4 Stocks to Watch From a Challenging Cable Television Industry

The Zacks Cable Television industry is witnessing a rise in cord-cutting on pay-TV options, including cable TV and satellite TV, due to intensifying competition from over-the-top service providers’ innovative content offerings. Focus on providing bundled offerings and on-demand programming content that cater to changing consumer behavior bodes well for streaming players.

Despite stiff competition, Cable Television industry players are benefiting from the spike in COVID-led demand for high-speed broadband. Strong demand for WiFi devices and wireless Internet has been driving growth. Increased consumption of media due to the pandemic-induced lockdowns and shelter-at-home guidelines has been a key catalyst for industry participants like Comcast CMCSA, Charter Communications CHTR, Cable One CABO and DISH Network DISH.

Industry Description

The Zacks Cable Television industry primarily comprises companies that provide integrated data, video and voice services. Industry participants offer pay-TV services, including Internet-based streaming content. These companies provide equipment such as satellite dish, digital set-top receivers and remote controls. Typically, cable companies either build their network backbone or lease physical access to the network backbone from telecommunication companies. These companies purchase licenses to provide subscribers access to cable television channels owned by programmers and distributed over the network backbone. Cable companies also sell advertising spots on their channels. The industry requires a high capital expenditure on infrastructure to enhance its services. The industry is highly regulated by the Federal Communications Commission.

4 Trends Shaping the Future of the Cable Industry

Skinny Bundles, Original Content Driving Growth: Cable television’s ability to generate ad revenues outside traditional TV platforms, such as websites and any digitally-consumed platform, provides increased scope for target-based advertising. Nevertheless, consumers’ unfavorable disposition, particularly toward advertising, has hit industry participants hard. Further, the growing consumer preference for digital and subscription services instead of linear pay-TV and rental or outright purchase has compelled industry players to alter their business models. Cable television companies are now offering a variety of alternative packages, including skinny bundles, which are delivered at lower costs than traditional offerings. These companies are also innovating in terms of original content to be competitive against streaming service providers.

High-Speed Internet Demand Key Catalyst: The growing demand for high-speed Internet, including broadband, has aided cable television industry participants like Comcast and Charter. Improving Internet speed is fueling the demand for high-quality video and the trend of binge viewing. Further, a strengthening broadband ecosystem in international markets, along with the proliferation of smart TVs, is anticipated to drive growth. Also, the surging work-from-home trend and online learning practice owing to coronavirus-induced quarantines and lockdowns have boosted Internet usage, thus supporting industry participants.

Cord Cutting and Matured PayTV Industry Hurting Prospects: The cable television industry is witnessing the rapid evolution of distribution platforms as well as embracing new players and advanced technologies. Declining profits of residential video services due to rising programming costs and retransmission fees have made survival difficult for traditional companies. Additionally, the heightened need for on-demand content has led to the mushrooming of streaming service providers, making it particularly tricky for traditional cable television companies to maintain a viewer base. Furthermore, the traditional pay-TV industry is maturing with widespread consolidation. Moreover, residential voice service revenues are declining due to the rising shift to wireless voice services.

Softness in Advertising Demand Impeding Business Growth: Persistent inflation and higher interest rates are having a detrimental effect on ad spending. Besides, the challenge with TV ads is that marketers have difficulty getting actionable metrics and insights such as attribution data. At this time, marketers must look for outside-the-box solutions to extract conversion data from offline media. TV has taken a secondary role in most marketing strategies due to the growing influence of digital marketing. Many marketers are increasing ad spending on digital mediums due to their unmatched ability to deliver personalized messages that are easy to measure. Cable TV players are set to face competition for ad dollars from streaming service providers like Netflix and Disney, which are raising prices and introducing cheaper ad-supported packages now that their subscriber growth has slowed.

Zacks Industry Rank Indicates Dull Prospects

The Zacks Cable Television industry is housed within the broader Zacks Consumer Discretionary sector. It carries a Zacks Industry Rank #163, which places it in the bottom 35% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all member stocks, indicates weak near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s position in the bottom 50% of the Zacks-ranked industries is a result of a negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are pessimistic about this group’s earnings growth potential. Since Nov 30, 2022, the industry’s earnings estimate for 2023 has moved down 9.4%.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

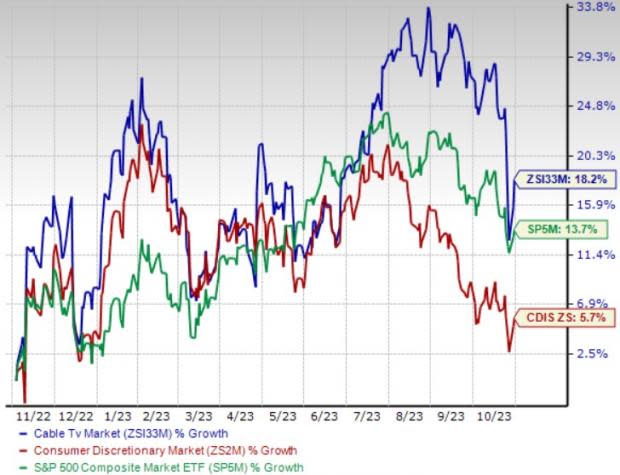

Industry Beats Sector, S&P 500

The Zacks Cable Television industry has outperformed the broader Zacks Consumer Discretionary sector and the S&P 500 composite over the past year.

The industry has returned 18.2% over this period compared with the broader sector’s increase of 5.7% and the S&P 500’s rise of 13.7%.

One-Year Price Performance

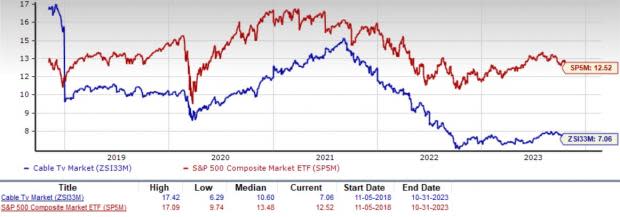

Industry's Current Valuation

On the basis of the trailing 12-month EV/EBITDA, a commonly used multiple for valuing cable companies, we see that the industry is currently trading at 7.06X compared with the S&P 500’s 12.52X and the sector’s 7.52X.

Over the past five years, the industry has traded as high as 17.42X, as low as 6.29X and at the median of 10.6X, as the chart below shows.

EV/EBITDA Ratio (TTM)

4 Cable Stocks in Focus

Comcast: The company is riding on strong momentum in the wireless business. Its strategy to provide high-speed Internet at an affordable price plays a pivotal role in providing connectivity and improving customer experience.

Comcast’s plan to transition to DOCSIS 4.0 is noteworthy. The technology will help it expand much faster and at a lower cost compared to competitors. The recovery in the park and movie business bodes well for Comcast’s profitability. Its streaming service, Peacock, is a key catalyst in driving broadband sales. Its strong free cash flow generation ability is noteworthy.

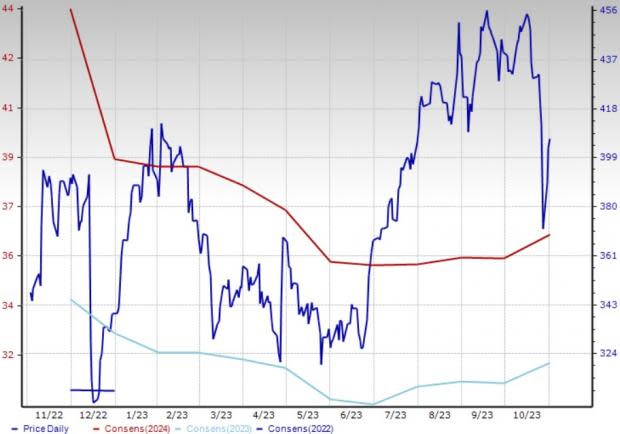

Shares of this Zacks Rank #2 (Buy) company have returned 19.6% year to date. The Zacks Consensus Estimate for Comcast’s 2023 earnings has increased 2.6% to $3.91 per share in 30 days’ time. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Price and Consensus: CMCSA

Cable One: This Zacks Rank #2 company is benefiting from strength in demand for both residential and business broadband offerings. The quality of its network allows CABO to deploy faster residential Internet speeds than most of its competitors. It has ample unused network capacity, providing a runway for increases in data consumption over time.

The demand for higher speed tiers remains robust, with the sale of 500 megabits or higher at nearly 65% and gig sales at an all-time high of nearly 40%. CABO has developed a unique device configuration using DOCSIS 3.1 that has created 20% to 30% more capacity upstream than previously available on traditional low-split hybrid fiber coax plants.

Shares of the company have declined 22.7% year to date. The Zacks Consensus Estimate for CABO’s 2023 earnings has increased 0.1% to $49.28 per share in 30 days’ time.

Price and Consensus: CABO

Charter Communications: This Zacks Rank #3 (Hold) company is benefiting from strong growth in residential mobile service and commercial business. The company’s expanding Internet subscriber base and strong mobile line growth boost prospects. Charter’s broadband service continues to gain traction among small and medium businesses.

The company’s initiatives to evolve its network services to improve speed and latency have been a key catalyst. Its partnership with Cisco is helping it offer enhanced cybersecurity solutions to enterprises, thereby driving the adoption of Spectrum enterprise solutions.

Charter’s shares have returned 19.9% in the year-to-date period. The consensus mark for 2023 earnings has moved north by 0.4% to $31.38 per share in the past 30 days.

Price and Consensus: CHTR

DISH Network: This Englewood, CO-based Zacks Rank #3 company’s focus on acquiring and retaining subscribers, who will be profitable in the long term, is commendable and is expected to drive growth. DISH created an extensive portfolio of spectrum, the most important component of wireless networks.

Partnerships with the likes of Qualcomm, Aviat, Everstream, Segra, Uniti, Zayo, Mavenir, Fujitsu, Altiostar, VMware, MATRIXX Software and Crown Castle for DISH’s standalone 5G network are other key catalysts. These initiatives bode well for DISH’s top-line growth in the long haul.

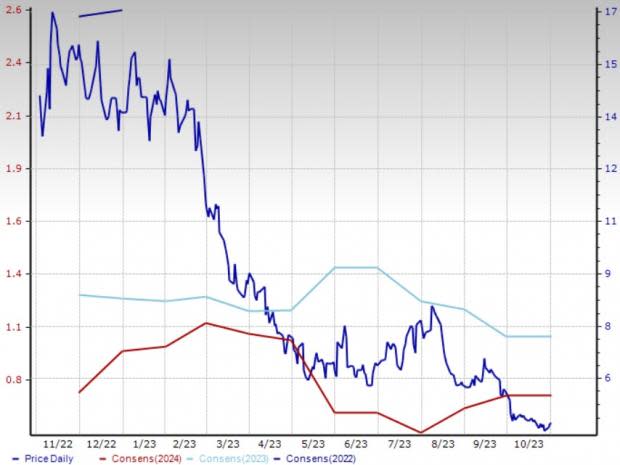

DISH Network’s shares have declined 65.2% in the year-to-date period. The consensus mark for 2023 earnings has remained steady at $1.05 per share in the past 30 days.

Price and Consensus: DISH

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Comcast Corporation (CMCSA) : Free Stock Analysis Report

DISH Network Corporation (DISH) : Free Stock Analysis Report

Charter Communications, Inc. (CHTR) : Free Stock Analysis Report

Cable One, Inc. (CABO) : Free Stock Analysis Report