4 Stocks to Watch in a Resilient Outpatient Home Health Industry

The Zacks Medical - Outpatient and Home Healthcare industry has gradually digitalized its healthcare solutions in the post-pandemic period, which altered the nature and dynamics of the industry. In the past few years, there has been a significant rise in demand for telemedicine-focused online medical and artificial intelligence (AI)-powered technology services. Owing to the pandemic, many healthcare companies that were traditionally not technology-based transformed to survive in the market. Per a report by Precedence Research, the global healthcare analytics market was valued at $37.15 billion in 2022 and is expected to exceed $121.1 billion by 2030 at a CAGR of 15.9%. Another factor prompting these MedTech players to embrace digital healthcare is skyrocketing healthcare costs.

On a positive note, rising dependence on telehealth and AI is likely to help the industry thrive in the near term. DaVita Inc. DVA, Encompass Health Corporation EHC, Option Care Health, Inc. OPCH and Addus HomeCare Corporation ADUS are likely to gain from the prospects.

Industry Description

The industry comprises companies that offer ambulatory care in an outpatient setting or at home. They use advanced medical technologies for diagnosis, treatment and rehabilitation services. The players include operators of HMO medical centers, kidney dialysis centers and other outpatient care centers. After navigating a tough pandemic era, the payers and providers have been seeing steady growth on the back of innovation in services. This buoys optimism about prospects over the next few years, although persistent inflation in consumer prices could dent the outlook. The potential for scaling up innovation is an added plus. Also, the acceleration of value-based care models and the increasing application of technology across the healthcare industry are likely to continue in the long run.

Major Trends Shaping the Future of the Outpatient and Home Healthcare Industry

Cost Effectiveness: The primary advantage of outpatient clinics is cost-effectiveness. Outpatient medical care clinics do not retain patients for long hours (overnight) or charge exorbitantly. Modern-day outpatient clinics offer a broad spectrum of treatment and diagnostic options and even conduct minor surgical procedures. Financial incentives like health plans and government program payment policies supporting services in lower-cost care settings have also been driving outpatient care.

Additionally, with value-based models of care steadily emerging as the future of healthcare, the shift from fee-for-service (FFS) to alternative payment models (APM) is an ongoing parallel trend. FFS will be crucial to care organizations as a benchmark through which providers can assess APM.

AI’s Dominant Role: AI has been a roaring success in healthcare, taking the outpatient and home healthcare space by storm. Outpatient companies prefer bots and automated techniques for managing health information. With the help of AI, hospitals have been achieving better outcomes, with patients receiving more efficient and personalized care. The outpatient industry has been generating huge profits from Electronic Health Records and ePrescriptions.

The most visible area where AI can make a significant difference is in mental healthcare at home. Addressing the most prevalent mental health conditions among home care patients —depression, anxiety and dementia — is essential to improving overall patient well-being. In recent years, complex machine learning algorithms have become capable of analyzing large datasets of patient information, including clinical and social diagnoses. These systems can alert caregivers regarding potential triggers or warning signs of mental health deterioration.

Dependence on Telehealth: The pandemic caused a decline in outpatient clinic visits where home healthcare providers struggled to offer quality care due to the risk of exposure to the virus. Though the impact of the pandemic has been far-reaching, it has accelerated healthcare innovation. Home healthcare can gain from benefits provided by Medicare (and several other payers), comprising a broad range of services that can be delivered in a patient’s home, including post-operative and chronic wound care. Home healthcare has seen a surge in the utilization of the telehealth platform in response to the pandemic. With a rise in the elderly population and increasing costs of in-person health care, the demand for home-based health care will rise. People with chronic illnesses and disabilities also require home-based care.

The rising demand for remote patient monitoring (RPM) has considerably driven the demand for wearable technology to monitor patient’s health. Although wearables have been popular for several years, their integration with AI has recently increased their popularity. Wearables have become a powerful home healthcare tool. AI technology-powered RPM enables healthcare firms to provide consistent patient care without occupying space in their hospitals and facilities, thus reducing overcrowding.

Staffing Shortages: The U.S. healthcare industry has been experiencing a severe shortage of workers at every level, worsened by the COVID-19 pandemic. Among support personnel, there is a laxity of home health aides. Increasing international migration of health workers may aggravate the health workforce shortfall, especially in low-income and lower-middle-income countries. Another reason for the acute staffing shortage is high burnout due to physical, emotional and mental exhaustion. Overworked employees are leaving the profession at an accelerating rate.

Healthcare staffing shortages lead to poor patient outcomes that can include hospital-acquired infections, patient falls and increased probabilities of death. With a lesser number of staff available in hospital settings for patient care, there has been a gradual shift toward home healthcare for non-critical patients who can be monitored remotely.

Zacks Industry Rank

The Zacks Medical - Outpatient and Home Healthcare industry falls within the broader Zacks Medical sector. It carries a Zacks Industry Rank #69, which places it in the top 28% of nearly 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bright near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Before we present a few outpatient home health stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry's Stock Market Performance

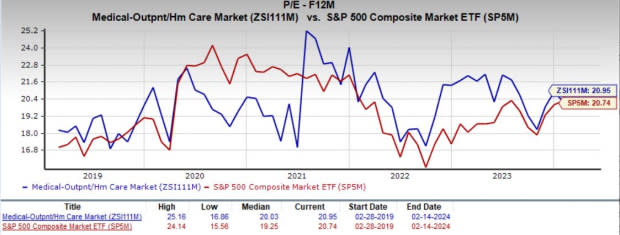

The industry has outperformed its sector but underperformed the Zacks S&P 500 composite in the past year.

The industry has risen 8.3% over this period compared with the S&P 500’s rise of 22.6%. The broader sector has also inched up 6% in the same time frame.

One Year Price Performance

Image Source: Zacks Investment Research

Industry's Current Valuation

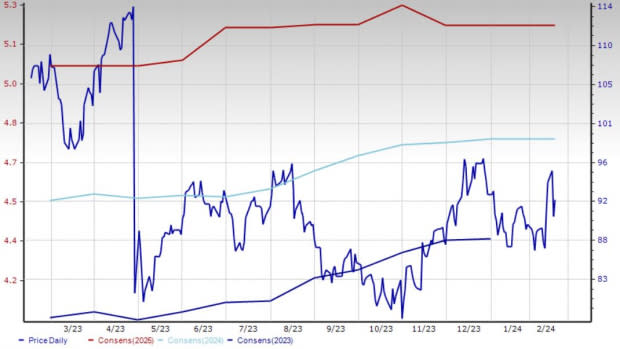

On the basis of the forward 12-month price-to-earnings (P/E), commonly used for valuing medical stocks, the industry is currently trading at 20.9X compared with the S&P 500’s 20.7X and the sector’s 23.3X.

Over the last five years, the industry has traded as high as 25.2X and as low as 16.9X, with the median being at 20X, as the charts below show.

Price-to-Earnings Forward Twelve Months (F12M)

Image Source: Zacks Investment Research

Price-to-Earnings Forward Twelve Months (F12M)

Image Source: Zacks Investment Research

4 Outpatient and Home Healthcare Stocks to Watch Right Now

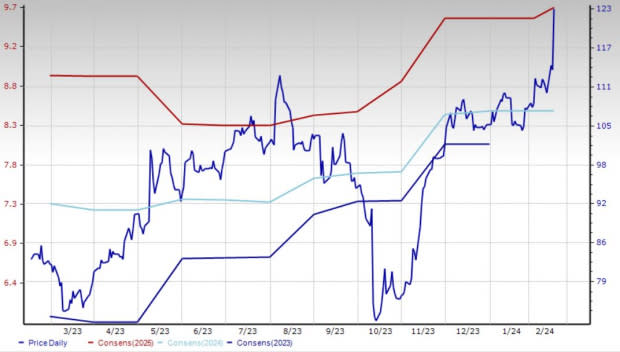

DaVita: This renowned global comprehensive kidney care provider reported its fourth-quarter 2023 results this month. The company registered an uptick in its overall top line and dialysis patient service and Other revenues during the period. The opening of dialysis centers within the United States and acquiring centers overseas were also recorded. The expansion of both margins bodes well for the stock. The per-day increase in total U.S. dialysis treatments for the fourth quarter on a sequential basis was also witnessed. DVA currently carries a Zacks Rank #2 (Buy).

For this Denver, CO-based company, the Zacks Consensus Estimate for 2024 revenues suggests growth of 1.4%.

Image Source: Zacks Investment Research

The company’s return on equity (ROE) of 64.9% compares favorably with the industry’s 4.9%.

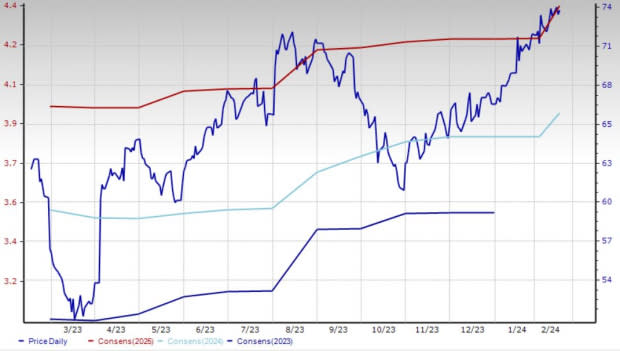

Encompass Health: This well-known owner and operator of inpatient rehabilitation hospitals in the United States reported its fourth-quarter 2023 results this month. The company recorded a solid uptick in its overall top and bottom line results on the back of an increase in discharges (including same-store growth) and higher net patient revenue per discharge.

EHC carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

For this company, the Zacks Consensus Estimate for 2024 revenues suggests growth of 9.5%. The same for earnings indicates an increase of 7.9%.

Image Source: Zacks Investment Research

The company’s ROE of 17.7% compares favorably with the industry’s 4.9%.

Option Care Health: It is a renowned independent provider of home and alternate site infusion services. Last month, Option Care Health announced a multi-year commercial partnership with Palantir Technologies Inc. Per the agreement terms, for Palantir’s software is expected to be leveraged across Option Care Health to help improve patient outcomes and increase efficiency.

OPCH presently carries a Zacks Rank #2.

For this Bannockburn, IL-based company, the Zacks Consensus Estimate for 2023 revenues suggests growth of 8.3%. The same for earnings indicates an increase of 72.3%.

Image Source: Zacks Investment Research

The company’s ROE of 18.2% compares favorably with the industry’s 4.9%.

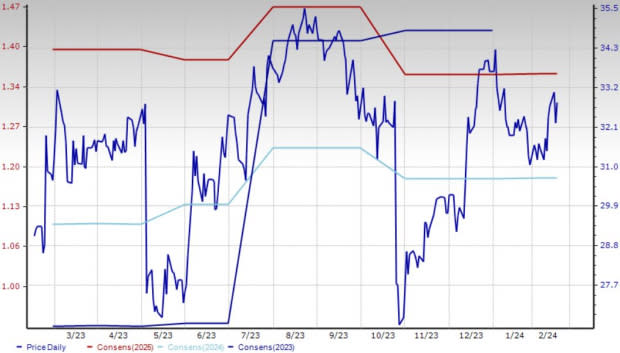

Addus HomeCare: Its services and operating model address a number of crucial needs across the healthcare continuum. In October 2023, Addus HomeCare announced its third-quarter 2023 results, where it registered a solid uptick in its net service revenues. Management confirmed that its personal care revenues (accounting for 74.6% of overall revenues) improved year over year on a same-store basis, reflecting steady volume growth trends. Home health and Hospice revenues were also up year over year. ADUS presently carries a Zacks Rank of 3 (Hold).

For this company, the Zacks Consensus Estimate for 2023 revenues suggests growth of 11.1%. The same for earnings indicates an increase of 16.9%.

Image Source: Zacks Investment Research

The company’s ROE of 9.4% compares favorably with the industry’s 4.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Addus HomeCare Corporation (ADUS) : Free Stock Analysis Report

Encompass Health Corporation (EHC) : Free Stock Analysis Report

Option Care Health, Inc. (OPCH) : Free Stock Analysis Report