4 Silver Mining Stocks to Watch Amid Industry Challenges

Silver prices have declined 6% so far this year amid rising interest rates, a stronger dollar and weak industrial demand, which, in turn, impacted the Zacks Mining - Silver industry’s performance. While prices have picked up lately on escalating geopolitical tensions in the Middle East and increased bets that the Federal Reserve will not increase rates going ahead, it remains to be seen whether this recovery will be sustained.

We suggest companies like Pan American Silver PAAS, Hecla Mining HL, Vizsla Silver Corp. VZLA and Avino Silver Mines ASM, which are poised to benefit from enhanced operational efficiency, disciplined cost management and solid projects.

About the Industry

The Zacks Mining - Silver industry comprises companies that are engaged in the exploration, development and production of silver. These include big and small players operating mines of widely varying types and scales. Silver-bearing ores are mined by open-pit or underground methods, and then crushed and ground. Miners continually look for opportunities to expand their reserves and resources through targeted near-mine exploration and business development. They strive to upgrade and improve the quality of their existing assets, internally and through acquisitions. Only 20% of silver comes from mining activities, wherein silver is the primary revenue source. The balance comes from projects, wherein silver is a by-product of mining other metals, such as copper, lead and zinc. Thus, several companies in the silver mining industry are engaged in mining other metals..

What's Shaping the Future of the Mining-Silver Industry

YTD Decline in Silver Prices Acts as a Woe: So far this year, silver has lost 5.7% of its value. Silver prices have ranged from a low of $19.83 per ounce to a high of $26.44 per ounce so far this year. Prices have averaged at $23.47 per ounce year to date. The contraction in the industrial sector due to muted customer spending and supply-chain constraints has weighed on the metal’s prices, considering that industrial demand makes up more than half of silver’s demand. Also, rising interest rates, along with a strong dollar, continued to impact silver prices. Prices have recovered somewhat lately to $22.50 per ounce — the highest level in two weeks — on increased safe-haven demand, triggered by the Israel-Hamas conflict. Also, expectations that the Federal Reserve will keep interest rates steady despite a rise in U.S. consumer prices have provided some support to silver prices. If interest rates get raised again, silver prices will change its course.

Efforts to Combat Inflationary Costs to Aid Margins: The industry players are facing escalating production costs, including electricity, wages, water and materials. Mining companies are major consumers of energy, with around 50% of their production costs closely linked to energy prices. A shortage of skilled workforce spiked wages. With no control over silver prices, the industry must focus on improving its sales volumes, while being cost-effective. Players are investing heavily in R&D and resorting to technological innovations required at almost every level of operation to increase efficiency, sustain growth and rein in costs.

Demand to Remain Strong: The Silver Institute expects industrial fabrication to peak at an all-time high in 2023, aided by continued gains in photovoltaic applications, as well as other industrial segments. Industrial demand is expected to grow, as ongoing vehicle electrification, the rising adoption of 5G technologies and the governmental focus on green infrastructure will drive demand. Silver demand is expected to remain solid in India in 2023, as employment and income have returned to the pre-pandemic levels. The silver physical investment will continue to be supported by ongoing macroeconomic uncertainties and inflationary pressures. Changes to solar panel technology are accelerating the demand for silver and are expected to make up 14% of silver consumption this year, according to the Silver Institute. The rise will mainly stem from China, as the country is expected to install more panels this year. Solid demand in all key sectors amid tight supply is expected to support silver prices.

Zacks Industry Rank Indicates Lackluster Prospects

The group's Zacks Industry Rank, basically the average of the Zacks Rank of all the member stocks, indicates gloomy prospects in the near term. The Zacks Mining - Silver industry, a ten-stock group within the broader Zacks Basic Materials sector, currently carries a Zacks Industry Rank #164, which places it in the bottom 35% of 251 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually losing confidence in this group's earnings growth potential. So far this year, the industry's earnings estimates for the current year have moved down 14%.

Despite bleak near-term prospects, we will present a few Mining-Silver stocks that one can add to their portfolio, given their prospects. But it is worth looking at the industry's shareholder returns and current valuation first.

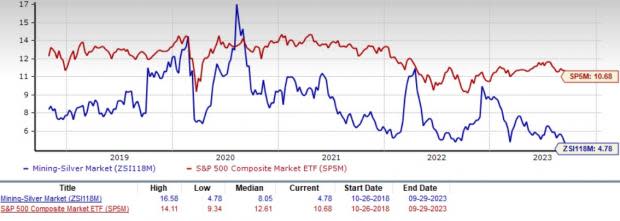

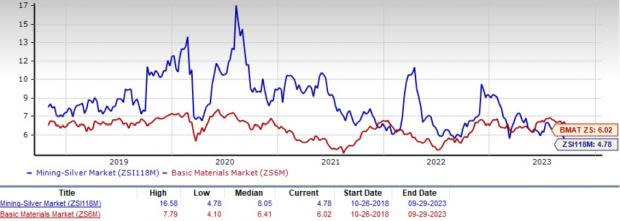

Industry Versus Broader Market

The Mining-Silver Industry has underperformed the S&P 500 and its sector over the past year. The stocks in this industry have collectively grown 6.6% in the past year compared with the Zacks S&P 500's rise of 18.1% and the Zacks Basic Material sector’s rally of 13%.

One-Year Price Performance

Industry's Current Valuation

Based on the forward 12-month EV/EBITDA ratio, a commonly used multiple for valuing silver-mining companies, we see that the industry is currently trading at 4.78X compared with the S&P 500's 10.68X and the Basic Material sector's forward 12-month EV/EBITDA of 6.02X. This is shown in the charts below.

Enterprise Value/EBITDA (EV/EBITDA) F12M Ratio

Enterprise Value/EBITDA (EV/EBITDA) F12M Ratio

Over the past five years, the industry has traded as high as 16.58X and as low as 4.78X, with the median being 8.05X.

4 Mining-Silver Stocks to Keep an Eye on

Pan American Silver: The company’s acquisition of Yamana Gold, which was completed earlier this year, is a transformational and strategic transaction that will strengthen its position as the leader in silver and gold production in Latin America. This deal added long-life, low-cost assets, and boosted the company’s portfolio to 12 operating mines. This was evident in the company’s second-quarter 2023 results, with production improving 33% for silver, 93% for gold and revenues soaring 88% year over year. Per the company, the integration is progressing well and Pan American Silver is on track to realize the targeted $40-$60 million in annual synergies. Following the acquisition, PAAS’s proven and probable mineral reserves are estimated to include 576.6 million ounces of silver and 12.9 million ounces of gold. This marks a significant rise from the proven and probable mineral reserves of 515 million ounces of silver and 4 million ounces of gold reported as of Jun 30, 2022. The company has been selling its non-core assets in sync with its ongoing endeavor to optimize its portfolio. This will also help lower its annual project development, reclamation, and care and maintenance costs.

The Zacks Consensus Estimate for the company’s current-year earnings indicates year-over-year growth of 400%. The estimate has moved up 5% over the past 60 days. PAAS currently carries a Zacks Rank #2 (Buy).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

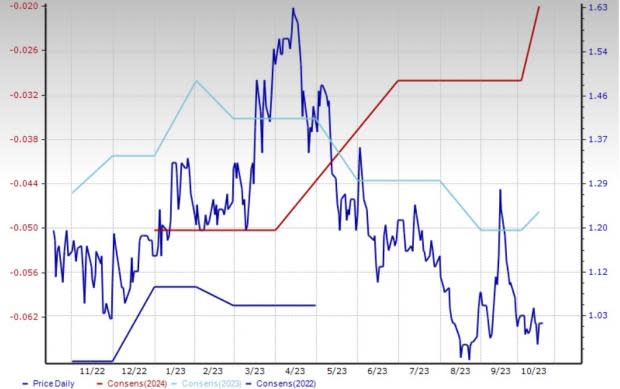

Price & Consensus: PAAS

Vizsla Silver: VZLA is focused on advancing its flagship, 100%-owned high-grade Panuco silver-gold project in Sinaloa, Mexico, one of the highest-grade silver primary discoveries in the world. The project benefits from power, water and road access. The project has indicated mineral resources of 104.8 million ounces of silver equivalent and inferred mineral resources of 114.1 million ounces of silver equivalent. About 93% of the value of the mineral resource estimate comprises precious metals, including 59% from silver. So far, Vizsla Silver has completed more than 250,000 meters of drilling at Panuco, leading to the discovery of several high-grade veins. For 2023, VZLA has budgeted more than 90,000 meters of resource/discovery-based drilling designed to upgrade and expand the mineral resource, as well as test other high-priority targets across the region.

The Zacks Consensus Estimate for this Vancouver, Canada-based player’s 2023 earnings is pegged at a loss of 5 cents per share, which indicates a slight improvement from the loss of 6 cents reported in 2022. The company has a trailing four-quarter earnings surprise of 37.5%, on average. VZLA currently carries a Zacks Rank of 2.

Price & Consensus: VZLA

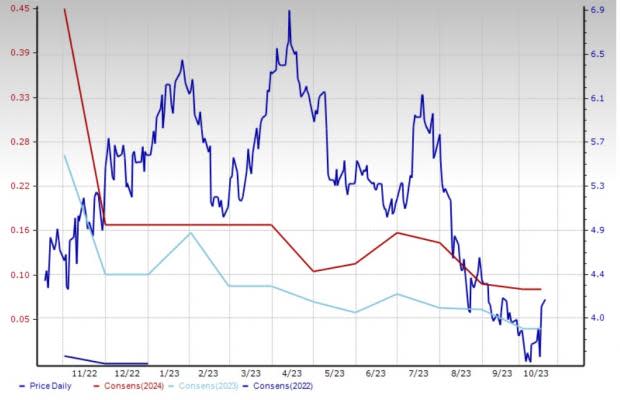

Avino Silver Mines: In July 2023, the company announced the results of three holes from below Level 17, the current deepest workings at the Elena Tolosa (“ET”) area of the Avino system. This mineralized intercept was exceptionally wide, has high silver, gold and copper grades, and is deemed to be the best drill intercept in the company history at the Avino mine. In September, the company completed its planned and budgeted drilling program for the year (7,545 meters in 13 drill holes). It has been focusing on generating profitable organic growth at its wholly-owned Avino Property. The acquisition of the La Preciosa property last year was also a strategic move to realize this. A large portion of the La Preciosa resource can be mined through an underground operation to potentially improve Avino’s organic production growth profile. Also, La Preciosa’s proximity to the Avino mine and infrastructure could yield numerous financial and operational synergies.

The Zacks Consensus Estimate for this Vancouver, Canada-based player’s 2023 earnings has been unchanged over the past 60 days. ASM currently carries a Zacks Rank #3 (Hold).

Price & Consensus: ASM

Hecla Mining: The company recently reported production numbers for the first nine months of 2023. Silver production has increased 8% year over year for the period. Despite the halt in operations at the Lucky Friday mine due to a fall of the ground incident in one of its shafts, backed by consistent performance at Greens Creek and the ramp-up of Keno Hill, the company expects to achieve its 2023 production guidance of 14.5-15.5 million ounces of silver. It is targeting to reach the 20-million-ounce mark in 2025. The company already produces 45% of the U.S. silver, and has the largest and highest-grade silver reserve base in the United States. It is gearing up to be Canada’s largest silver producer by 2024.

The Coeur d'Alene, Idaho-based company has a trailing four-quarter earnings surprise of 25%, on average. HL currently carries a Zacks Rank of 3.

Price & Consensus: HL

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pan American Silver Corp. (PAAS) : Free Stock Analysis Report

Hecla Mining Company (HL) : Free Stock Analysis Report

Avino Silver (ASM) : Free Stock Analysis Report

Vizsla Silver Corp. (VZLA) : Free Stock Analysis Report