4 Steel Stocks That Have Gained More Than 30% This Year

The steel industry lost some momentum after enjoying a solid run earlier this year as steel prices witnessed a sharp downward correction from their April 2023 peak. However, the industry benefited from a demand recovery in automotive and a resilient non-residential construction market. Also, a strong year-end steel price recovery has put the wind back in the sails of the industry.

Steel prices witnessed a significant correction globally in 2022 as the Russia-Ukraine conflict, skyrocketing energy costs in Europe, persistently high inflation, interest rate hikes, and the slowdown in China due to new COVID-19 lockdowns dampened demand for steel across key end-use markets. Notably, U.S. steel prices tumbled after surging to roughly $1,500 per short ton in April 2022 due to supply concerns stemming from the Russia-Ukraine war. The benchmark hot-rolled coil (HRC) prices cratered to near the $600 per short ton level in November 2022. The downward drift partly reflects weaker demand and fears of a recession.

After rebounding strongly during the first three months of 2023, the benchmark hot-rolled coil ("HRC") prices tumbled more than 40% from their April 2023 peak of around $1,200 per short ton to below the $700 per short ton level in late September. The downside was partly driven by shorter lead times. The United Auto Workers (UAW) strike and lower cost of raw materials (including scrap prices) also weighed on HRC prices.

However, HRC prices have rebounded over roughly the past three months to break above $1,000 per short ton this month, driven by U.S. steel mills’ price hike actions, supply tightness and a recovery in demand, and the uptrend is likely to continue into 2024. The strong price recovery has instilled optimism in this space. We believe that stocks like Universal Stainless & Alloy Products, Inc. USAP, SSAB AB SSAAY, Olympic Steel, Inc. ZEUS and Ternium S.A. TX are worth adding to your portfolio now.

Steelmakers are expected to benefit from healthy demand across major steel-consuming sectors such as construction and automotive. Steel demand in automotive has improved this year on the back of an easing global shortage in semiconductor chips that weighed heavily on the automotive industry for nearly two years. Also, the UAW reached a deal with the Detroit Big Three in November 2023, ending the roughly six-week strike that weighed on the U.S. steel industry due to a slowdown in automotive demand. The resolution to the UAW strikes augurs well for steel demand.

While residential construction has been impacted by interest rate hikes, order activities in the non-residential construction market remain strong globally, underscoring the underlying strength of this industry. Demand for steel is expected to continue to be supported by infrastructure investment. Moreover, demand in the energy sector has improved on the back of strength in oil and gas prices. The healthy demand in major markets will likely support steel companies’ volumes in 2024.

The massive infrastructure development project should also act as a catalyst for the American steel industry and U.S. HRC prices in 2024. The sizable federal infrastructure spending should favor the U.S. steel industry, given the expected rise in consumption of the commodity. Moreover, the Inflation Reduction Act and the CHIPS and Science Act will spur demand for domestic steel in the United States.

4 Steel Stocks Set to Run Higher

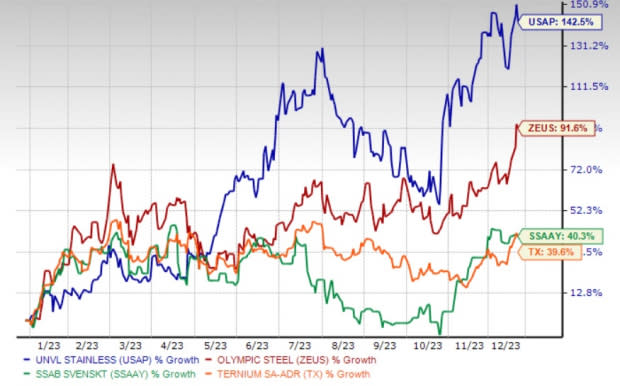

An uptick in automotive demand, rising steel prices and the sizable infrastructure investment augur well for the steel industry heading into 2024. We have taken the help of the Zacks Stocks Screener to shortlist stocks that have gained more than 30% this year and are likely to continue their winning streak next year. Also, these stocks currently carry a Zacks Rank #1 (Strong Buy) or 2 (Buy) or 3 (Hold).

Image Source: Zacks Investment Research

You can see the complete list of today’s Zacks #1 Rank stocks here.

Universal Stainless & Alloy Products: Pennsylvania-based Universal Stainless & Alloy Products, carrying a Zacks Rank #2, is benefiting from strengthening demand in the aerospace market, which is driving its premium alloy sales and the top line. USAP is seeing strong growth in aerospace sales as demand for new airplanes is being driven by a recovery in air travel and higher demand for business jets and freighters. The company is also gaining from a favorable product mix and higher selling prices. The completion of its capital project is expected to enable the expansion of its portfolio with technologically advanced, higher-margin products.

Universal Stainless & Alloy Products has an expected earnings growth rate of 188.5% for 2024. It has a trailing four-quarter earnings surprise of roughly 44.4%, on average. Shares of USAP have surged 142.5% so far this year.

SSAB: Sweden-based SSAB is witnessing healthy demand in the automotive space, where it is strongly placed in high-strength steel. Demand also remains favorable in heavy transport in Europe, offsetting the weakness in construction. SSAAY is seeing stable demand for high-strength steel in North America. The company’s ongoing transformation actions as well as efforts to lower costs and strengthen its product portfolio are expected to support its performance.

SSAB currently carries a Zacks Rank #2. The consensus estimate for 2024 earnings has been revised 21.9% upward over the past 60 days. SSAAY shares have also rallied 40.3% year to date.

Olympic Steel: Ohio-based Olympic Steel, carrying a Zacks Rank #3, is benefiting from its strong liquidity position, actions to lower operating expenses, and strength in its pipe and tube business. Improving industrial market conditions are expected to support its volumes. The company’s strong balance sheet also allows it to invest in higher-return growth opportunities. The recent acquisition of Central Tube & Bar expands the company's footprint into the burgeoning markets of the Mid-South and enhances its capabilities in value-added contract manufacturing.

Olympic Steel has a projected earnings growth rate of 6.9% for 2024. The Zacks Consensus Estimate for Olympic Steel’s 2024 earnings has been revised 10.2% upward over the past 60 days. Shares of ZEUS have shot up 91.6% so far this year.

Ternium: Based in Luxembourg, Ternium, carrying a Zacks Rank #3, is expected to benefit from strong demand for steel products. Its shipments in Mexico are likely to be aided by healthy demand from industrial and commercial customers. TX is seeing higher shipments to commercial customers and increased demand in automotive in Mexico. Moreover, the company is benefiting from the cost competitiveness of its facilities. It is also taking actions to boost liquidity and strengthen its financial position.

The Zacks Consensus Estimate for Ternium’s 2024 earnings has been revised 28.1% upward over the last 60 days. TX also beat the Zacks Consensus Estimate for earnings in three of the trailing four quarters. In this time frame, it has delivered an average earnings surprise of roughly 38.6%. The stock has gained 39.6% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ternium S.A. (TX) : Free Stock Analysis Report

Universal Stainless & Alloy Products, Inc. (USAP) : Free Stock Analysis Report

Olympic Steel, Inc. (ZEUS) : Free Stock Analysis Report

SSAB (SSAAY) : Free Stock Analysis Report