4 Staffing Stocks to Make You a Prudent Dividend Investor

Quoting Benjamin Graham, "In the short run, the market is a voting machine, but in the long run, it is a weighing machine." This quote underscores that while emotions and sentiment can influence short-term market movements, factors such as dividends and financial performance will be of greater significance in the long run. Dividend investing, one of the popular stock market strategies, involves buying stocks that regularly share their profits with shareholders through dividends. Investing in companies with a strong fundamental footing is an icing on the cake. Dividend-focused investors aim for companies with a reliable record of paying dividends consistently while maintaining stable growth.

Heidrick & Struggles International, Inc.HSII, ManpowerGroup Inc. MAN, Insperity, Inc. NSP and Randstad N.V. RANJY are some stocks from the Zacks Staffing Firms industry can be considered to unravel lucrative investing options if you are looking to earn regular dividends.

What’s Going on in the Staffing Industry

The U.S. Bureau of Labor Statistics reported an increase of 187,000 in total non-farm payroll employment in July, and the unemployment rate remained relatively stable at 3.5%. This data indicates that job growth continued during the period.

The sectors that saw job gains included health care, social assistance, financial activities and wholesale trade. The healthcare sector saw a noteworthy addition of 63,000 jobs, surpassing the average monthly increase of 51,000 observed in the previous 12 months. Social assistance also contributed 24,000 new jobs in July, aligning closely with the average monthly gain of 23,000 seen in the past year.

Furthermore, the financial activities industry experienced a notable rise in employment, with an increase of 19,000 jobs in July. This sector had been averaging an additional 16,000 jobs per month during the second quarter, following a relatively stagnant performance in the first quarter.

Additionally, the wholesale trade sector saw an upswing in employment with the addition of 18,000 jobs in July, following a period of minimal change in employment in recent months.

Lastly, employment in the other services industry displayed continued growth throughout July.

Why Invest in a Dividend Paying Stocks

Dividends offer a dependable income source without the need to sell shares, making them a more reliable option than counting on share price growth. They are attractive for investors seeking consistent returns without waiting for share prices to rise.

During market volatility, dividend stocks can be a reliable choice for investors. Given the fluctuations in the U.S. markets, adding dividend-paying stocks to your portfolio can complement investments in growth markets and help mitigate risk. Companies that pay dividends tend to bounce back more swiftly following significant market corrections when compared to those that don't offer dividends.

Stocks to Consider

To select dividend-paying stocks, we ran the Zacks Stocks Screener to identify the abovementioned stocks with a dividend yield of over 2% and a five-year historical dividend growth of more than 0.1%. These stocks have a dividend payout ratio of less than 60%.

Heidrick & Struggles International, Inc. is a global executive search and leadership consulting company. It has beaten the Zacks Consensus Estimate in all four preceding quarters with an average earning surprise of 18.8%. HSII’s earnings for 2023 have been revised northwards 3.4% in the past 90 days, while for 2024, it has been revised 10.4%. It has a payout ratio of 18%. The company’s annualized dividend comes at 60 cents, yielding 2.2%. It has an annualized five-year dividend growth of 1.56%. HSII currently sports Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Heidrick & Struggles International, Inc. Dividend Yield (TTM)

Heidrick & Struggles International, Inc. dividend-yield-ttm | Heidrick & Struggles International, Inc. Quote

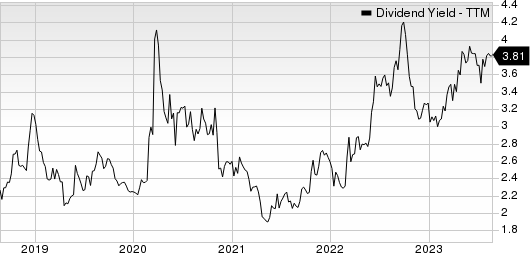

ManpowerGroup is a global workforce solutions company that assists organizations in sourcing, assessing, and developing talent to address their workforce needs. MAN has a payout ratio of 39%. The company’s annualized dividend comes at $2.94, currently yielding 3.83%. It has an annualized five-year dividend growth of 7.95%. The company has increased its dividend 5 times in the past 5 years. ManpowerGroup currently holds Zacks Rank #3 (Hold).

ManpowerGroup Inc. Dividend Yield (TTM)

ManpowerGroup Inc. dividend-yield-ttm | ManpowerGroup Inc. Quote

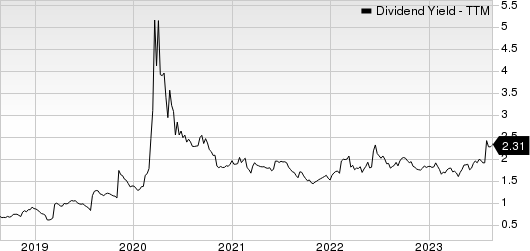

Insperity, Inc. is a comprehensive human resource outsourcing and business performance solutions provider, supporting companies in managing their HR needs and enhancing organizational efficiency. It has beaten the Zacks Consensus Estimate in three of the four preceding quarters, missing one instance with an average earning surprise of 5.4%. NSP’s Revenues for 2023 are expected to grow 8.9% while for 2024, it is expected to reflect growth of 7.7%. It has a payout ratio of 48%. The company’s annualized dividend comes at $2.28, currently yielding 2.28%. It has an annualized five-year dividend growth of 20.86%. Insperity currently holds Zacks Rank #3 (Hold).

Insperity, Inc. Dividend Yield (TTM)

Insperity, Inc. dividend-yield-ttm | Insperity, Inc. Quote

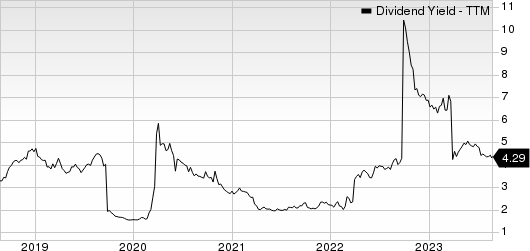

Randstad Holding is a multinational human resource consulting firm known for providing staffing and workforce solutions. RANJY has a payout ratio of 46%. The company’s annualized dividend comes at $1.27, currently yielding 4.3%. It has an annualized five-year dividend growth of 9.17%. The company has increased its dividend 6 times in the past 5 years. Randstad also holds a Zacks Rank #3 (Hold).

Randstad Holding NV Dividend Yield (TTM)

Randstad Holding NV dividend-yield-ttm | Randstad Holding NV Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ManpowerGroup Inc. (MAN) : Free Stock Analysis Report

Insperity, Inc. (NSP) : Free Stock Analysis Report

Heidrick & Struggles International, Inc. (HSII) : Free Stock Analysis Report

Randstad Holding NV (RANJY) : Free Stock Analysis Report