4 Reasons to Invest in Capital Southwest (CSWC) Stock Now

Capital Southwest Corporation CSWC stock looks like an impressive investment option now. Supported by strong fundamentals, the company remains on track for growth.

Analysts are optimistic regarding the company’s earnings growth potential. The Zacks Consensus Estimate for CSWC’s current fiscal-year earnings has been revised 2.7% upward over the past 60 days.

CSWC currently carries a Zacks Rank #2 (Buy).

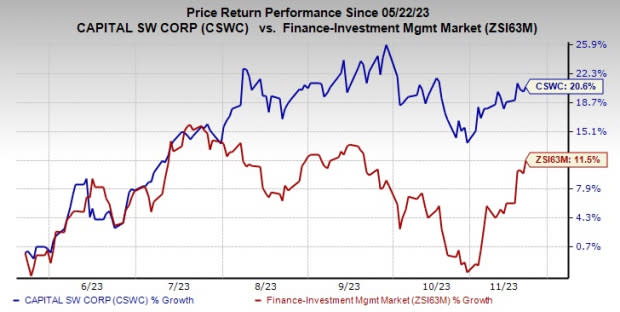

Shares of Capital Southwest have gained 20.6% over the past six months compared with the industry’s 11.5% growth.

Image Source: Zacks Investment Research

Mentioned below are some other factors that make Capital Southwest stock a solid pick right now.

Earnings per Share (EPS) Growth: In the last three to five years, CSWC witnessed EPS growth of 12.3%, higher than the industry average of 5.7%. The upward trend will likely continue in the near term. In fiscal 2024 and 2025, the company’s earnings are projected to grow 16.6% and 1.4%, respectively.

CSWC also has an impressive earnings surprise history. Its earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average beat being 6.6%.

Revenue Strength: Capital Southwest’s total investment income witnessed a compound annual growth rate (CAGR) of 23.1% over the last five fiscal years (ended Mar 31, 2023), with the uptrend continuing in the first six months of fiscal 2024. The company’s top line is expected to keep improving in the near term, as reflected by the projected sales growth rates of 46.4% and 14.2% for fiscal 2024 and 2025, respectively.

Impressive Capital Distributions: Capital Southwest has been enhancing shareholder value through efficient capital distributions. In October 2023, the company hiked its regular dividend to 57 cents. Also, it announced a supplemental distribution of 6 cents per share. CSWC has an efficient share repurchase plan in place.

Superior Return on Equity (ROE): The company’s ROE of 15.30% is higher than the industry average of 13.91%. This shows that it reinvests its cash more efficiently than its peers.

Other Stocks Worth a Look

A couple of other top-ranked stocks from the finance space are Prospect Capital Corporation PSEC and First Citizens BancShares, Inc. FCNCA.

Earnings estimates for PSEC have been revised 8.1% upward for the current fiscal year over the past 60 days. The company’s share price has decreased 6.4% over the past three months. PSEC currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

First Citizens BancShares currently carries a Zacks Rank of 2. Its earnings estimates have been revised upward by 6.7% for the current year over the past 60 days. In the last three months, FCNCA’s share price increased 5.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

First Citizens BancShares, Inc. (FCNCA) : Free Stock Analysis Report

Prospect Capital Corporation (PSEC) : Free Stock Analysis Report

Capital Southwest Corporation (CSWC) : Free Stock Analysis Report