4 Stocks to Watch on Dividend Hikes Amid Market Uncertainty

Investors are keenly waiting for the June inflation numbers. The Consumer Price Index (CPI) reading, which is the most accepted gauge for inflation, will be released today. Wall Street expects headline inflation to cool down further, with a forecast of 3.1% year over year.

Meanwhile, major indices like the S&P 500, the Nasdaq and the Dow have posted positive returns of 15.6%, 31.5% and 3.4%, respectively, so far this year.

Though inflation is gradually moving downward, the Federal Reserve’s ambitious target of 2% long-term inflation looks distant. After a pause in June from the aggressive rate hike cycle, which began in January 2022, the Fed will probably hike the overnight interest rate by a quarter basis point in its upcoming policy meeting this month.

Currently, the interest rate is in the range of 5-5.25%, the highest since January 2007. Fed Chairman Jerome Powell hinted at two more quarter-basis-point hikes this year to tame sticky inflation. Possibilities of such a move are validated after last week's jobs data presented a strong labor market with low unemployment and high wage rates. The payroll for the month of June climbed by 209,000 while the unemployment rate fell to 3.6% and average hourly wages rose by 4.4%.

Prudent investors looking for regular income and capital preservation in such adverse economic conditions can invest in dividend stocks. Due to their well-established businesses, these companies pay out regular dividends and remain profitable due to their proven business models. Companies that tend to reward investors with a high dividend payout outperform non-dividend-paying stocks during market volatility.

On that note, let us look at companies like Lindsay LNN, Bank OZK OZK,The PNC Financial Services Group PNC and Worthington Industries WOR that have lately hiked their dividend payouts.

Lindsay is an Irrigation and Infrastructure company. This Zacks Rank #3 (Hold) company provides a variety of proprietary water management, and road infrastructure products and services. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

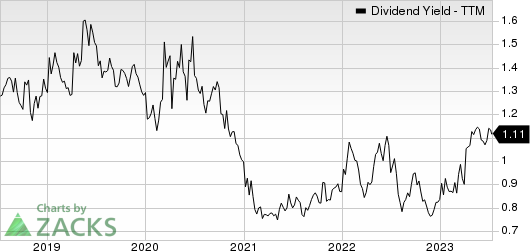

On Jul 7, LNN declared that its shareholders would receive a dividend of 35 cents a share on Aug 31, 2023. LNN has a dividend yield of 1.13%.

Over the past five years, LNN has increased its dividend five times, and its payout ratio presently sits at 21% of earnings. Check Lindsay’s’ dividend history here.

Lindsay Corporation Dividend Yield (TTM)

Lindsay Corporation dividend-yield-ttm | Lindsay Corporation Quote

Bank OZK is a bank holding company. This Zacks Rank #3 company offers a wide range of retail and commercial banking services to businesses, individuals, and non-profit and governmental entities.

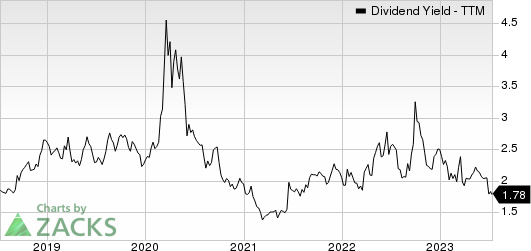

On Jul 3, OZK announced that its shareholders would receive a dividend of 36 cents a share on Jul 21, 2023. OZK has a dividend yield of 3.48%.

Over the past five years, OZK has increased its dividend 21 times. Its payout ratio now sits at 28% of earnings. Check Bank OZK's dividend history here.

Bank OZK Dividend Yield (TTM)

Bank OZK dividend-yield-ttm | Bank OZK Quote

The PNC Financial Services Group is a diversified financial services company. This Zacks Rank #3 company provides consumer and business banking services in the United States.

On Jul 3, PNC declared that its shareholders would receive a dividend of $1.55 a share on Aug 5, 2023. PNC has a dividend yield of 4.79%.

In the past five years, PNC has increased its dividend five times. Its payout ratio at present sits at 41% of earnings. Check The PNC Financial Services Group’s dividend history here.

The PNC Financial Services Group, Inc Dividend Yield (TTM)

The PNC Financial Services Group, Inc dividend-yield-ttm | The PNC Financial Services Group, Inc Quote

Worthington Industries is an industrial manufacturing company. This Zacks Rank #1 company produces value-added steel processors, products and services for a variety of industries, including automotive, construction and agriculture and also pressure tanks and cylinders.

On Jun 28, WOR declared that its shareholders would receive a dividend of 32 cents a share on Sep 29, 2023. WOR has a dividend yield of 1.81%.

In the past five years, WOR has increased its dividend six times. Its payout ratio at present sits at 21% of earnings. Check Worthington Industries’ dividend history here.

Worthington Industries, Inc. Dividend Yield (TTM)

Worthington Industries, Inc. dividend-yield-ttm | Worthington Industries, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The PNC Financial Services Group, Inc (PNC) : Free Stock Analysis Report

Worthington Industries, Inc. (WOR) : Free Stock Analysis Report

Lindsay Corporation (LNN) : Free Stock Analysis Report

Bank OZK (OZK) : Free Stock Analysis Report