4 Utilities Set to Outperform Estimates This Earnings Season

Per the latest Earnings Preview, the Zacks Utilities sector’s second-quarter 2023 earnings are expected to decline 2.4% and revenues are expected to drop 1%. The capital-intensive utility stocks were impacted by increased interest rates and rising operating costs. Further, cost management, customer growth, systematic investment to strengthen infrastructure to increase the resilience of the system and new rates implemented in their service territories boosted revenues.

With the assistance of the Zacks Stock Screener, we have identified four utilities, namely Exelon Corporation EXC, Consolidated Edison ED, Public Service Enterprise Group PEG and Atmos Energy ATO, which are poised to beat the Zacks Consensus Estimate this earnings season.

These stocks have the ideal combination of two ingredients — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) — to surpass expectations. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

The Utilities sector’s second-quarter earnings started on a positive note, with NextEra Energy reporting an earnings surprise.

Factors That Likely Impacted Performances

Domestic-focused companies operating in the sector are concentrating on cost management and the implementation of energy-efficiency programs. New rates and customer additions are creating fresh demand, and assisting the utilities. Investments in strengthening the infrastructure are allowing utilities to provide services even during extreme conditions, leading to stable earnings.

Capital-intensive utilities need massive funds to upgrade, maintain and expand their infrastructure and operations. The performances of the utilities are likely to have been adversely impacted by the increase in interest rates from near-zero levels.

Utilities have been focused on improving productivity and their cost structures through investments in digital technologies, integrating key systems and analyzing data to make proper decisions to improve overall operations. The utilities continue to invest smart capital that assists in cutting operating and maintenance expenses, and fuel costs, in turn, keeping the utility bills affordable for customers.

Utilities have been adding more renewable and clean energy sources to their production portfolios, and cutting down the use of coal and other polluting sources in their generation portfolios. Weather in the second quarter was mild and adversely impacted the use per customer during the quarter.

Expected Outperformers

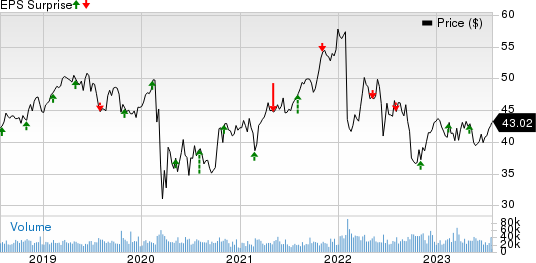

Exelon is engaged in the transmission and distribution of electricity. Exelon’s customers benefited from the tax reforms, energy efficiency programs and cost-saving initiatives undertaken by the company. Exelon has been working on its plans to invest $31.3 billion during the 2023-2026 period to strengthen its infrastructure.

The Zacks Consensus Estimate for second-quarter earnings is pegged at 41 cents, indicating a decline of 6.82% from the year-ago reported figure. EXC currently has an Earnings ESP of +0.12% and a Zacks Rank #3.

Exelon Corporation Price and EPS Surprise

Exelon Corporation price-eps-surprise | Exelon Corporation Quote

Consolidated Edison, through its subsidiaries, is engaged in regulated electric, gas and steam delivery businesses. The company has a capital expenditure plan of $14.6 billion for the 2023-2025 period.

The Zacks Consensus Estimate for its second-quarter earnings is pegged at 57 cents, suggesting a decline of 10.94% from the year-ago reported figure. ED presently has an Earnings ESP of +1.4% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Consolidated Edison Inc Price and EPS Surprise

Consolidated Edison Inc price-eps-surprise | Consolidated Edison Inc Quote

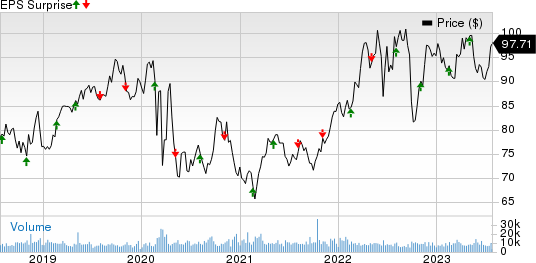

Public Service Enterprise is a diversified energy company. It provides electric transmission, and electric and gas distribution services to residential, commercial and industrial customers. The company has a solid portfolio of regulated and non-regulated utility assets that offer stable earnings and significant long-term growth potential. It has been working on its plan to invest $9.6 billion in the 2023-2026 period to strengthen its operations.

The Zacks Consensus Estimate for Public Service Enterprise’s second-quarter earnings is pegged at 62 cents, implying a decline of 3.13% from the year-ago reported figure. PEG currently has an Earnings ESP of +1.94% and a Zacks Rank #2.

Public Service Enterprise Group Incorporated Price and EPS Surprise

Public Service Enterprise Group Incorporated price-eps-surprise | Public Service Enterprise Group Incorporated Quote

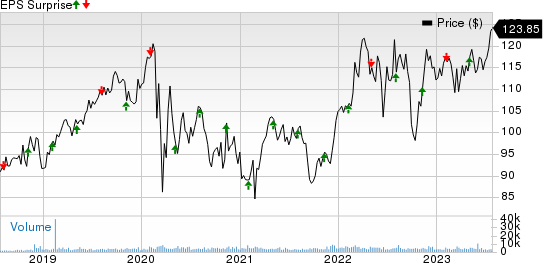

Atmos Energy is engaged in the regulated natural gas distribution and storage business. The company plans to invest $11 billion through fiscal 2027.

The Zacks Consensus Estimate for Atmos Energy's fiscal third-quarter earnings is pegged at 95 cents, suggesting an increase of 3.26% from the year-ago reported figure. ATO has an Earnings ESP of +6.88% and a Zacks Rank #2 at present.

Atmos Energy Corporation Price and EPS Surprise

Atmos Energy Corporation price-eps-surprise | Atmos Energy Corporation Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exelon Corporation (EXC) : Free Stock Analysis Report

Public Service Enterprise Group Incorporated (PEG) : Free Stock Analysis Report

Consolidated Edison Inc (ED) : Free Stock Analysis Report

Atmos Energy Corporation (ATO) : Free Stock Analysis Report