4 Top-Ranked Auto Stocks That Crushed the Market in 2023

After a rocky 2022 headlined by sky-high inflation and a string of interest rate hikes to tame the same, 2023 turned out to be rewarding for investors. Year to date, the S&P 500 Index has surged 25%, a stark contrast to the 18% decline in 2022.

Throughout 2023, the focus of the market was on the Federal Reserve policy and inflation. The proactive interest rate increases implemented by the Federal Reserve since March 2022 resulted in a year-over-year decrease in Consumer Price Index (CPI) inflation, which dropped from its peak of 9.1% to 6.4% by January 2023 and further down to 3.2% by October.

While inflation exhibited a gradual decline in 2023, it persisted above the Fed's target. Vehicle financing remained expensive, and auto industry experts were apprehensive that high borrowing costs would discourage consumers from making big-ticket purchases. Despite the Federal Reserve pausing its rate hikes in August and September, average interest rates for new-vehicle loans were around 9%, marking their highest point in 23 years, according to Cox Automotive.

However, pent-up demand — held back by limited product availability in 2022 — was fulfilled in 2023 as inventory levels improved around the country. Affordability concerns failed to hinder the momentum of auto sales, which exceeded expectations throughout 2023, bolstered by enhanced supply levels and attractive incentives.

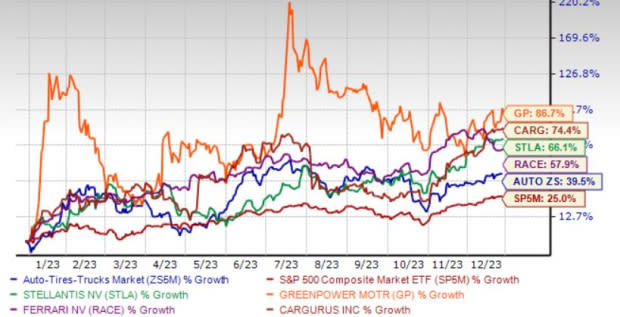

On that note, we have shortlisted four stocks from the Zacks Auto, Tires and Trucks sector —Stellantis STLA, Ferrari RACE, GreenPower Motor GP and CarGurus CARG — all of which have rallied at least 50% year to date and also appear well positioned for 2024.

A key factor driving the growth of U.S. auto sales was the substantial improvement in inventory levels compared to the previous year when the industry grappled with severe supply chain disruptions due to the COVID-19 pandemic. Notably, new-vehicle inventory volume was 2.56 million at the beginning of this month, a surge of over 900,000 units from a year ago and the highest level since early spring of 2021.

Cox Automotive projects U.S. auto sales in 2023 to reach 15.5 million units, up from 13.9 million in 2022. The seasonally adjusted annual rate (SAAR) is anticipated to be approximately 15.1 million in December, reflecting an increase of 1.6 million compared to last year's SAAR. December's sales volume is expected to rise 6.2% from a year ago, reaching 1.36 million units and showing a 10.4% increase from November.

4 Auto Stocks That Outpaced the Market

With the help of our Zacks Stock Screener, we have shortlisted four stocks that carry a Zacks Rank #1 (Strong Buy) or #2 (Buy) and have outperformed the S&P 500 index and the Auto sector this year. Further, these stocks have a VGM Score of A or B. The VGM Score rates each stock on the combined weighted styles, helping identify the ones with the most attractive value, highest growth and most promising momentum across the board.

Stellantis: Formed from the merger of Fiat Chrysler and the PSA Group, this Italian-American carmaker is one of the notable names in the auto space. The firm’s six iconic brands — Citroën, FIAT Professional, Opel, Peugeot, Ram and Vauxhall — are driving sales growth. Stellantis’ Dare Forward 2030 strategy is instilling investors’ confidence. The core objective of Dare Forward 2030 is to achieve 100% of total passenger car sales in Europe and 50% of light-duty truck and passenger car sales in the United States as battery electric vehicles by the end of the decade.

With plans to introduce 75 BEV models and sell five million BEVs annually, Stellantis is on track to revolutionize its offerings. During the nine months ending Sep 30, 2023, the company repurchased €1.2 billion worth of shares. It anticipates concluding the announced €1.5 billion 2023 share buyback program in the fourth quarter of 2023.

The Zacks Consensus Estimate for STLA’s 2023 sales and EPS implies year-over-year growth of 12.3% and 11.3%, respectively. EPS estimates for 2023 and 2024 have moved north by 6 cents and 33 cents, respectively, over the past 30 days. Stellantis’ shares have surged 66% on a year-to-date basis. The stock currently sports a Zacks Rank #1 and has a VGM Score of A. You can see the complete list of today’s Zacks #1 Rank stocks here.

Ferrari: This luxury supercar manufacturer achieved record-breaking results in 2022, setting the stage for a robust 2023 driven by strong demand and a burgeoning order book. For the nine months ending Sep 30, 2023, the company’s shipments, revenues and EBIT grew 5.3%, 19.3%, and 34%, respectively, on a year-over-year basis. RACE’s pricing power, brand recognition and exclusivity enable it to register high margins.

The introduction of Ferrari's first-ever utility vehicle, the Purosangue, has received acclaim for its performance capabilities. Quoting the verdict from Car and Driver Magazine, “The Purosangue is the performance SUV that only Ferrari could build and its performance capabilities speak for themselves.” Looking ahead, Ferrari is poised to embrace the electric vehicle (EV) landscape. It targets 80% of sales to comprise full-electric and hybrid models by 2030. The company aims to launch 15 new models from 2023 to 2026.

The Zacks Consensus Estimate for RACE’s 2023 sales and EPS implies year-over-year growth of 18.4% and 31.5%, respectively. Sales and EPS estimates for 2024 imply a further uptick of 10.7% and 12.8%, respectively, on a year-over-year basis. Ferrari’s shares have rallied 58% on a year-to-date basis. The stock currently has a Zacks Rank #2 and a VGM Score of B.

GreenPower: It is a leading manufacturer and distributor of zero-emission electric-powered medium- and heavy-duty vehicles. This Canadian manufacturer uses a “clean sheet” design to build battery-powered and zero-emission electric buses and vehicles with a vision to advance the adoption of EVs. The acquisition of Lion Truck seeks to leverage its long-standing expertise and adds to GreenPower’s EV Star truck customer offerings. GP is riding on the deliveries of EV Star Cab and Chassis, as well as EV Star Cargoes, EV Star Passenger Vans, specialty EV Star products, BEAST Type D school buses and Nano BEAST Type A school buses.

GreenPower is well positioned to achieve a greater reach of its EVs on the back of its tie-ups with McCandless Truck Center, Industrial Power Truck & Equipment, Kingmor, Piedmont Truck Center and Creative Bus Sales, among others. The company registered record revenues of $26 million for the first half of fiscal 2024 (ending on Sep 30, 2023), up 124% from $11.6 million revenues generated in the first half of fiscal 2023.

The Zacks Consensus Estimate for GP’s fiscal 2024 sales and EPS implies year-over-year growth of 80% and 42%, respectively. Sales and EPS estimates for fiscal 2025 imply a further uptick of 58% and 68%, respectively, on a year-over-year basis. GreenPower shares have rocketed 87% on a year-to-date basis. The stock currently has a Zacks Rank #2 and a VGM Score of B.

CarGurus: The company is an online automotive marketplace connecting buyers and sellers of new and used cars. CarGurus is the #1 listing platform, with the largest selection of vehicles in the United States. The acquisition of the CarOffer platform added wholesale vehicle acquisition and selling capabilities to CarGurus’ portfolio of dealer offerings. It has enabled the firm to offer Instant Max Cash Offer to customers who wish to sell their car while purchasing a new one. This has been benefiting the firm.

Also, the company has enhanced automotive search and shopping by introducing the ChatGPT plugin. It utilizes generative AI to provide shoppers with greater personalization and ease in exploring vehicle options without being restricted by specific search fields. The company surpassed earnings estimates in the last four quarters, the average beat being 64.7%.

The Zacks Consensus Estimate for CARG’s 2023 and 2024 EPS implies year-over-year growth of 21% and 13.5%, respectively. EPS estimates for 2023 and 2024 have moved north by 11 cents and 14 cents, respectively, over the past 60 days. CarGurus’ shares have grown a whopping 74% on a year-to-date basis. The stock currently has a Zacks Rank #2 and a VGM Score of B.

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GreenPower Motor Company Inc. (GP) : Free Stock Analysis Report

Ferrari N.V. (RACE) : Free Stock Analysis Report

CarGurus, Inc. (CARG) : Free Stock Analysis Report

Stellantis N.V. (STLA) : Free Stock Analysis Report