4 Transportation Stocks That Appear to be Solid Bets for 2H23

It goes without saying that the Zacks Transportation sector was one of the hardest-hit corners in the investment space during the peak of the COVID-19 pandemic. However, things started to brighten from last year with the lessening of the severity of the pandemic and the subsequent easing of restrictions.

Notwithstanding the economic uncertainties, the sector has been prospering this year owing to multiple tailwinds. We expect most participants to continue their good performance in the second half of the year.

Given the positivity surrounding the sector, we believe that betting on transportation stocks like Copa Holdings CPA, Allegiant Travel Company ALGT, Global Ship Lease GSL and Textainer Group TGH is a prudent move.

Let’s delve deeper to focus on the tailwinds driving the sector, which houses airlines, railroads, trucking, leasing and shipping companies to name a few, and also the reasons why the space is likely to be attractive for investors in the latter half of the year.

Air travel demand has seen a stronger-than-expected recovery from the pandemic lows. While demand for leisure travel is exceptionally strong, what is all the more encouraging is that international air travel demand is bouncing back. International Air Transport Association or IATA recently doubled its current-year projection with respect to net profits for airlines across the globe.

With economic activities picking up and key economies like China reopening, shipping stocks in the sector are also likely to be in good shape. This is because the shipping industry is responsible for transporting the bulk of the goods involved in global trade.

Another key positive for the sectoral participants is the decline in fuel costs. Expenses on fuel are one of the key input costs for any transportation player. Consequently, the decline in fuel costs should support bottom-line growth. The easing of supply chain disruptions also bodes well for the sector participants.

Given this encouraging backdrop, we anticipate transportation stocks to flourish in the latter half of the year as well. We have picked four transportation stocks, which investors can bet on.

These stocks carry a Zacks Rank #1 (Strong Buy) or #2 (Buy) presently and have a VGM Score of A or B. Moreover, the companies have witnessed favorable earnings estimate revisions for the current year. Our research shows that stocks with a VGM Score of A or B, when combined with a Zacks Rank #1 or 2, offer the best investment opportunities for investors.

You can see the complete list of today’s Zacks #1 Rank stocks here.

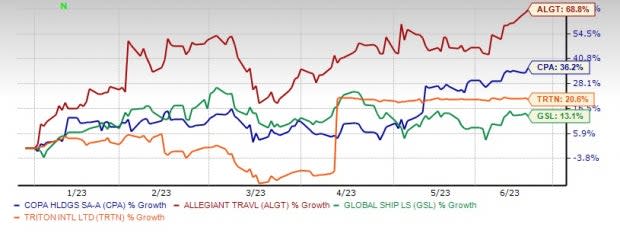

Price Performance: Year to Date

Image Source: Zacks Investment Research

Our Choices

Copa Holdings, currently sporting a Zacks Rank #1, is benefiting from an improvement in air travel demand. In first-quarter 2023, passenger revenues increased 28.5% from first-quarter 2019 levels due to higher yields.

CPA’s focus on its cargo segment is encouraging. In first-quarter 2023, cargo and mail revenues grew 51.8% at this Latin American carrier from first-quarter 2019 levels on higher volumes and yields.

Copa Holdings' fleet modernization and cost-management efforts are commendable. The Zacks Consensus Estimate for current-year earnings has been revised 22.4% upward over the past 60 days. CPA currently has a VGM Score of A.

Allegiant is seeing a steady recovery in leisure air travel demand. In first-quarter 2023, this Las Vegas, NV-based company’s operating revenues grew 29.9% on a year-over-year basis. Passenger revenues, accounting for 93.7% of the top line, increased 31.3% on a year-over-year basis.

Allegiant's fleet-modernization efforts are encouraging. The Zacks Consensus Estimate for ALGT's current-year earnings has been revised upward by 36.2% in the past 60 days. Allegiant currently sports a Zacks Rank #1 and has a VGM Score of A.

Global Ship Lease is being aided by the bullish sentiment surrounding the containership market. GSL’s strong balance sheet is an added positive. Global Ship Lease currently sports a Zacks Rank #1

The uptick in trading volumes bodes well for Global Ship Lease. The Zacks Consensus Estimate for current-year earnings has moved up 4.2% over the past 60 days. GSL currently has a VGM Score of A.

Textainer Group, currently carrying a Zacks Rank #2, is headquartered in Hamilton, Bermuda. TGH is the world's largest lessor of intermodal containers. We are impressed by TGH’s efforts to grow its fleet.

The Zacks Consensus Estimate for TGH’s 2023 earnings has been revised 1.5% upward over the past 90 days. TGH outpaced the Zacks Consensus Estimate for earnings in each of the last four quarters, the average beat being 6.2%. TGH presently has a VGM Score of B.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Copa Holdings, S.A. (CPA) : Free Stock Analysis Report

Allegiant Travel Company (ALGT) : Free Stock Analysis Report

Global Ship Lease, Inc. (GSL) : Free Stock Analysis Report

Textainer Group Holdings Limited (TGH) : Free Stock Analysis Report