4 Picks From the Robust Auto Equipment Industry to Fuel Your Gains

The Zacks Automotive - Original Equipment industry is poised for growth due to pent-up vehicle demand and improved inventory levels. Adapting to the shift toward electric and self-driving cars requires industry players to invest in research and development. The rise of new technologies and increased demand for electrified and autonomous vehicles reflect encouraging prospects. Effective cost management in mass production and advanced technology will be crucial for the industry’s success. Companies like Magna International MGA, Lear Corp. LEA, Autoliv, Inc. ALV and Gentex Corp. GNTX are well-placed to thrive in the changing landscape.

About the Industry

The Zacks Automotive - Original Equipment industry includes companies that engage in the designing, manufacture and distribution of automotive equipment components used for manufacturing vehicles. A few of the components manufactured by the participants include drive axle, engine, gearbox parts, steering, and suspension, as well as brakes. Demand for original equipment depends directly on the sale of vehicles, which, in turn, is heavily reliant on economic growth and consumer confidence. Importantly, the rapidly globalizing world is opening up newer avenues for auto-equipment manufacturers who need to adapt to the changing dynamics through systematic research and development. From a future competitive standpoint, the industry players need to focus on technologies that offer the best value in a short span of time to the market.

3 Themes Shaping the Industry

Robust Vehicle Demand Augurs Well: With supply chain challenges showing signs of improvement this year, the U.S. auto market has bounced back with renewed vigor. During the second quarter of 2023, most automakers recorded year-over-year sales growth, primarily due to the recovery of inventory levels. The demand for automobiles remains resilient, indicating that the increase in interest rates has not yet significantly impacted consumers' purchasing decisions. Despite concerns about elevated borrowing costs, the passion for cars among Americans and pent-up demand are bolstering the prospects of the U.S. auto market. Consequently, Cox Automotive has raised its full-year vehicle sales forecast to 15 million units, reflecting a substantial increase from 13.9 million in 2022. Robust vehicle demand signifies promising times ahead for industry stakeholders.

Tech Advancement Unleashes Exciting Possibilities: The automotive sector is currently experiencing a transformative shift, driven by the widespread integration of cutting-edge technology and swift digitization, resulting in a complete overhaul of the market landscape. This transformation has opened up prospects for original equipment manufacturers (OEMs). As the electrification and autonomous driving trends gain momentum, OEMs are redoubling their efforts to engineer technologically sophisticated components. Furthermore, escalating demand for fuel-efficient vehicles, compelled by stringent emission regulations, is stoking the necessity for auto components and equipment that boast both high quality and cost-effectiveness.

Optimizing Production Costs for Success: With the automotive market undergoing a significant technological shift, effective cost management has become paramount. OEMs must continually upgrade and enhance their products to stay relevant in this rapidly evolving landscape. Introducing new features, upgrades and component designs entails considerable financial investment, time and labor, leading to escalated R&D expenses. Streamlining production costs is essential to alleviate pressure on profit margins. The performance of industry players hinges on their ability to absorb manufacturing and expansion expenses, thereby positioning themselves to capitalize on lucrative revenue opportunities. Furthermore, equipment manufacturing companies must prioritize technology that delivers maximum value within a short timeframe to maintain a competitive edge in the future.

Zacks Industry Rank Holds Promise

The Zacks Automotive – Original Equipment industry is a 56-stock group within the broader Zacks Auto-Tires-Trucks sector. The industry currently carries a Zacks Industry Rank #121, which places it in the top 48% of around 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates decent near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are optimistic about this group’s earnings growth potential. The industry’s earnings estimates for 2023 have moved up by 1 cent over the past month.

Before we present a few stocks that you may invest in to cash in on the industry’s potential, it’s worth taking a look at the industry’s performance and current valuation.

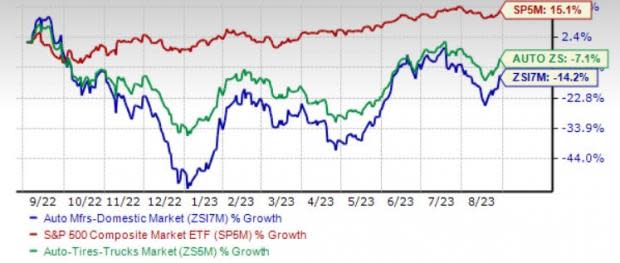

Industry Tops Sector but Lags S&P 500

Over the past year, the Zacks Original Equipment industry has outperformed the broader Auto sector but lagged the Zacks S&P 500 composite. The industry has gained 3.6% against the sector’s decline of 8.9%. Meanwhile, the S&P 500 has risen 11.6% over the same timeframe.

One-Year Price Performance

Industry's Current Valuation

Since automotive companies are debt-laden, it makes sense to value them based on the EV/EBITDA (Enterprise Value/ Earnings before Interest Tax Depreciation and Amortization) ratio.

On the basis of the trailing 12-month enterprise value to EBITDA (EV/EBITDA), the industry is currently trading at 27.52X compared with the S&P 500’s 13.99X and the sector’s 14.07X.

Over the past five years, the industry has traded as high as 27.83X, as low as 3.92X and at a median of 8.45X, as the chart below shows.

EV/EBITDA Ratio (Past Five Years)

4 Stocks to Buy

Magna: Canada-based manufacturer and supplier of automotive components,Magna’s broad range of product and service offerings gives it a competitive edge. The company is actively focusing on innovation and technology development along with program launches across its business segments. Magna’s electrification portfolio includes EtelligentEco, EtelligentForce and EtelligentReach, all of which are aiding top-line growth. The acquisition of Veoneer Active Safety business (completed in the second quarter of 2023) is set to further rev up Magna's ADAS business. The healthy balance sheet of the firm enables it to tap growth opportunities.

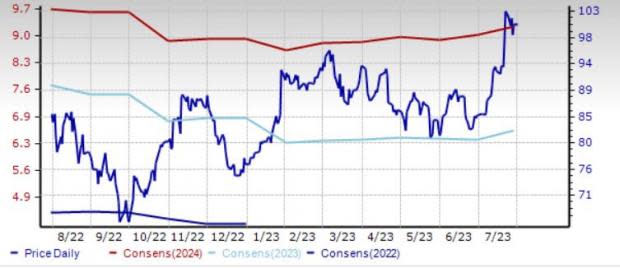

Magna currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for 2023 top and bottom lines implies year-over-year growth of 9% and 20.5%, respectively. The consensus mark for 2023 EPS has moved up 5 cents over the past 30 days.

Price & Consensus: MGA

Lear: This Michigan-based company is a provider of automotive seating and electrical systems (E-Systems). Lear's consolidated three-year (2023-2025) sales backlog of around $2.85 billion is likely to aid the top line. Buyouts of M&N Plastics and Kongsberg are driving its prospects. The acquisition of IGB has further expanded Lear’s product offerings in the growing thermal comfort solutions market. Rising consumer demand for vehicle content and increasing electrification efforts by the company will drive growth of the E-Systems unit. The company is on track to exceed its goal of $1.3 billion in electrification sales in E-Systems unit by 2025, implying a 34% compound annual growth rate for the three-year period. LEA’s strong financials instill confidence.

Lear currently carries a Zacks Rank #2. The Zacks Consensus Estimate for 2023 top and bottom lines implies year-over-year growth of 9% and 36%, respectively. The consensus mark for 2023 EPS has moved up 12 cents over the past seven days.

Price & Consensus: LEA

Autoliv: Based in Stockholm, Autoliv is at the forefront of automotive safety technology. With content per vehicle on the rise, the company is set to gain from growing demand for front-center airbags, knee airbags, seatbelts and battery cut-off switches. The soaring popularity of electric vehicles is extending Autoliv’s exposure to this red-hot market, thereby opening new growth avenues for the firm.The company is actively focusing on cost-efficiency projects and strategic initiatives, including footprint optimization. Balance sheet strength and investor-friendly moves via dividend and buybacks instill shareholders’ confidence.

Autoliv currently carries a Zacks Rank #2. The Zacks Consensus Estimate for 2023 top and bottom lines implies year-over-year growth of 15% and 50%, respectively. The consensus mark for 2023 EPS has moved up 20 cents over the past seven days.

Price & Consensus: ALV

Gentex: Michigan-based Gentex is engaged in supplying automatic-dimming rear-view mirrors and electronics to the automotive industry, fire protection products to the fire protection market, and dimmable aircraft windows for aviation markets. Gentex aims at generating meaningful growth driven by product launches, improved product mix and unique technology platforms. The company's industry-leading Full Display Mirror (FDM) is a key growth engine of the firm and is likely to boost its top-line growth trajectory. Partnership with Simplenight has bolstered Gentex’s connected car offerings. Strategic buyouts of Air-Craftglass, Guardian Optical Technologies and Vaporsens have strengthened Gentex’s product portfolio. Balance sheet strength and investor-friendly moves also boost confidence.

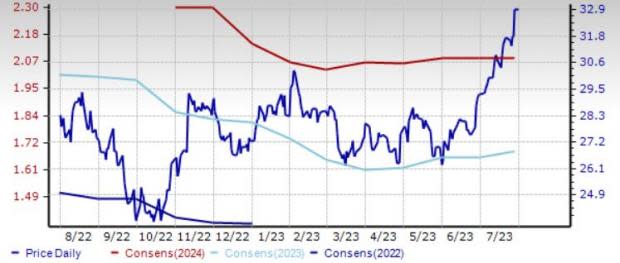

Gentex currently carries a Zacks Rank #2. The Zacks Consensus Estimate for 2023 top and bottom lines implies year-over-year growth of 15% and 24%, respectively. The consensus mark for 2023 EPS has moved up 3 cents over the past 30 days.

Price & Consensus: GNTX

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Magna International Inc. (MGA) : Free Stock Analysis Report

Autoliv, Inc. (ALV) : Free Stock Analysis Report

Lear Corporation (LEA) : Free Stock Analysis Report

Gentex Corporation (GNTX) : Free Stock Analysis Report