5 Airline Stocks to Buy on Buoyant Passenger & Cargo Demand

The airlines industry is seeing a steady recovery in domestic and international travel demand. A stronger-than-expected recovery in air-travel demand from the pandemic lows is a huge positive for the industry, which was one of the worst hits in the peak COVID-19 period. The removal of COVID-related restrictions is aiding air travel, which is now strong on the international front as well.

Aside from buoyant air-travel demand, airlines are currently focusing on boosting cargo revenues. The International Air Transport Association (IATA) expects airlines to return to profitability in 2023. Airlines are also investing heavily in technology. Notably, the Zacks Airline industry has risen 19.9% so far this year, outperforming the 12.6% growth of the broader Zacks Transportation sector.

Most of the airlines have provided a rosy outlook in their recent earnings reports. At this stage, investment in airline stocks with a favorable Zacks Rank should prove fruitful in the near term.

Our Top Picks

We have narrowed our search to five airlines stocks with strong potential for the rest of 2023. These stocks have seen positive earnings estimate revisions in the last 30 days. Each of our picks carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

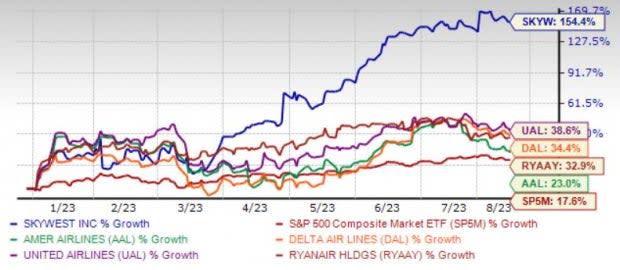

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

United Airlines Holdings Inc. UAL: For the third quarter of 2023, UAL expects capacity to improve almost 16% from the year-ago reported figure. Total revenues are anticipated to grow 10-13% year over year. UAL expects third-quarter earnings per share in the band of $3.85-$4.35.

For 2023, United Airlines expects capacity to improve almost 18% from the year-ago reported figure. Adjusted capital expenditures are expected to be around $8.5 billion. In a bid to modernize its fleet, United Airlines will purchase 100 Boeing 787 Dreamliners, with options to buy 100 more. UAL expects 2023 EPS in the band of $11.00-$12.00 (prior view: $10-$12).

United Airlines has an expected revenue and earnings growth rate of 19.2% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 13.7% over the last 30 days.

American Airlines Group Inc. AAL: With air-travel demand having improved, AAL is constantly looking to add routes and broaden network. AAL expects 2023 adjusted earnings in the band of $3-$3.75 per share (the earlier view was in the $2.5-$3.5 per share range).

AAL projects the September-end quarter's adjusted earnings per share in the $0.85-$0.95 range. Management expects third-quarter 2023 TRASM to be between 4.5% and 6.5%, lower than third-quarter 2022 actuals. System capacity for the September-end quarter is estimated to increase 5-7% from third-quarter 2022 levels.

American Airlines has an expected revenue and earnings growth rate of 8.5% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 11.2% over the last 30 days.

Delta Air Lines Inc. DAL: The company expects 2023 adjusted earnings in the band of $6-$7 per share (the earlier view was $6 per share). Free cash flow for the current year is expected to be $3 billion. DAL expects September-quarter adjusted revenues to increase in the 11-14% band from third-quarter 2022 actuals.

Third-quarter adjusted earnings are expected in the range of $2.20-$2.50 per share. The adjusted operating margin in the September quarter is expected in the mid-teens. DAL projects current-year total revenues (adjusted) to increase in the 17-20% range on a year-over-year basis. The operating margin is expected to be above 12%.

Delta Air Lines has an expected revenue and earnings growth rate of 10.8% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 7.4% over the last 30 days.

SkyWest Inc. SKYW: The company’s fleet-modernization efforts are commendable. In a bid to modernize its fleet, SKYW entered into an agreement with Delta to add two E175 aircraft in fourth-quarter 2023 and one E175 aircraft in 2024. By the end of 2025, SKYW is scheduled to operate a total of 239 E175 aircraft.

SkyWest spent $31 million on spare engines and other fixed assets. SKYW’s environmentally-friendly deal with Eve Air is encouraging. Under this deal, SKYW and Eve aim to develop a portfolio of services-based capabilities to optimize eVTOL performance in key early adopter cities that will be prioritized for initial Urban Air Mobility operations.

SkyWest has an expected revenue and earnings growth rate of 20% and more than 100%, respectively, for the next year. The Zacks Consensus Estimate for next-year earnings has improved 19% over the last seven days.

Ryanair Holdings plc RYAAY: Improvement in traffic from the pandemic-led slump is encouraging. Traffic grew 11% to 50.4 million in first-quarter fiscal 2024. RYAAY expects its traffic view for fiscal 2024 to be 183.5 million.

On the back of a buoyant traffic scenario, RYAAY’s profit after tax was €663 million in first-quarter fiscal 2024, up more than 100% year over year. Load factor increased to 95% in first-quarter fiscal 2024 from 92% in the year-ago reported quarter. Measures to expand RYAAY’s fleet to cater to the rising travel demand are encouraging.

Ryanair Holdings has an expected revenue and earnings growth rate of 28.3% and 24.7%, respectively, for the current year (ending March 2024). The Zacks Consensus Estimate for current-year earnings has improved 4.1% over the last seven days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ryanair Holdings PLC (RYAAY) : Free Stock Analysis Report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

American Airlines Group Inc. (AAL) : Free Stock Analysis Report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report