4 Stocks to Watch on Dividend Hikes as Fed Resumes Rate Hike

Wall Street ended lower last week after Fitch Ratings downgraded the U.S. long-term foreign-currency issuer default rating on Aug 2 to AA+ from AAA, citing "expected fiscal deterioration over the next three years." The agency had earlier placed the country's AAA rating on the negative watchlist.

This has once again raised concerns about the economy's health. This saw the Dow ending 1.1% lower for the week, while the S&P 500 and Nasdaq ended down 2.3% and 2.8%, respectively. The Dow and S&P 500 ended their three consecutive weeks of gains, while both the S&P and Nasdaq recorded their largest weekly percentage declines since March.

Understandably, the upbeat sentiment following positive inflation data for June is fast fading. Instead, fears of an economic slowdown escalated again after the Fed raised interest rates by 25 basis points in its July FOMC after briefly pausing in June.

The Fed has increased interest rates by 525 basis points since March 2022, taking the benchmark rate to the 5.25-5.5% range. Moreover, the Fed made it clear that it is open to more interest rate hikes depending on economic data.

The Fed's decision came despite easing inflation over the past year. The Consumer Price Index (CPI) declined to 3% in June, following a 4% jump in May. Inflation has declined over the past 12 months from its peak of 9.1% in June 2022.

In the second quarter, Personal Consumption Expenditures (PCE) inflation and core PCE inflation rose by 2.6% and 3.8%, respectively. These figures are lower than the first quarter's increase of 4.1% for PCE and 4.9% for core PCE.

Also, the headline PCE inflation rose a modest 3% in June on a year-over-year basis, reaching its lowest level since March 2021. Additionally, U.S. GDP grew 2.4% in the second quarter, following a 2% increase in the first quarter.

However, inflation is still above the Fed's target level of 2%, which is keeping it open to more interest rates.

Stocks in Focus

Given this situation, investing in dividend-paying stocks would be a prudent choice. The ability of dividend stocks to withstand market volatility is attributed to their sound business strategy and track record. An astute investor should thus want to focus on stocks that have recently increased their dividend payouts. Four such stocks are Wingstop Inc. WING, German American Bancorp, Inc. GABC, Northern Oil and Gas, Inc. NOG and Berry Corporation BRY.

Wingstop Inc. franchises and operates restaurants. WING's operating segment consists of the Franchise and Company segments. WING offers cooked-to-order, hand-sauced and tossed chicken wings. Wingstop currently carries a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

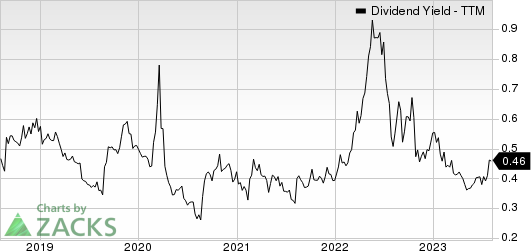

On Aug 1, Wingstopannounced that its shareholders would receive a dividend of $0.22 a share on Sep 8, 2023. WING has a dividend yield of 0.46%. Over the past five years, Wingstop has increased its dividend eight times, and its payout ratio at present sits at 34% of earnings. Check Wingstop's dividend history here.

Wingstop Inc. Dividend Yield (TTM)

Wingstop Inc. dividend-yield-ttm | Wingstop Inc. Quote

German American Bancorp, Inc. is a multi-bank holding company. Through its subsidiaries, GABC operates affiliated community banks with banking offices and full-service independent insurance agencies in the eight contiguous Southwestern Indiana counties of Daviess, Dubois, Gibson, Knox, Martin, Perry, Pike and Spencer. German American Bancorp's lines of business include retail and commercial banking, mortgage banking, trust and brokerage services, title insurance, and a full range of personal and corporate property and casualty insurance products.

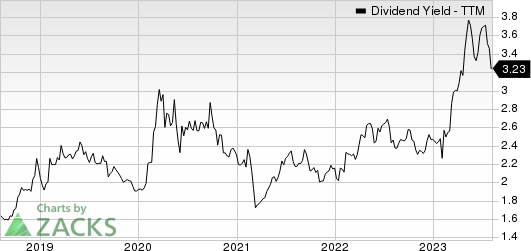

On Jul 31, German American Bancorp declared that its shareholders would receive a dividend of $0.25 a share on Aug 20, 2023. GABC has a dividend yield of 3.23%. Over the past five years, German American Bancorp has increased its dividend five times, and its payout ratio at present sits at 32% of earnings. Check German American Bancorp's dividend history here.

German American Bancorp, Inc. Dividend Yield (TTM)

German American Bancorp, Inc. dividend-yield-ttm | German American Bancorp, Inc. Quote

Northern Oil and Gas, Inc. is an independent upstream operator engaged in the acquisition, exploration, development and production of oil and natural gas properties. NOG is primarily focused on three leading basins of the United States — the Williston, Permian and the Appalachian.

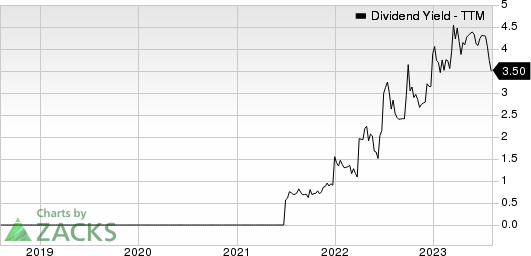

On Aug 1, Northern Oil and Gas announced that its shareholders would receive a dividend of $0.38 a share on Oct 31, 2023. NOG has a dividend yield of 3.50%. Over the past five years, Northern Oil and Gas has increased its dividend nine times, and its payout ratio at present sits at 23% of earnings. Check Northern Oil and Gas' dividend history here.

Northern Oil and Gas, Inc. Dividend Yield (TTM)

Northern Oil and Gas, Inc. dividend-yield-ttm | Northern Oil and Gas, Inc. Quote

Berry Corporation is an independent upstream energy company that focuses on the conventional, long-lived oil reserves principally in the San Joaquin basin of California. BRY, formerly known as Berry Petroleum Corporation, is based in Dallas, TX.

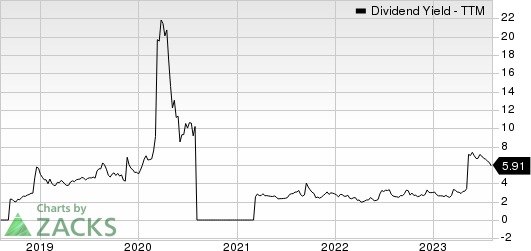

On Aug 2, Berry Corporation declared that its shareholders would receive a dividend of $0.14 a share on Aug 25, 2023. BRY has a dividend yield of 5.91%. Over the past five years, Berry Corporation has increased its dividend six times, and its payout ratio at present sits at 28% of earnings. Check Berry Corporation's dividend history here.

Berry Corporation Dividend Yield (TTM)

Berry Corporation dividend-yield-ttm | Berry Corporation Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Berry Corporation (BRY) : Free Stock Analysis Report

German American Bancorp, Inc. (GABC) : Free Stock Analysis Report

Northern Oil and Gas, Inc. (NOG) : Free Stock Analysis Report

Wingstop Inc. (WING) : Free Stock Analysis Report