4 Undervalued Medical Stocks to Buy Amid High Market Volatility

The U.S. stock market has been highly volatile year to date. Although the Dow Jones Industrial Average, Nasdaq Composite and S&P 500 have gained 1.6%, 12.4% and 27.1%, respectively, during the same time frame, these are down 3.4%, 4.4% and 5.3% in the last one month. The global economy has been undergoing a slowdown due to the macroeconomic and geopolitical headwinds.

The ongoing Russia-Ukraine war has increased worries for investors who were already concerned about global economic recovery due to increasing crude oil price, rising inflation and a hawkish policy adopted by the Fed, leading to a highly volatile equity market.

At this stage, investors may consider adding stocks such as Acadia Healthcare ACHC, Progyny PGNY, Eagle Pharmaceuticals EGRX and NeuroBo Pharmaceuticals NRBO to their portfolio to deter the impacts of the current volatile market environment and make some gains from the stocks’ upside potential.

Undervalued Stocks With Growth Potential

In the current scenario (highly volatile market situation), one should look for stocks that are undervalued but have the bright growth prospects. On the other hand, if the market shoots up, these stocks have increased chances of registering higher gains. This implies that undervalued stocks cushion investors from market jitters, while the companies’ robust fundamentals ensure solid portfolio returns.

However, it is difficult to pick such multi-faceted stocks from a plethora of investment opportunities.

This is exactly where the Zacks Style Score comes in handy. The Value Style Score will help filter stocks that are undervalued, while the Growth Style Score condenses all the essential metrics from a company’s financial statements to get a true sense of the quality and sustainability of its growth.

Image Source: Zacks Investment Research

Our Picks

With the help of our style score system, we have zeroed in on four aforementioned stocks that look promising, based on their encouraging Zacks Rank and favorable Value and Growth style scores.

Our first pick is Acadia Healthcare, which sports a Zacks Rank #1 (Strong Buy) and has a Growth Score and Value Score of B. For the current fiscal year, the company has a projected EPS growth rate of 13%. ACHC also has a Momentum score of A, implying the highest probability of strong move in stock price.

Favorable patient volumes and operational improvement are driving strong growth in the U.S. market. The company’s acquisitions to expand business in the behavioral healthcare industry bode well. Acadia Healthcare has a robust pipeline of upcoming joint ventures with renowned healthcare systems.

Acadia Healthcare Company, Inc. Price

Acadia Healthcare Company, Inc. price | Acadia Healthcare Company, Inc. Quote

The second stock that makes it to our list is Progyny, which has a Growth Score and Value Score of A and C, respectively. It carries a Zacks Rank of 2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

For the current fiscal year, the company has a projected EPS growth rate of 80%.

The rising demand for PGNY’s fertility and family building solutions due to increasing prevalence of infertility as well as improved access to care, is driving the top line. This trend is likely to continue as the demand for assisted reproductive technology (ART) cycles rises. In the past 10 years, ART cycles have witnessed a CAGR of 10.5%. The rate increased to 11.5% in the past couple of years, even amid the pandemic. This should accelerate further with improving healthcare activities.

Progyny, Inc. Price

Progyny, Inc. price | Progyny, Inc. Quote

Our third choice is Eagle Pharmaceuticals, which has a Growth and Value Score of A. For fiscal 2023, this Zacks Rank #2 company has an estimated EPS decline rate of 41.2%. However, the Zacks Consensus Estimate for full-year earnings has risen 7.3% in the past 60 days.

Strong uptake of its new drug, Barhemsys, will be a key driver for revenue growth in the upcoming quarters. Sales have grown approximately 30% in each of the last two quarters. Moreover, the company’s strong presence in the bendamustine U.S. market, with approximately 84% market share, continues to support long-term growth. Meanwhile, the company plans to file a new drug application (NDA) in 2024, seeking approval for its pipeline candidate EA-114 for personalized treatment regimen to breast cancer patients, especially in post-menopausal women. A potential approval will create significant growth opportunity for the stock.

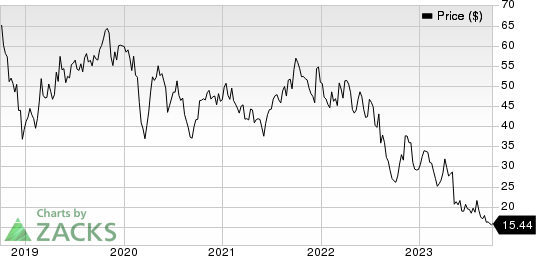

Eagle Pharmaceuticals, Inc. Price

Eagle Pharmaceuticals, Inc. price | Eagle Pharmaceuticals, Inc. Quote

Our final pick is NeuroBo Pharmaceuticals, which has a Growth Score of B and a Value Score of A. It currently carries a Zacks Rank #2. The consensus estimate for the company’s current year earnings suggests year-over-year growth of 94.3%.

NRBO is progressing well with its lead pipeline candidate, DA-1241, which is being evaluated for the treatment of nonalcoholic steatohepatitis (NASH). It initiated a phase II study evaluating DA-1241 in NASH patients earlier this month. A potential positive interim data, which is expected in the first half of 2024, will be a significant boost for the company.

NeuroBo Pharmaceuticals, Inc. Price

NeuroBo Pharmaceuticals, Inc. price | NeuroBo Pharmaceuticals, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Acadia Healthcare Company, Inc. (ACHC) : Free Stock Analysis Report

Eagle Pharmaceuticals, Inc. (EGRX) : Free Stock Analysis Report

Progyny, Inc. (PGNY) : Free Stock Analysis Report

NeuroBo Pharmaceuticals, Inc. (NRBO) : Free Stock Analysis Report