4 Reasons to Add PG&E (PCG) Stock to Your Portfolio Now

PG&E Corporation’s PCG strategic investments in gas-related projects and electric system safety and reliability will help it boost customers’ satisfaction. Given its growth opportunities, PCG is a solid investment option in the utility sector.

Let us focus on the reasons that make this Zacks Rank #2 (Buy) stock a solid investment pick at the moment.

Growth Projections & Surprise History

The Zacks Consensus Estimate for PCG’s first-quarter 2024 earnings per share (EPS) has increased 2.9% to 36 cents in the past 60 days. The Zacks Consensus Estimate for PCG’s total revenues for first-quarter 2024 is pegged at $6.55 billion, indicating year-over-year growth of 5.6%.

The company’s long-term (three to five years) earnings growth is pegged at 2.50%.

Return on Equity

Return on equity (ROE) indicates how efficiently a company has been utilizing its funds to generate higher returns. Currently, PCG’s ROE is 10.84% compared with the industry’s 8.76%. This indicates that the company has been utilizing its funds more constructively than its peers in the industry.

Solvency

PG&E Corporation’s times interest earned ratio (TIE) at the end of the fourth quarter of 2023 was 1.2. The TIE ratio of more than 1 indicates that the company will be able to meet its interest payment obligations in the near term without any problems.

Systematic Capital Expenditure

Strategic capital investments are making PCG’s infrastructure stronger and more resilient. It invested $9.8 billion in 2023. PCG expects its capital expenditures to be worth $10.4 billion for 2024 and a total of $62 billion for the 2024-2028 period. These systematic investments can drive the rate base growth of 9.5% during 2024-2028.

To promote green energy, the company invests in battery energy storage. Notably, the company managed to secure more than 3.5 GW of battery energy storage contracts in 2023, which will be deployed over the next years. As of Dec 31, 2023, the company was on track to meet its storage goals of making its 580 MW of qualifying storage capacity operational by the end of 2024. Such efforts should enable PCG to expand the battery storage business.

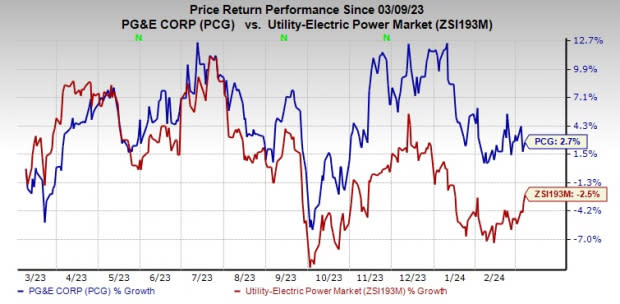

Price Performance

In the past year, PCG shares have increased 2.7% against the industry’s decline of 2.5%.

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks from the same industry are IDACORP IDA, DTE Energy DTE and Avangrid AGR, each holding a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

IDA’s long-term earnings growth rate is 4.40%. The company delivered an average earnings surprise of 12.73% in the last four quarters.

DTE’s long-term earnings growth rate is 6%. The Zacks Consensus Estimate for DTE Energy’s 2024 EPS is pegged at $6.70, which suggests a year-over-year improvement of 16.9%.

AGR’s long-term earnings growth rate is 3.60%. The Zacks Consensus Estimate for Avangrid’s 2024 EPS is pegged at $2.25, which suggests year-over-year growth of 7.7%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pacific Gas & Electric Co. (PCG) : Free Stock Analysis Report

DTE Energy Company (DTE) : Free Stock Analysis Report

IDACORP, Inc. (IDA) : Free Stock Analysis Report

Avangrid, Inc. (AGR) : Free Stock Analysis Report