4 Reasons to Add Unitil (UTL) to Your Portfolio Right Now

Unitil Corporations UTL, having a strong dividend history and rising earnings estimates, offers a great investment opportunity in the utility sector.

Now, let’s focus on the reasons that make this Zacks Rank #2 (Buy) stock an investment opportunity at the moment.

Growth Projections, Earnings Growth & Surprise History

The Zacks Consensus Estimate for UTL’s 2023 earnings per share EPS has increased 0.73% to $2.77 in the past 60 days. The Zacks Consensus Estimate for UTL’s total revenues for 2023 stands at $578 million, indicating year-over-year growth of 2.63%.

The company’s (three to five years) earnings growth is pegged at 7.08%. It delivered an average earnings surprise of 13.77% in the last four quarters.

Return on Equity

Return on equity (ROE) indicates how efficiently a company has been utilizing its funds to generate higher returns. Currently, Unitil’s ROE is 9.22% compared to its industry average of 6.99%. This indicates that the company has been utilizing its funds more constructively than its peers in the electric power utility industry.

Dividend History

UTL has been consistently hiking its dividend over the past five years and has increased its dividend five times on a year-over-year basis for an annual average increase of 2.09%. In October 2023, UTL announced a dividend of 40.5 cents per share and an annual dividend of $1.62 per share. Unitil’s current dividend yield is 3.15%, better than the Zacks S&P 500 Composite’s yield of 1.4%.

Systematic Investment and Customer Growth

Unitil invested $1.4 billion in the Net Utility Plant on Sep 30, 2023. Earnings from Unitil’s utility operations are derived primarily from the return on investment in the utility assets of the three distribution utilities and Granite State.

Unitil’s total operating revenues include revenues to recover the approved cost of purchased electricity and gas in rates on a fully reconciling basis. As a result of this reconciling rate structure, the company’s earnings are not directly affected by changes in the cost of purchased electricity and gas.

Utilities serve approximately 108,100 electric customers and 87,500 gas customers. As of Sep 30, 2023, the number of electric customers increased by approximately 50 over the previous year.

Solvency

Unitil’s times interest earned ratio (TIE) at the end of the third quarter of 2023 was 3.1. The strong TIE ratio indicates that the company will be able to meet its interest payment obligations in the near term without any problems.

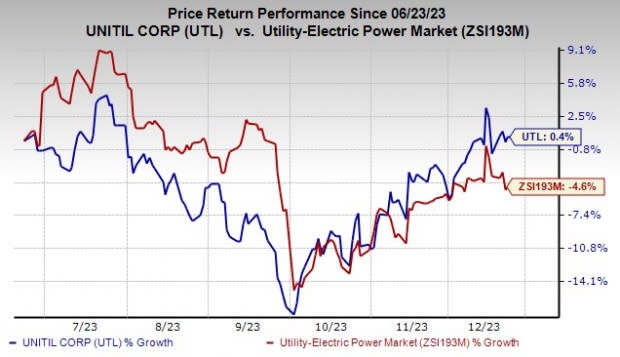

Price Performance

In the past six months, UTL shares have risen 0.4% compared with its industry’s average decline of 4.6%.

Image Source: Zacks Investment Research

Other Stocks to Consider

A few other top-ranked stocks related to the same industry are CenterPoint Energy CNP, ALLETE ALE and Alliant Energy LNT, each holding a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

CenterPoint Energy’s long-term earnings growth rate is pegged at 7.51%. The Zacks Consensus Estimate for the company’s 2023 EPS is pegged at $1.5, implying a year-over-year increase of 8.70%.

Alliant Energy’s long-term earnings growth rate is pegged at 6.26%. The Zacks Consensus Estimate for the company’s 2023 EPS stands at $2.87, calling for a year-over-year increase of 2.50%

ALLETE’s long-term earnings growth rate is pegged at 8.10%. The Zacks Consensus Estimate for the company’s 2023 EPS is pegged at $4.34, indicating a year-over-year rise of 28.40%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CenterPoint Energy, Inc. (CNP) : Free Stock Analysis Report

Alliant Energy Corporation (LNT) : Free Stock Analysis Report

Allete, Inc. (ALE) : Free Stock Analysis Report

Unitil Corporation (UTL) : Free Stock Analysis Report