4 Stocks to Watch in a Challenging Consumer Products-Discretionary Industry

As stimulus-driven spending gradually wanes and interest rates remain elevated, the Consumer Products-Discretionary industry finds itself at a pivotal juncture. Consumers are adopting a more cautious stance toward their disposable income, signaling a return to more conservative spending habits. This shift in consumer sentiment is reverberating across various merchandise categories, creating challenges for businesses. As the once-easy-to-spend "discretionary dollar" becomes harder for consumers to part with, companies in this sector must adapt to this evolving landscape.

Nonetheless, the industry participants are proactively addressing the changing consumer environment by emphasizing a superior product strategy, enhancing their omnichannel capabilities and making prudent capital investments. Backed by these initiatives, companies like Central Garden & Pet Company CENT, Alto Ingredients, Inc. ALTO, The RealReal, Inc. REAL and Lifetime Brands, Inc. LCUT are well-positioned to seize opportunities that may arise in this changed marketplace.

About the Industry

The Consumer Products-Discretionary industry has a direct correlation with the economy, thus making it cyclical. Discretionary products command high prices, with middle-to-higher-income groups being targeted customers. The industry comprises companies that offer product categories, including fashion, jewelry and watches, and other home and art products. Quite a few players develop, manufacture, market and sell over-the-counter health and personal care products. Some even manufacture and distribute party goods. There are companies that design, source and distribute licensed pop culture products too. Some industry participants also produce and distribute various products for the lawn and garden and pet supplies markets. Companies sell products to specialty retailers, mass-market retailers and e-commerce sites.

3 Key Trends to Watch in the Industry

Cautious Consumer Environment: Consumers are contending with a host of economic issues, encompassing high inflation, elevated interest rates, a softening job market and the impending return of student loan obligations. Cumulatively, these factors have significantly eroded consumer sentiment. Consumer confidence plays a pivotal role in shaping the overall health of the economy, and any decline in it could have significant repercussions on spending. In September, U.S. consumer confidence, a vital barometer of economic health, tumbled to a four-month low. Per the Conference Board, the Consumer Confidence Index dropped to 103 in September from an upwardly revised reading of 108.7 in August. The rise in gasoline prices and a high-interest-rate environment have cast a shadow over Americans, underscoring the potential impact of these economic factors on spending patterns.

Margins, an Area to Watch: The industry is quite fragmented, with companies vying for a bigger slice of the pie on attributes, such as price, products and speed to market. To address these, a significant number of players in the industry have been investing in strengthening their digital ecosystem. While these endeavors provide an edge, they entail high costs. Apart from these, higher marketing, advertising and other operational expenses might compress margins. Of late, the industry participants have been dealing with product cost inflation. Nonetheless, companies have been focusing on undertaking initiatives to mitigate cost-related challenges. These include streamlining operational structures, optimizing supply networks and adopting effective pricing policies.

Brand Enhancement, Capital Discipline: Industry participants have been focusing on deepening engagements with consumers, creating innovative and compelling products and enhancing digital and data analytics capabilities. The launch of newer styles, customization options, unique packaging, point-of-sale displays, automation and high-end customer service enables them to woo consumers. Efforts to enhance the brand portfolio via marketing strategies, buyouts, innovations and alliances are likely to keep supporting players in the space. The companies have been taking steps to strengthen their financial position. They have been making every move, from managing the inventory to optimizing capital expenditures and enhancing operational efficiency.

Zacks Industry Rank Indicates Bleak Prospects

The Zacks Consumer Products-Discretionary industry is a group within the broader Consumer Discretionary sector. The industry currently carries a Zacks Industry Rank #156, which places it in the bottom 36% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates drab near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the bottom 50% of the Zacks-ranked industries is a result of the negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are losing confidence in this group’s earnings growth potential. Since the beginning of May 2023, the industry’s earnings estimate has declined 14.8%.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Versus Broader Market

The Zacks Consumer Products-Discretionary industry has underperformed the broader Zacks Consumer Discretionary sector and the Zacks S&P 500 composite over the past year.

The industry has declined 1.4% over this period against the S&P 500’s rise of 17.7%. Meanwhile, the broader sector has increased 0.5%.

One-Year Price Performance

Industry's Current Valuation

On the basis of forward 12-month price-to-sales (P/S), which is commonly used for valuing consumer discretionary stocks, the industry is currently trading at 1.47X compared with the S&P 500’s 3.55X and the sector’s 7.51X.

Over the last three years, the industry has traded as high as 12.02X and as low as 1.11X, with the median being at 3.35X, as the chart below shows.

Price-to-Sales Ratio (Past 3 Years)

4 Stocks to Watch

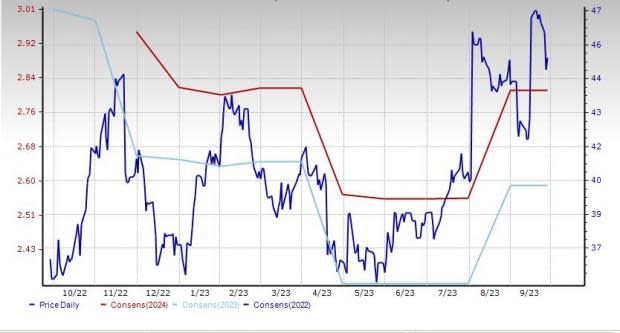

Central Garden & Pet Company: The company is positioning itself as a frontrunner in the U.S. pet supplies and lawn and garden supplies industry, bolstering its competitive edge through a range of strategic endeavors. These include unique packaging, impactful point-of-sale displays, logistics capabilities and a steadfast commitment to delivering exceptional customer service. The company is also making meaningful progress in its Central-to-home strategy.

The Zacks Consensus Estimate for current financial-year earnings has moved up by 10.2% in the past 60 days. Central Garden & Pet Company delivered an earnings surprise of 20.7% in the last reported quarter. Shares of this Zacks Rank #1 (Strong Buy) company have rallied 25.6% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Price and Consensus: CENT

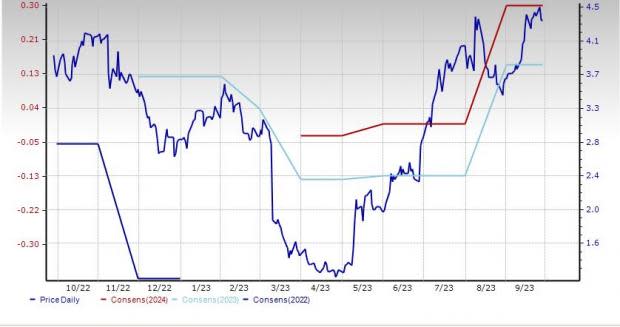

Alto Ingredients: Alto Ingredients is actively seeking opportunities to maximize value through strategic capital investments and partnerships that align with its vision. The company is also intensifying its focus on long-term capital projects aimed at expanding its product portfolio, enhancing plant efficiency and embarking on sustainability initiatives, such as a natural gas pipeline, biogas conversion, improved cogeneration capabilities, primary yeast production, and carbon capture and sequestration, as part of its ongoing business transformation.

Alto Ingredients delivered an earnings surprise of 242.9% in the last reported quarter. The Zacks Consensus Estimate for ALTO’s current financial-year bottom line suggests growth of 125% from the year-ago period. We note that shares of this Zacks Rank #2 (Buy) company have risen 16.1% in the past year.

Price and Consensus: ALTO

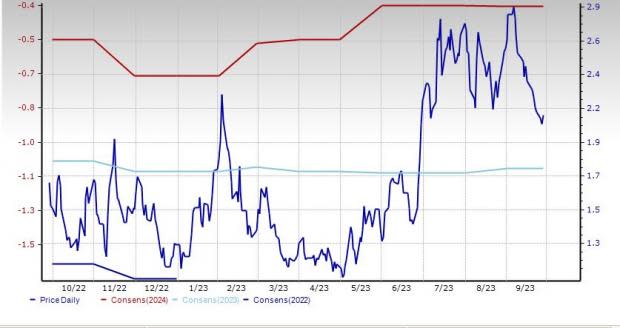

The RealReal: This San Francisco, CA-based company is the world’s largest online marketplace for authenticated, resale luxury goods. The RealReal is focusing on enhancing profitability through price optimization, cost containment, the tapping of potential revenue streams and concentration on the higher-margin consignment business.

The RealReal has a trailing four-quarter earnings surprise of 12.8%, on average. The Zacks Consensus Estimate for the current financial-year bottom line suggests growth of 27.5% from the year-ago reported figure. Shares of this Zacks Rank #2 company have advanced 40.4% in the past year.

Price and Consensus: REAL

Lifetime Brands: This leading global designer, developer and marketer of a broad range of branded consumer products used in the home continues to navigate the tough operating environment through a comprehensive array of strategies. These encompass balance sheet management, cost-containment measures, disciplined investment decisions and targeted restructuring initiatives. The recently completed restructuring of European operations is anticipated to yield future growth and profitability as market conditions improve.

The Zacks Consensus Estimate for current financial-year earnings suggests growth of 93.6% from the year-ago reported figure. Lifetime Brands delivered an earnings surprise of 90.9% in the last reported quarter. Shares of this Zacks Rank #3 (Hold) company have decreased 19.8% in the past year.

Price and Consensus: LCUT

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Central Garden & Pet Company (CENT) : Free Stock Analysis Report

Lifetime Brands, Inc. (LCUT) : Free Stock Analysis Report

The RealReal, Inc. (REAL) : Free Stock Analysis Report

Alto Ingredients, Inc. (ALTO) : Free Stock Analysis Report