4 Top-Ranked Tech Stocks to Buy for Better Returns in 2H23

Tech stocks have made a remarkable comeback in the first half of 2023 after a massive sell-off in 2022 on recession concerns, inflationary pressure, increased oil prices and higher interest rates. With a year-to-date (YTD) rise of 32%, the tech-laden Nasdaq Composite has outperformed The Dow Jones Industrial Average and the S&P 500 index’s increase of 3.8% and 16.1%, respectively.

Technology stocks have more than 50% of weightage in the Nasdaq Composite index. Technology Select Sector SPDR (XLK), the most important component of the broad market index, has returned 40% YTD.

With persistent inflationary pressure and softening demand, the fears of recession have not subsided yet. However, technology companies have been focusing on cost-cutting measures to improve profitability and stay afloat amid these turbulent times. The strategies have boosted investors’ confidence, thereby boosting their share prices.

In addition, the long-term growth prospects of these companies look promising due to continued digital transformations. The accelerated deployment of 5G technology — the next-generation wireless revolution — is likely to spur growth. Apart from this, blockchain, the Internet of Things, autonomous vehicles, AR/VR and wearables offer significant growth opportunities.

Furthermore, the success of OpenAI’s ChatGPT has demonstrated the AI technology’s potential to improve operations in almost every industry. Though AI has been around for years, the meteoric rise of OpenAI’s ChatGPT has captivated the world’s attention on the power of generative AI to augment human capability, suggesting that the AI boom may just get started. Generative AI is a type of AI technology that can produce various types of content, including text, imagery, audio and synthetic data.

Additionally, the latest forecast for worldwide IT spending by Gartner is an upside for tech stocks. Despite the ongoing macroeconomic and geopolitical challenges, the independent research firm forecasts worldwide IT spending to increase 5.5% year over year to $4.6 trillion in 2023.

Therefore, investors should look for fundamentally strong technology stocks that could sustain market jitters and ensure solid portfolio returns. However, it is difficult to pick such multi-faceted stocks from a plethora of investment opportunities.

Here the Growth Style Score comes in handy. The Growth Style Score condenses all the essential metrics from a company’s financial statements to get a true sense of the quality and sustainability of its growth.

With the help of Zacks Stock Screener, we have zeroed in on four technology stocks — Salesforce CRM, Palo Alto Networks PANW, ON Semiconductor ON and Fortinet FTNT — which look promising based on their encouraging Zacks Rank and Growth Score.

These stocks have a favorable combination of a Growth Score of A or B and a Zacks Rank #1 (Strong Buy) or #2 (Buy), thus offering solid investment opportunities.

Our Picks

Salesforce is the leading provider of on-demand Customer Relationship Management software, which enables organizations to better manage critical operations, such as sales force automation, customer service and support, marketing automation, document management, analytics and custom application development. The stock currently sports a Zacks Rank #1 and has a Growth Score of A. You can see the complete list of today’s Zacks #1 Rank stocks here.

Salesforce is benefiting from a robust demand environment as customers are undergoing a major digital transformation. The rapid adoption of its cloud-based solutions is driving the demand for its products. Its sustained focus on introducing more aligned products per customer needs is driving its top line.

Continued deal wins in the international market are another growth driver. The acquisition of Slack has positioned the company as one of the leading enterprise team collaboration solution providers and can better compete with Microsoft’s Teams product.

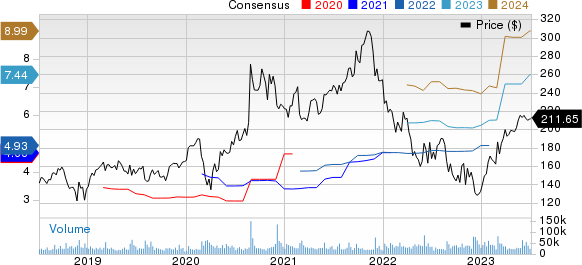

The Zacks Consensus Estimate for fiscal 2024 earnings has been revised upward by a couple of cents in the past 30 days to $7.44 per share, which calls for an increase of 42% on a year-over-year basis. Moreover, the long-term earnings growth rate is pegged at 19.3%. CRM stock has rallied 59.6% YTD.

Salesforce Inc. Price and Consensus

Salesforce Inc. price-consensus-chart | Salesforce Inc. Quote

Palo Alto Networks offers network security solutions to enterprises, service providers and government entities worldwide. The company's next-generation firewall products deliver natively integrated application, user, and content visibility and control through its operating system, hardware and software architecture.

Palo Alto Networks has been benefiting from continuous deal wins and the increasing adoption of the company’s next-generation security platforms, attributable to the rise in the remote work environment and the need for stronger security. Growing traction in Prisma and Cortex offerings is acting as a tailwind. Palo Alto continues to acquire new customers and increase wallet share with existing customers.

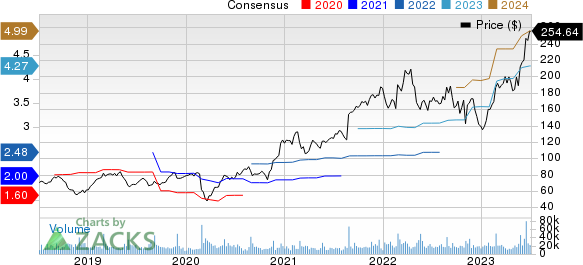

The company sports a Zacks Rank #1 and has a Growth Score of A. The Zacks Consensus Estimate for fiscal 2023 earnings has been revised upward by 4 cents to $4.27 per share in the past 30 days, suggesting a 69.4% year-over-year increase. The long-term earnings growth expectation for the company is 31.5%. The stock has surged 82.5% YTD.

Palo Alto Networks, Inc. Price and Consensus

Palo Alto Networks, Inc. price-consensus-chart | Palo Alto Networks, Inc. Quote

ON Semiconductor is an original equipment manufacturer of a broad range of discrete and embedded semiconductor components. This Zacks Rank #2 company’s product lines include discretes, such as bipolar transistors, diodes, filters, FETs, rectifiers and thyristors.

ON Semiconductor is benefiting from solid momentum across Power Solutions and Intelligent Sensing Group. Its broad-based strength across the industrial, computing, consumer and automotive end markets for both silicon carbide and insulated-gate bipolar transistor-based products remains an upside. Moreover, the company is winning market share in the automotive segment due to its silicon carbide dominance, and intelligent power and sensing solution.

Currently, ON Semiconductor has a Growth Score of B. The Zacks Consensus Estimate for 2023 earnings has moved 4 cents north in 60 days to $4.87 per share. The long-term earnings growth rate is pegged at 5.9%. Shares of the company have rallied 55.3% YTD.

ON Semiconductor Corporation Price and Consensus

ON Semiconductor Corporation price-consensus-chart | ON Semiconductor Corporation Quote

Fortinet is a provider of network security appliances and Unified Threat Management (“UTM”) network security solutions to enterprises, service providers and government entities worldwide. Its solutions are designed to integrate multiple levels of security protection, including firewall, virtual private networking, antivirus, intrusion prevention, web filtering, anti-spam and wide area network (WAN) acceleration.

Fortinet is benefiting from the rising demand for security and networking products amid the growing hybrid working trend. It is also gaining from robust growth in Fortinet Security Fabric, cloud and Software-defined WAN offerings.

Continued deal wins, especially those of high value, are a key driver. Higher IT spending on cybersecurity is expected to aid Fortinet in growing faster than the security market. A focus on enhancing its UTM portfolio through product development and acquisitions is a tailwind for this Zacks Rank #2 company.

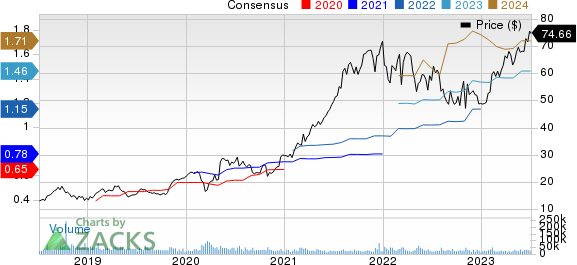

The Zacks Consensus Estimate for 2023 earnings has moved 3 cents northward to $1.46 per share in the past 60 days, suggesting year-over-year growth of 22.7%. The stock has a Growth Score of A and has an estimated long-term earnings growth rate of 18%. The company’s shares have increased 52.7% in the YTD period.

Fortinet, Inc. Price and Consensus

Fortinet, Inc. price-consensus-chart | Fortinet, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Salesforce Inc. (CRM) : Free Stock Analysis Report

Fortinet, Inc. (FTNT) : Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW) : Free Stock Analysis Report

ON Semiconductor Corporation (ON) : Free Stock Analysis Report