4 REIT Stocks Set to Continue Their Winning Streaks in 2024

After a lackluster performance for the majority of 2023, the Fed’s latest decision to keep interest rates steady and an indication of three rate cuts in 2024 are likely to make real estate investment trusts (REITs) an attractive investment option for many. The industry depends highly on the debt market to carry out business activities, and lower interest rates would mean lower borrowing costs. Moreover, low interest rates contribute to higher valuations.

What is even more encouraging is that REITs are widely known for their regular dividend payouts as this offers stable income with a good inflation upside shield. With rate cuts on the line in the coming year, dividend yields for REITs are likely to be on the attractive side compared with the yields on fixed-income and money-market accounts, making them a desirable investment choice. As of Oct 31, 2023, the dividend yield of the FTSE NAREIT All REITs Index was 5.01%, which clearly outpaced 1.61% offered by the S&P 500 as of that date.

Apart from these broad-based factors, economic activity continues to gain pace from its pandemic lows and remains resilient. A favorable job market seems encouraging. These aspects are jointly expected to aid the industry’s recovery in 2024.

The FTSE NAREIT All REIT Index rose 11.92% in November and 10.27% through Dec 28, outperforming the S&P 500’s rise of 9.13% and 4.83%, respectively, with asset categories like data centers, lodging/resorts, specialty, industrial and self-storage faring well.

Compared with the FTSE NAREIT All Equity REITs Index’s year-to-date performance of 12.72%, data centers witnessed growth of 31.51%, followed by lodging/resorts at 25.30%. Specialty, industrial and self-storage grew at 23.71%, 20.77% and 19.73%, respectively. Retail and residential sectors were seen catching up with the rally and climbed 12.17% and 9.07%, respectively, during this period.

As we step into 2024, commercial real estate investment activity is likely to pick up pace, with investments in certain asset categories ramping up. Specifically, enterprises’ growing reliance on technology and acceleration in digital transformation strategies are likely to drive the demand for data centers in this digital era. Also, the integration of artificial intelligence (AI) into their strategies will attract a significant amount of investment in this asset class in the near future.

Speaking of the industrial real estate market, demand is expected to remain buoyant as growth in industries and expansion of the e-commerce market continue. Despite an anticipated stabilization in this space, companies’ efforts to improve supply-chain efficiencies will drive logistics infrastructure demand in the upcoming period. Also, the recovery in group and business travel demand from the pandemic lows will support the lodging industry’s growth. The growing demand for retail space will drive the performance of retail REITs.

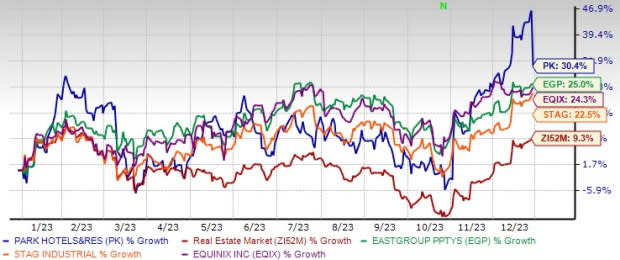

In this article, we have handpicked four REITs that have outpaced the real estate market’s growth on a year-to-date basis and are poised to continue their winning streaks in 2024. Alongside having solid fundamentals, these REITs hold a favorable Zacks Rank, which indicates high chances of market outperformance over the next one to three months. Further, these stocks are witnessing upward estimate revisions, reflecting analysts’ optimism.

Park Hotels & Resorts PK is a Tysons, VA-based lodging REIT that owns a geographically diverse portfolio of premium-branded hotels and resorts located in the prime U.S. markets with high barriers to entry. Notably, 86% of the company’s hotels and resorts are in the luxury or upper upscale segment. Moreover, around 80% of the portfolio is strategically located in the central business districts of major cities or resort or conference destinations, which serve as key demand drivers. PK also has hotels in select airport and suburban locations.

Amid the recovering lodging industry fundamentals, the company continues to experience improvement in overall demand across its portfolio. It expects the positive momentum to continue into 2024 based on improved international travel and current demand trends.

PK currently sports a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for the company’s 2024 funds from operations (FFO) per share has been raised 1.5% over the past month and indicates year-over-year growth of 2.3%. The stock has gained 30.4% in the year-to-date period.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Equinix, Inc. EQIX provides a global, vendor-neutral data center, inter-connection and edge solutions platform. Global enterprises, service providers and business ecosystems of industry partners depend on the company’s International Business Exchange data centers and expertise for safe housing of their critical IT equipment. Platform Equinix allows customers to directly and securely interconnect to networks, clouds and contents that enable today's information-driven global digital economy.

In this digital era, the high demand for inter-connected data center spaces by enterprises and service providers will continue as they integrate AI into their strategies and offerings, and advance their digital transformation agendas. As the implementation of AI becomes more prevalent, the sector is likely to see more investments in 2024, enhancing the growth prospects for data center REITs.

This Redwood City, CA-based company currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for EQIX’s 2024 FFO per share has been revised marginally upward over the past month and suggests year-over-year growth of 7.7%. The stock has appreciated 24.3% year to date.

EastGroup Properties, Inc. EGP, a Ridgeland, MS-based industrial REIT, is engaged in the acquisition, development and operation of industrial properties, the majority of which are clustered around key transportation hubs in supply-constrained submarkets of major Sunbelt regions. Its core markets include the states of Florida, Texas, Arizona, California and North Carolina. Given the strategic location of EGP’s high-quality distribution facilities, it is expected to benefit from the healthy secular fundamentals of the industrial real estate market.

EGP currently carries a Zacks Rank #2. The Zacks Consensus Estimate for its 2024 FFO per share has been raised marginally over the past two months and implies a year-over-year rise of 7.4%. The stock has soared 25% on a year-to-date basis.

Stag Industrial, Inc. STAG is engaged in the acquisition, ownership and operation of industrial properties throughout the United States. The Boston, MA-based company enjoys a diversified portfolio in terms of the market and tenant industry, which is likely to help it tide over the current market conditions and enable it to generate stable rental revenues. Also, a robust liquidity position will allow it to carry on with its expansion activities.

The REIT has a Zacks Rank #2 at present. The Zacks Consensus Estimate for STAG’s 2024 FFO per share has been moved up marginally over the past two months and suggests year-over-year growth of 4%. Year to date, the stock has gained 22.5%.

Image Source: Zacks Investment Research

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Equinix, Inc. (EQIX) : Free Stock Analysis Report

Stag Industrial, Inc. (STAG) : Free Stock Analysis Report

EastGroup Properties, Inc. (EGP) : Free Stock Analysis Report

Park Hotels & Resorts Inc. (PK) : Free Stock Analysis Report