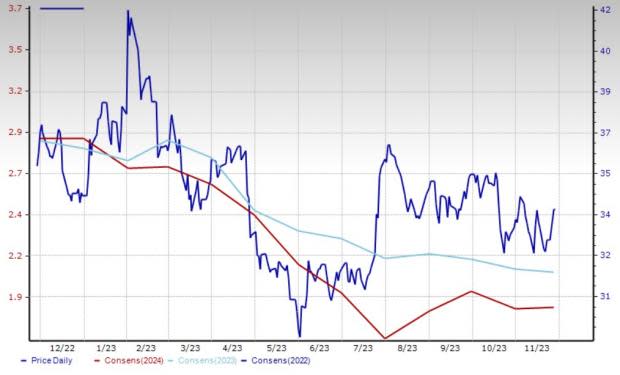

International Paper: The company is adding capacity to its existing plants and investing in new plants that will help it capitalize on the demand for corrugated and containerboard packaging, going forward. This will aid the Industrial Paper segment’s results. The Global cellulose fibers segment will benefit from a favorable supply-demand backdrop for fluff pulp. International Paper achieved $250 million in earnings through the Building a Better IP initiatives in 2022, exceeding the target of $200-$225 million. The company realized $195 million of year-over-year incremental earnings improvement in the first nine months of 2023, outperforming the previously stated $125-$150 million for the year. This was achieved by streamlining the organization, cutting overhead spending, leveraging advanced technology and data analytics to improve efficiencies and lowering costs across its large system of mills and box plants. The same target is projected for 2024 as well. The company’s efforts to reduce debt levels appear encouraging. Mergers and acquisitions are the key strategies for IP to strengthen its packaging business. The stock has gained 11% over the past three months.

This Memphis, TN-based entity has a trailing four-quarter earnings surprise of 20.8%, on average. International Paper currently carries a Zacks Rank #3.

Price & Consensus: IP

Sylvamo: The company recently initiated a cost-reduction program called Project Horizon, which will focus on streamlining its organization and cost structures in an effort to make a leaner, stronger company. SLVM is targeting run rate savings of at least $110 million by the end of 2024. Around two-thirds of the target will come from operational improvements in its mills and supply chains, and the balance from the reduction in selling and administrative expenses. Since becoming an independent company in 2021, the company has returned $200 million in cash to shareholders. Recently, its board of directors raised the regular dividend by 20% and authorized an incremental $150-million share repurchase program. Through this period, SLVM has generated more than $1.3 billion in adjusted EBITDA (translating into 19% margin) and $568 million in free cash flow. It has also lowered the debt levels by 35%. The company’s shares have gained 22% in the past six months.

Earnings estimates for Sylvamo’s fiscal 2023 have moved 5% north over the past 60 days. Memphis, Tennessee-based SLVM has a trailing four-quarter earnings surprise of 12.2%, on average. The company has a Zacks Rank #3 at present.

Price & Consensus: SLVM

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Suzano S.A. Sponsored ADR (SUZ) : Free Stock Analysis Report

International Paper Company (IP) : Free Stock Analysis Report

Klabin SA (KLBAY) : Free Stock Analysis Report

Sylvamo Corporation (SLVM) : Free Stock Analysis Report