4 Top Stocks to Watch From the Promising Furniture Industry

Indeed, higher interest rates, complications from the banking crisis and relatively low consumer confidence levels will continue to pose challenges for the Zacks Furniture industry in the near term. Again, continued investments in e-commerce and intense competition are added headwinds. Nonetheless, increasing investments in technological advancements and solutions are expected to drive the industry’s growth. Importantly, product innovation, along with accretive buyouts, should favor the furniture industry in expanding its global reach. Apart from these tailwinds, efficient cost management should lend support to industry players like WillScot Mobile Mini Holdings Corp. WSC, MillerKnoll, Inc. MLKN, La-Z-Boy Incorporated LZB, and American Woodmark Corporation AMWD.

Industry Description

The Zacks Furniture industry comprises manufacturers, designers and marketers of residential as well as commercial furnishing solutions. Some of the companies provide kitchen and bath cabinets as well as various engineered components and products in the United States, along with international markets. A few industry players also offer specialty rental services, such as modular and portable storage solutions as well as modular space and portable storage solutions. They are involved in designing and producing a wide variety of engineered components and products for homes, offices and automobiles. The industry players cater to different sectors, namely, construction, energy, healthcare, security, government, retail, commercial, education and transportation.

4 Trends Shaping the Furniture Industry's Future

Innovation, Digital Marketing: Product innovation plays a decisive factor in market share gain in this industry. Players are investing in new products to improve the product mix in a competitive landscape and drive top-line growth. Also, millennials represent the largest consumer cohort in the furniture market. More money in the hands of this largest and most active generation of homebuyers should keep demand elevated. Customer experience is getting enhanced by innovative marketing techniques, emphasizing digital marketing, better merchandising, store remodeling and loyalty programs. These companies are utilizing advanced technology to enhance the overall customer experience, optimize their operations, and provide innovative solutions. Precisely, companies that make strategic investments in digital innovation are poised to navigate challenges successfully and emerge as industry leaders.

Acquisitions & Focus on Public Sector: The industry players are pursuing acquisitions to broaden their product portfolio and expand their geographic footprint as well as market share. Additionally, they are prioritizing the diversification of their business portfolios, expanding their global footprint, and strengthening their positions in resilient sectors such as healthcare and the public sector.

Challenging Macroeconomic Environment: The dynamic macroeconomic and geopolitical environments have been putting pressure on end markets and thereby impacting the companies’ performances. Spending on home improvements and repairs is expected to be soft in the near term, given several macroeconomic challenges, such as slowing sales of existing homes and rising interest rates. The slowdown in the homebuilding industry, retail sales of building materials, and renovation permits point to a soft environment for residential remodeling, which would impact the furniture industry players. Additionally, complications from banking crisis and relatively low consumer confidence levels add to the headwinds. However, 2023 is expected to be challenging due to continued economic uncertainty.

Supply-Chain Issues, Rising Inflation & Higher Expenses: The companies have been witnessing supply-chain disruptions, especially in chemicals, semiconductors, labor and transportation, which are constraining volume growth. As such, consumers are increasingly concerned about rising inflation and many expect inflation to outpace income growth. This would be a risk to spending, which makes up two-thirds of the economy. The industry players are distressed by rising logistic expenses. The labor market has struggled with the limited availability of labor, which is pushing up labor costs.

Also, the furniture industry is highly competitive, with home furnishing retailers, department stores and antique dealers giving a hard time. Again, companies need to make incremental investments to address an expanding omni-channel environment, as shoppers tend to look for online options. Growth in online sales may continue to dent traditional furniture retailers’ market share as brands such as Etsy, Things Remembered, Costco and Amazon are finding their way into the market.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Furniture industry is a nine-stock group within the broader Zacks Consumer Discretionary sector. The industry currently carries a Zacks Industry Rank #105, which places it at the top 43% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates good near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of a higher earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually gaining confidence in this group’s earnings growth potential. Since June 2023, the industry’s earnings estimates for 2023 and 2024 have increased 3.7% and 2.2%, respectively.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Lags Sector, S&P 500

The Zacks Furniture industry has underperformed the broader Zacks Consumer Discretionary sector and the Zacks S&P 500 composite over the past year.

Over this period, the industry has lost 20.2% against the broader sector’s 5.5% rise and the S&P 500’s increase of 12.1%.

One-Year Price Performance

Industry's Current Valuation

On the basis of the forward 12-month price-to-earnings (P/E), which is commonly used for valuing furniture stocks, the industry is currently trading at 12.7X compared with the S&P 500’s 19.1X and the sector’s 17.1X.

Over the past five years, the industry has traded as high as 19.4X and as low as 10X, with the median being 15.2X, as the chart below shows.

Industry’s P/E Ratio (Forward 12-Month) Versus S&P 500

4 Furniture Stocks to Watch

We have selected four stocks from the Zacks universe of furniture stocks that currently carry a Zacks Rank #2 (Buy) or 3 (Hold) and have impressive growth prospects. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

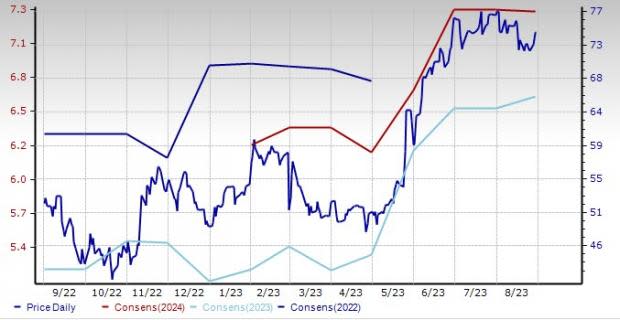

American Woodmark: This Winchester, VA-based company is one of the largest manufacturers of kitchen and bath cabinets. Amid continued inflationary pressures, and labor and logistics challenges, the company has been witnessing strong sales growth in its new construction channel. A solid backlog level, higher investments in production capability and capacity, outsourcing staffing additions and productivity improvements are expected to drive growth for American Woodmark.

AMWD — a Zacks Rank #2 stock — gained 52.2% year to date against the industry’s 16.5% decline. Earnings estimates for fiscal 2024 have increased to $6.63 per share from $6.53 over the past 30 days, depicting analysts’ optimism about the company’s prospects. This company surpassed earnings estimates in three of the trailing four quarters but missed on one occasion, with the average surprise being 26.8%. It also carries an impressive VGM Score of A. This helps to identify stocks with the most attractive value, growth and momentum.

Price and Consensus: AMWD

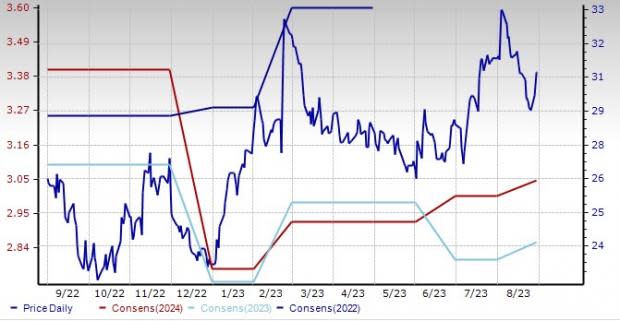

MillerKnoll: Based in Zeeland, MI, this company researches, designs, manufactures, and distributes interior furnishings worldwide. MLKN has placed a strong emphasis on diversifying its business portfolio, extending its global presence, and bolstering its position in robust sectors like healthcare and the public sector. The company is harnessing advanced technology to elevate the overall customer experience, streamline its operations, and deliver cutting-edge solutions. Furthermore, MLKN is deepening its partnerships with dealers to ensure flawless communication and optimize its operational efficiency.

MLKN — a Zacks Rank #2 stock — lost 10.3% year to date. Earnings estimates for fiscal 2024 and 2025 have increased to $1.80 per share (from $1.71) and $2.53 per share (from $2.29), respectively, over the past 60 days. It also carries an impressive VGM Score of A.

Price and Consensus: MLKN

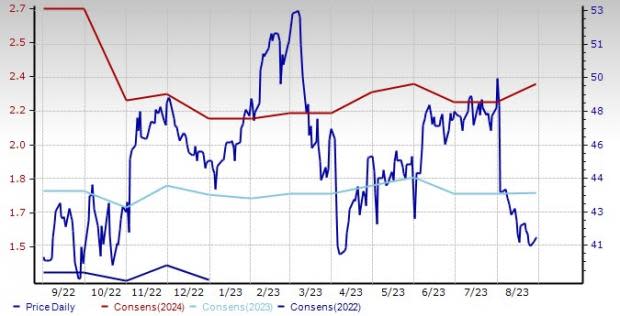

La-Z-Boy: Based in Monroe, MI, this company manufactures, markets, imports, exports, distributes and retails upholstery furniture products, accessories and casegoods furniture products. LZB has been navigating well through challenges like escalating commodity and freight costs with the help of higher pricing, strong brand presence, vast distribution through multiple channels and strategic investments across the business to drive market share gains. It remains focused on navigating the near-term volatile environment while strengthening business for the long term with the Century Vision strategy.

LZB — a Zacks Rank #3 stock — has gained 35% so far this year. Earnings estimates for 2023 and 2024 have increased to $2.86 (from $2.80) and $3.05 (from $3.00), respectively, over the past seven days. This company surpassed earnings estimates in all the trailing four quarters, with the average surprise being 27.1%. It also carries an impressive VGM Score of A.

Price and Consensus: LZB

WillScot Mobile Mini Holdings: This Phoenix, AZ-based company provides modular space and portable storage solutions. The company is benefiting from continuous product innovation, increased value-added products (VAPs) penetration, solid segmental results and transformation of the legacy WillScot business into Mobile Mini's SAP platform. Record order backlog, broad-based end-market strength and growth initiatives such as pricing, VAPs, cross-selling, and acquisitions have been driving growth.

WSC — a Zacks Rank #3 stock — has lost 8.9% year to date, faring better than the industry. Earnings estimates for 2023 and 2024 have increased to $1.76 (from $1.75) and $2.32 (from $2.23) over the past 30 days. The company’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average being 11%. It carries an impressive VGM Score of B.

Price and Consensus: WSC

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

WillScot Mobile Mini Holdings Corp. (WSC) : Free Stock Analysis Report

American Woodmark Corporation (AMWD) : Free Stock Analysis Report

La-Z-Boy Incorporated (LZB) : Free Stock Analysis Report

MillerKnoll, Inc. (MLKN) : Free Stock Analysis Report