4 Wood Stocks Worth Watching Despite Industry Challenges

Soft demand from the residential market, a difficult macroeconomic and geopolitical environment have been hurting the Zacks Building Products – Wood industry. Also, inflationary pressure on material and labor and high fuel-related costs have added to the headwinds. However, the companies are expected to benefit from higher demand across export markets, repair and remodel (R&R) activity and more funding for infrastructure and carbon/ESG-related projects. In addition, inorganic and prudent cost containment should support industry players like Trex Company, Inc. TREX, UFP Industries, Inc. UFPI, Boise Cascade Company BCC and JELD-WEN Holding, Inc. JELD.

Industry Description

The Zacks Building Products – Wood industry includes forest product companies and manufacturers of lumber as well as other wood products used in home construction, repair and remodeling along with the development of outdoor structures. Companies in the industry design, manufacture, source and sell flooring products like tile, wood, laminate, vinyl, and natural stone flooring products as well as decorative and installation accessories. The industry players are also involved in the manufacturing and distribution of wood and plastic composite products along with related accessories, mainly for residential decking and railing applications. The industry also includes timberland real estate investment trusts or REITs.

4 Trends Shaping the Future of Building Products - Wood Industry

Lower Demand: The slowdown in the U.S. housing market and continued headwinds in China have been impacting demand. Presently, the outlook for the housing industry remains less favorable compared to the last couple of years due to several headwinds, such as a rapid increase in mortgage rates, housing affordability challenges, high inflation and growing concerns about the economy. Although the residential market has started to gain momentum owing to stabilized mortgage rates and the lack of existing homes for sale, macroeconomic uncertainties might dampen demand in the future.

Rapid Lumber Market Swings & Supply Chain-Related Challenges Weigh on Margins: Historically, volatility in lumber prices has been a major concern for the wood industry. Any unusual rise in the cost of lumber products sold by primary producers increases the cost of inventory and limits margins on fixed-priced lumber products. Yet, a decline in costs eats into profits as products sold are indexed to the current lumber market. Meanwhile, the timberland business is governed by federal rules and state forestry commissions, which are subject to frequent changes, thereby affecting businesses. Due to the very nature of their properties, timberland REITs are required to follow eco-friendly mandates in their trade. The companies have been experiencing supply-chain challenges and higher freight and transport costs. For example, resin unavailability is posing quite a challenge. The industry participants use a significant quantity of various resins in the manufacturing processes. Resin product costs are influenced by changes in prices or availability of raw materials used to produce resins, primarily petroleum products, and their demand and availability.

Higher Export Market Demand, Spending on Carbon/ESG Projects, Repair & Remodeling: The industry participants have been experiencing higher demand across export markets owing to a combination of diverse factors. For example, shipping and logistics challenges are spurring demand for North American logs in Japan. Again, trade limitations have impacted the import of Australian logs into China. Meanwhile, the Russia-Ukraine war has led to the ban of log exports from Russia. Overall, this tightening global wood market is proving conducive for some of the industry participants. The companies are experiencing higher funding for carbon/ESG-related projects to pursue carbon capture and storage work. The industry’s prospects are highly correlated with the U.S. housing market conditions. Although the slowing housing market and pandemic-related challenges are creating hurdles, the R&R market (considered one of the largest in terms of lumber demand) has been impressive. The age of U.S. housing stock and a higher level of homeowner equity provide a favorable backdrop for repair-and-remodel spending for 2023. Also, increased government spending on infrastructure projects bodes well.

Acquisitions, Product Innovation & Efficient Cost-Reduction Strategies: The companies also bank on acquisitions and divestitures to expand as well as improve portfolio quality. New products continue to be an important top-line driver for the industry players. Also, efforts to introduce products are likely to have helped the players. Again, in a bid to reduce costs, companies have been reducing the cost structure of their facilities through Lean Six Sigma efforts, the sale or shutdown of underperforming units and manufacturing facilities as well as investments in technology. Also, the industry players have been focusing on operational excellence, comprising merchandising for value, harvest, and transportation efficiencies, and boosting harvest to capture seasonal and short-term opportunities.

Zacks Industry Rank Indicates Dull Prospects

The Zacks Building Products – Wood industry is a 12-stock group within the broader Construction sector. The Zacks Wood industry currently carries a Zacks Industry Rank #227, which places it in the bottom 10% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bleak near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the bottom 50% of the Zacks-ranked industries is a result of the bleak earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually losing confidence in this group’s earnings growth potential. Since April 2023, the industry’s earnings estimates for 2023 and 2024 decreased to $1.62 and $2.01 per share from $1.69 and $2.13 per share, respectively.

Despite the industry’s blurred near-term view, we will present a few stocks that one may consider adding to their portfolio. Before that, it’s worth taking a look at the industry’s shareholder returns and current valuation.

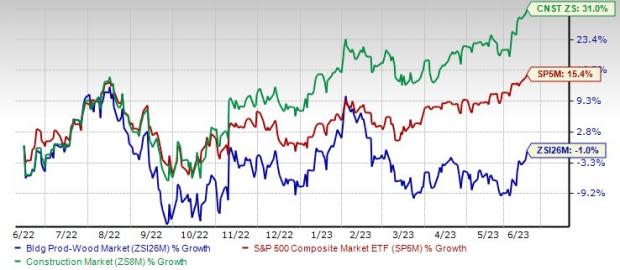

Industry Lags Sector & S&P 500

The Zacks Building Products – Wood industry has underperformed the broader Zacks Construction sector and the Zacks S&P 500 composite over the past year.

Over this period, the industry has lost 1% against the S&P 500 and the broader sector’s 15.4% and 31% rise, respectively.

One-Year Price Performance

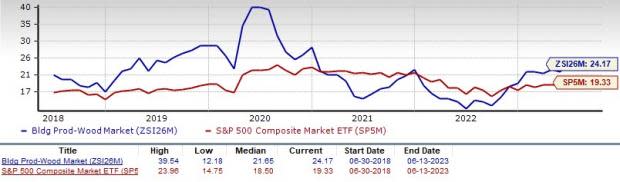

Industry's Current Valuation

On the basis of the forward 12-month price-to-earnings ratio, which is a commonly used multiple for valuing wood stocks, the industry trades at 24.2X versus the S&P 500’s 19.3X and the sector’s 15.8X.

Over the last five years, the industry has traded as high as 39.5X, as low as 12.2X and at a median of 21.7X, as the chart below shows.

Industry’s P/E Ratio (Forward 12-Month) Versus S&P 500

4 Wood Stocks to Keep an Eye On

We have highlighted one stock, carrying a Zacks Rank #2 (Buy), and three stocks currently, with a Zacks Rank #3 (Hold), which have been capitalizing on fundamental strengths. You can see the complete list of today’s Zacks #1 Rank stocks here.

UFP Industries: Headquartered in Grand Rapids, MI, UFP Industries supplies wood, wood composite and other products to retail, industrial, and construction markets. The company has been gaining from its diversity of markets, solid contributions from buyouts, new product innovation and an improved pricing model. In first-quarter 2023, new product sales (those that generate sales of at least $1 million per year within four years of launch, and are still growing and gaining market penetration) were $166.6 million, up 10.6% from the year-ago period. New product sales, as a percent of total sales, rose to 9.1% from 7.4% a year ago. Management expects new product sales to meet the target of $795 million in 2023.

Importantly, UFPI — which has gained 34.8% year to date (compared to 11.5% growth of the industry) — currently carries a Zacks Rank #2. Its earnings surpassed the Zacks Consensus Estimates in each of the trailing four quarters, with the average surprise being 22.7%. It has seen a 1.7% and 1% upward estimate revision for 2023 and 2024 earnings over the past 30 days, respectively. This depicts analysts’ optimism over the company’s prospects.

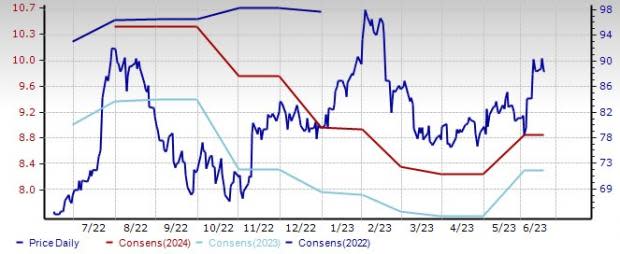

Price and Consensus: UFPI

JELD-WEN Holding: Headquartered in Charlotte, NC, JELD-WEN designs, manufactures and sells doors and windows primarily in North America, Europe and Australasia. Although the company expects softening demand in most of its end markets in 2023, JELD has taken a two-pronged style to streamline and strengthen JELD-WEN in order to improve the short-term financial performance as well as to position the company well for the longer term. It has been focusing on margin expansion and increasing cash flow generation by reducing cost structure through operational efficiencies and rationalizing its global footprint. At the same time, JELD has streamlined workstreams for long-term profitable growth by optimizing the production network and investing in products and services to better serve customers.

Importantly, JELD — which has gained 60.4% year to date — has seen a 12.6% upward estimate revision for 2023 earnings over the past 60 days. This Zacks Rank #3 company carries an impressive VGM Score of B. This helps to identify stocks with the most attractive value, growth and momentum.

Price and Consensus: JELD

Boise Cascade Company: Based in Boise, ID, this company makes wood products and distributes building materials in the United States as well as Canada. Although BCC acknowledges that the industry will face challenges during 2023, given the current economic uncertainties and weaker near-term demand from residential construction, it remains well positioned to execute the growth initiatives that started in 2022. The company has been demonstrating a balanced approach to capital allocation, including the ability to pursue additional growth initiatives that align with strategy. Boise Cascade has also been increasing commodity offerings that will instill growth in the existing and underserved markets, and across its entire national footprint.

Importantly, BCC — which has gained 14.5% year to date — surpassed earnings estimates in three of the trailing four quarters but missed on one occasion, leading to the average surprise of 19%. It carries an impressive VGM Score of A. The stock has seen a 5.6% upward estimate revision for 2023 earnings over the past 60 days.

Price and Consensus: BCC

Trex Company: Based in Winchester, VA, this company manufactures and distributes wood and plastic composite products as well as related accessories mainly for residential decking, and railing applications. Despite soft demand owing to softening economic conditions, more resilient repair and remodel, the sector has been driving growth. Additionally, Trex’s tiered product strategy — which supports consumers’ decision making by providing a range of product aesthetics — is encouraging. Its focus on automation, modernization, energy efficiency and raw material processing is expected to be a major tailwind.

TREX currently carries a Zacks Rank #3. The stock — which has gained 37% so far this year — surpassed earnings estimates in three of the trailing four quarters but missed on one occasion, with the average surprise being 7.3%. It has seen a 5.2% upward estimate revision for 2023 earnings over the past 60 days.

Price and Consensus: TREX

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Trex Company, Inc. (TREX) : Free Stock Analysis Report

UFP Industries, Inc. (UFPI) : Free Stock Analysis Report

Boise Cascade, L.L.C. (BCC) : Free Stock Analysis Report

JELD-WEN Holding, Inc. (JELD) : Free Stock Analysis Report