4 Value Stocks to Hold for the Long Term

Long-term investing, as the name implies, refers to those stocks, bonds and other assets that you intend to hold for a very long period of time, say 5-10 years at least. Since most of us aren’t experts on how different markets and technologies will develop, the task of finding long-term options and resisting the urge to sell off when any Tom, Dick or Harry sounds an alarm, can be daunting.

Therefore, in order to avoid the anxiety that would be natural in such a setting, it’s best to get in with the attitude that you may make mistakes. And the best way to deal with such a situation -- alright, the second-best way -- is to make sure you have diversified holdings. (The best way is to study, study and study the stocks you intend to invest in.) Back to diversification. Ideally, this should be different industries and not just different stocks within the same industry. Although it’s more work, stocks in different industries give you better protection because the same industry would have certain dynamics that affect all the players in the same way. And you don’t want to get caught in that sameness.

Tip number two, it really helps if you’re getting paid for holding the stocks. So, if there’s a dividend going, all the better. For those who can stomach more risk, go ahead and use those dividends to buy more stock. As your holdings grow, you get to earn even more dividends. In addition to the increase in capital. Remember, a company that pays a dividend is likely to have more stable prices than one that does not. But do go back 5-10 years and check its dividend payment history. If it’s steady and rising periodically, that’s good. Only a company that has stable earnings can pay steady dividends over a period of time.

Third, buy cheap. I know, that sounds kind of obvious. But only if you know what I mean by cheap. I don’t mean just that the dollar value is low, which can also be a good thing. But the real point is, you need to buy stocks that are trading below their potential value. There’s a number of ways that you can gauge this. Analysts generally use a ratio called P/E (price-to-earnings), but there are also several others, such as P/B (price-to-book) or P/S (price-to-sales).

To keep things simple, you can stick with P/E alone or a combination of P/E and P/S in most cases. And you need to compare this ratio with that of the peer group, industry, or some benchmark, such as the S&P 500. A relatively low P/E basically means that the price is relatively low considering the earnings potential and compared to other stocks within the industry (when comparing with the industry) or other stocks in the market (when comparing with a broader index, such as the S&P 500).

Let’s consider some examples:

AXIS Capital Holdings Ltd. (AXS)

Pembroke, Bermuda-based AXIS Capital Holdings is a global provider of specialty insurance and reinsurance products. The company operates through two segments: Insurance and Reinsurance. The Insurance segment offers a range of property, marine, terrorism, aviation and liability insurance products, as well as accidental death, travel and specialty health products. It also provides professional insurance coverage for directors and officers, errors and omissions, and other financial risks. The Reinsurance segment provides various reinsurance products, including catastrophe, property, professional lines and motor liability coverage.

AXIS has paid a very steady dividend over the last 10 years and the dividend has also been increasing. The current dividend yields 3.28%.

The near-term outlook indicates continued momentum: 7.6% revenue growth and 32.5% earnings growth in 2023, followed by 6.0% revenue growth and 11.7% earnings growth in 2024. In the last quarter, AXIS beat estimates by 23.3%. Therefore, there’s a good chance it will do it again.

Not only that – Its 2023 earnings estimate has increased 4.3% in the last 60 days with the 2024 estimate also increasing 1.2%, despite an expected recession. AXIS is expected to grow its earnings 5.0% in the long term.

Finally, the Zacks Rank #2 (Buy) rated stock is also cheap. It's trading at a mere 0.88X sales, which means that investors are undervaluing revenue potential. At 6.59X earnings, they are also undervaluing its earnings. The industry P/E averages at 26.08X while the S&P averages at 19.28X, both significantly higher. At the current level, they’re also at a 14.0% discount to their own median value over the past year.

No wonder that Zacks has a Value Score of A on this stock.

Lifetime Brands, Inc. (LCUT)

Garden City, NY-based Lifetime Brands is a global company that designs, sources and sells branded kitchenware, tableware and other home products, including tools, cutlery, cookware and bakeware, as well as tableware products like dinnerware and flatware. It also offers home solutions such as thermal beverageware, bath scales and home décor items. Some of its well-known brands are Farberware, Mikasa, KitchenAid and Pfaltzgraff. Products are mainly sold through mass market merchants, specialty stores, department stores and e-commerce channels.

Lifetime Brands has been paying a steady dividend for more than 10 years although the dividend has not increased much. The current divided yields 3.33%, which is not bad at all.

Near-term growth prospects appear solid. Lifetime Brands is expected to generate earnings growth of 93.6% this year on revenue that’s expected to decline 6.6%. In the following year, however, revenue is expected to grow 5.0% and earnings 73.3%. In the long term, the company is expected to grow 14.0%.

The 2023 estimate increased 9.1% although the 2024 estimate remains consistent with the level 60 days ago. However, things appear to be going well for Lifetime Brands, which beat earnings estimates by 40.0% in the last quarter.

Its valuation is also supportive. The P/S multiple of 0.16X is a gross undervaluation of its sales potential, while the P/E of 6.28X reflects similarly on its earnings potential.

The shares carry a Zacks #1 (Strong Buy) rank and have a Value Score of A.

Unum Group (UNM)

Chattanooga, TN-based Unum Group is a leading provider of financial protection benefit solutions primarily in the U.S., the UK and Poland. Its operating segments are Unum US, Unum International, Colonial Life, and Closed Block and Corporate. Unum's range of offerings include group disability, life, and accidental death and dismemberment coverage, as well as supplemental and voluntary products termed individual disability, dental and vision plans.

Additionally, Unum provides group pensions, individual life insurance, and other related products. Distribution is through various channels including field sales personnel, independent brokers and consultants.

Unum’s dividend currently yields 2.88%, which is not too bad. It has been paying a steadily increasing dividend for more than 10 years.

Analysts currently expect the company to generate revenue and earnings growth of 2.5% and 206% in 2023. In 2024, revenue growth is expected to be 3.6% and earnings growth 3.5%. The 2023 earnings estimate has increased 10.6% and the 2024 estimate 7.9%. The long-term growth estimate is 8.4%. Therefore, since the 13.3% surprise in the last earnings announcement, analyst opinion has been very optimistic.

At 6.01X earnings, the shares trade at a significant discount to the industry’s 9.93X, the S&P 500, as well as their own median value of 6.37X over the past year. The P/S ratio of 0.75X indicates that sales are also undervalued.

The shares carry a Zacks #1 rank and Value Score of A.

Telefónica, S.A. (TEF)

Headquartered in Madrid, Spain, Telefónica, S.A. is a telecom company that offers services in Europe and Latin America. Its fixed telecom services include PSTN lines, ISDN accesses and public telephone services. It also provides mobile services like Internet, broadband multimedia and voice over Internet protocol services. Additionally, Telefónica offers a range of wholesale services, leased lines, web hosting, system integration and professional services, as well as video/TV services, IoT products, financial services, cloud solutions and virtual assistants.

Telefónica pays a dividend that currently yields 6.04%. The dividend has been continuous but the amount has fluctuated quite a bit in the last 10 years, as has its earnings.

The near-term outlook is, however, encouraging. Despite the recession that everyone’s expecting around the corner, revenue growth is projected to be flattish both this year and the next while earnings growth is to be flattish this year and 5.7% in the next. Analysts expect the company to grow 20.2% in the long term. Given the 66.7% positive surprise in the last announcement, it isn’t surprising that 2023 estimates increased 34.6% in the last 60 days while the 2024 estimate increased 68%.

At 10.9X earnings, the shares trade at a considerable discount to the industry’s 18.6X, as well as the S&P 500. The median value of 13.0X is also higher. Therefore, the shares appear to be undervalued. On a P/S basis as well, the multiple of 0.54X makes them hugely undervalued.

The #2 ranked shares carry a Value Score of A.

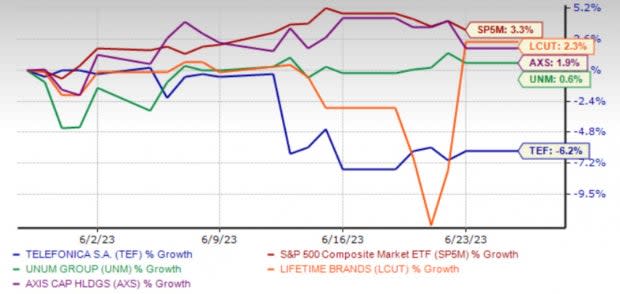

One-Month Price Performance

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Telefonica SA (TEF) : Free Stock Analysis Report

Axis Capital Holdings Limited (AXS) : Free Stock Analysis Report

Unum Group (UNM) : Free Stock Analysis Report

Lifetime Brands, Inc. (LCUT) : Free Stock Analysis Report