4 Stocks to Watch on Their Recent Dividend Hikes

After a pause in June from the aggressive rate hike cycle, which began in January 2022, the Federal Reserve hiked the overnight interest rate again by a quarter percentage point in its July meeting. Taking the benchmark borrowing rate to the highest in 22 years, interest rate is currently in the range of 5.25-5.5%.

Inflation is gradually moving in a favorable direction as CPI for the month of June rose by 3% on a 12-month basis compared to 9.1% a year ago. However, Fed Chairman Jerome Powell has hinted at further rate hikes this year to tackle higher-than-targeted inflation of 2% over the long-term period.

The possibilities of such a move are validated as the labor market is still strong. The payroll for June rose 209,000 while the unemployment rate fell to 3.6%, and average hourly wages rose 4.4%. Personal disposable income also increased 5.2% in the second quarter.

By raising interest rates further, the Fed wants to cool off demand by making borrowing money more expensive. Currently, the borrowing cost is at a 16-year high, which will eventually impact corporate profitability. Such a move by the Fed will slow down the economy, according to its expectations, to counter inflation. Many economists fear a recession later this year if the Fed fails to create a soft landing for the economy.

Prudent investors who wish to park their money for regular income and capital preservation in such critical situations can invest in dividend stocks. Due to their well-established businesses, these companies pay out regular dividends and remain profitable due to their proven business models. Companies that tend to reward investors with a high dividend payout outperform non-dividend-paying stocks during market volatility.

On that note, let us look at companies like Rogers Communication RCI, STERIS STE, Ameriprise Financial AMP and Canadian National Railway CNI that have lately hiked their dividend payouts.

Rogers Communication is a communications and media company. This Zacks Rank #2 (Buy) company provides cable television, high-speed Internet access and video retailing. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

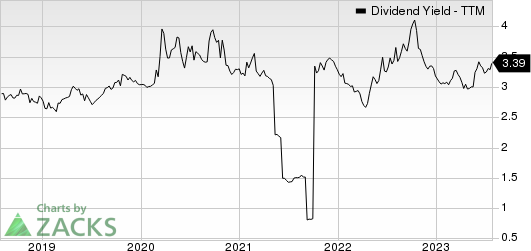

On Jul 25, RCI declared that its shareholders would receive a dividend of 68 cents a share on Aug 14, 2023. RCI has a dividend yield of 7.9%.

Over the past five years, RCI has increased its dividend 16 times, and its payout ratio presently sits at 33% of earnings. Check Rogers Communication’s dividend history here.

Rogers Communication, Inc. Dividend Yield (TTM)

Rogers Communication, Inc. dividend-yield-ttm | Rogers Communication, Inc. Quote

STERIS develops, manufactures and markets infection prevention products and services. This Zacks Rank #3 (Hold) company serves healthcare, pharmaceutical, research, industrial and governmental customers across the globe.

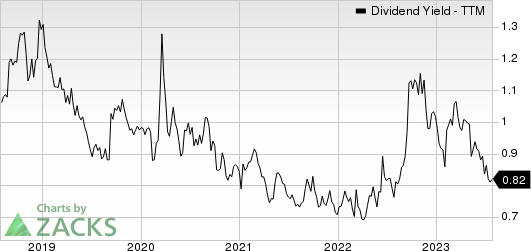

On Jul 26, STE announced that its shareholders would receive a dividend of 52 cents a share on Sep 22, 2023. STE has a dividend yield of 0.8%.

Over the past five years, STE has increased its dividend six times. Its payout ratio now sits at 23% of earnings. Check STERIS's dividend history here.

STERIS plc Dividend Yield (TTM)

STERIS plc dividend-yield-ttm | STERIS plc Quote

Ameriprise Financial is a diversified financial services company. This Zacks Rank #3 company provides advice & wealth management, asset management, retirement & protection solutions to retail and institutional clients.

On Jul 26, AMP declared that its shareholders would receive a dividend of $1.35 a share on Aug 18, 2023. AMP has a dividend yield of 1.5%.

In the past five years, AMP has increased its dividend five times. Its payout ratio at present sits at 19% of earnings. Check Ameriprise Financial’s dividend history here.

Ameriprise Financial, Inc. Dividend Yield (TTM)

Ameriprise Financial, Inc. dividend-yield-ttm | Ameriprise Financial, Inc. Quote

Canadian National Railway is engaged in the rail and related transportation business. This Zacks Rank #3 company operates as the largest rail network in Canada and the only transcontinental network in North America.

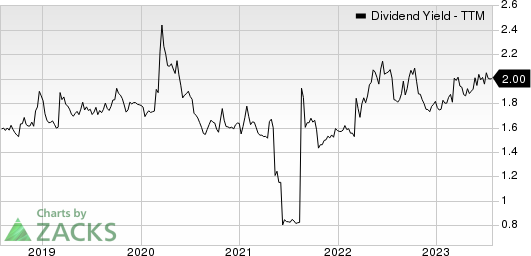

On Jul 25, CNI declared that its shareholders would receive a dividend of 60 cents a share on Sep 29, 2023. CNI has a dividend yield of 2.0%.

In the past five years, CNI has increased its dividend 14 times. Its payout ratio at present sits at 38% of earnings. Check Canadian National Railway’s dividend history here.

Canadian National Railway Company Dividend Yield (TTM)

Canadian National Railway Company dividend-yield-ttm | Canadian National Railway Company Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Rogers Communication, Inc. (RCI) : Free Stock Analysis Report

Canadian National Railway Company (CNI) : Free Stock Analysis Report

Ameriprise Financial, Inc. (AMP) : Free Stock Analysis Report

STERIS plc (STE) : Free Stock Analysis Report