4 Reasons to Include Bank7 (BSVN) Stock in Your Portfolio Now

It seems to be a wise idea to add Bank7 Corp. BSVN stock to your portfolio now. The stock is well-poised to gain from its strong fundamentals, solid loan and deposit balances, and decent earning growth.

Over the past 30 days, the Zacks Consensus Estimate for Bank7’s earnings has moved 1.1% and marginally upward for 2023 and 2024, respectively. Currently, BSVN carries a Zacks Rank #2 (Buy).

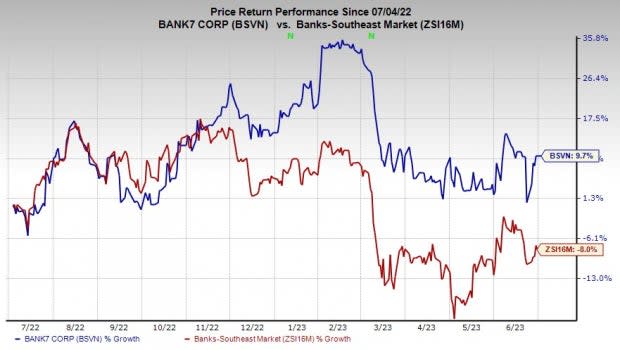

Bank7’s shares have gained 9.7% over the past year against the industry’s fall of 8%.

Image Source: Zacks Investment Research

A few aspects, which make the company an attractive investment option right now, are mentioned below.

Earnings Growth: In the past three to five years, Bank7 has witnessed a earnings per share (EPS) gain of 39.7%, which is significantly higher than the industry’s growth of 12%. While Bank7’s earnings are projected to grow 18% in 2023, the same is projected to decline 9.1% in 2024.

Additionally, the company has a decent earning surprise history. Its earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters and missed once, the average surprise being 4.1%.

Solid Loan & Deposit Balance: Bank7 has been focused on improving the loan and deposit balance. Over the last three years (2019-2022), loan and deposits recorded a compound annual growth rate (CAGR) of 21.5% and 23.6%, respectively. Also, both witnessed a rise on a sequential basis in the first quarter of 2023.

Driven by decent loan demand and higher rates, the company is expected to witness an uptrend in loan and deposit balances, going forward.

Revenue Growth: Bank7 is witnessing a steady improvement in revenues. Its net revenues witnessed a compound annual growth rate (CAGR) of 18.5% over the last three years (2019-2022), with the trend continuing in the first quarter of 2023. The improvement was backed by a strong loan and deposit balance, and high interest rates. Additionally, its acquisition of Watonga Bancshares in 2021 supported its top line.

While revenues are expected to rise 13.6% this year on an uptrend in loan and deposit balances, the same is projected to decline 0.5% in 2024.

Decent Capital Deployment Activities: Bank7 has been increasing its quarterly dividend regularly, with the latest hike of 33.3% to 16 cents per share announced in November 2022. Over the past five years, the company raised its dividend four times, with an annualized dividend growth rate of 13.78%. On Jun 8, the company announced a cash dividend of 16 cents per share for the second quarter of 2023. The dividend will be paid out on Jul 7, 2023, to shareholders of record as of Jun 22, 2023.

Additionally, on October 2021, the company’s board of directors approved a share repurchase plan. The board authorized Bank7 to buy up to 750,000 shares of the company’s common stock. However, there have been no repurchases since the first quarter of 2023. Given its decent earnings strength, the company is expected to sustain its current capital deployment activities.

Superior Return on Equity (ROE): The company’s ROE of 23.38% is higher than the industry average of 12.15%. This shows that it reinvests its cash more efficiently than its peers.

Other Stocks Worth a Look

A couple of other top-ranked stocks from the banking space are First Citizens BancShares FCNCA and Live Oak Bancshares LOB.

The Zacks Consensus Estimate for First Citizens BancShares' current-year earnings has been revised 67.2% upward over the last 60 days. The company’s shares have jumped 69.9% over the past six months. Currently, FCNCA sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Live Oak Bancshares carries a Zacks Rank #2 at present. The consensus mark for the company’s 2023 earnings was revised marginally upward over the last 60 days. In the past three months, LOB’s shares have gained 8.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

First Citizens BancShares, Inc. (FCNCA) : Free Stock Analysis Report

Live Oak Bancshares, Inc. (LOB) : Free Stock Analysis Report

Bank7 Corp. (BSVN) : Free Stock Analysis Report