5 Artificial Intelligence (AI) Stocks That Could Make You a Millionaire

If you bought Nvidia stock years ago and held on to it, you are likely to be significantly wealthier today. This semiconductor stock benefitted greatly from the interest in artificial intelligence (AI) and generated millionaire-making returns, helping the company grow to be worth $2.1 trillion. However, it will be hard for new Nvidia investors to get the same kinds of returns going forward because it is already so large. Investors looking for similar return production will need to dig deeper and find rising stars small enough to multiply in size over the coming years.

To aid in that search, here are five AI stocks with the potential to make millionaires over the coming decade and beyond:

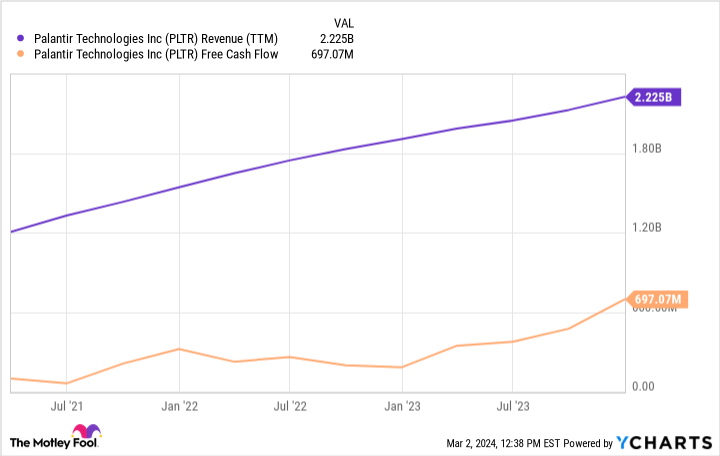

1. Palantir Technologies

Data analytics company Palantir Technologies (NYSE: PLTR) builds custom software and AI applications on its Gotham, Apollo, and AIP platforms. The company has a deep relationship with the U.S. government and has been scooping up commercial customers. U.S. commercial bookings grew over 100% year over year in Q4. The company is profitable and has a whopping $3.6 billion in cash against zero debt to keep investing to grow.

The company's market cap is $55 billion, small enough that the stock has room to grow multiple times its current size if Palantir becomes the eventual mega-cap technology business investors hope. Palantir still has just 497 customers, leaving lots of room for more over the next decade and beyond.

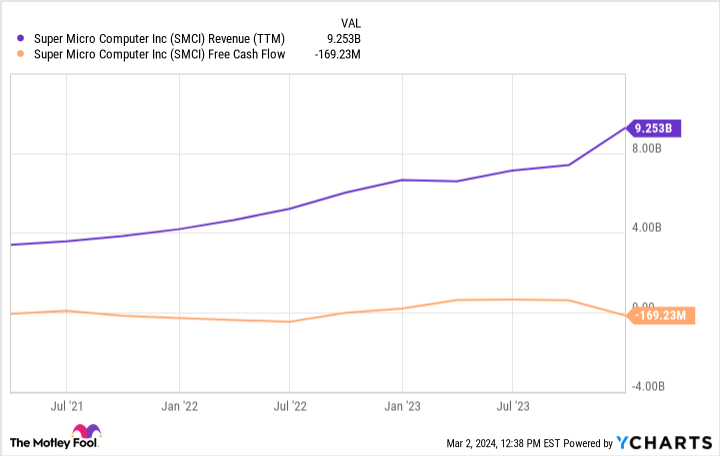

2. Super Micro Computer

Modular computer systems company Super Micro Computer (NASDAQ: SMCI) is growing its business grow at triple-digit rates thanks to the surge in demand for data center systems for AI. Supermicro's modular system is popular; management has pointed out that its growth far exceeds that of the broader industry. Nvidia's CEO Jensen Huang projects there will be a need for up to a trillion dollars of data center spending to accommodate the resource needs of AI.

Considering Supermicro is still doing under $10 billion in annual sales, that's a considerable pie the company will be able to take a bite of. While the stock has already appreciated so much over the past year, the company is only now being added to the S&P 500 and is still worth just $50 billion today. That leaves room for long-term growth.

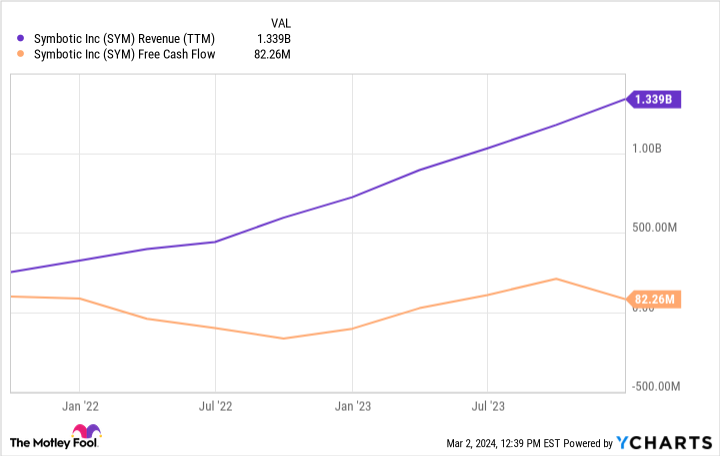

3. Symbotic

Robotics company Symbotic (NASDAQ: SYM) is a game-changer in retail and e-commerce. The company is building proprietary fulfillment systems that efficiently store merchandise and use robotics to pick and fill orders. The company has only deployed 35 systems for nine customers, but mega-retailers like Walmart and Target are among them. The company is also developing fulfillment-as-a-service: rentable systems for third-party customers.

Having customers like Walmart (who rely on efficiency to keep prices low) shows confidence in the performance of these fulfillment systems. Symbotic is a young company but is already generating free cash flow. The company's $23 billion market cap leaves room for investment upside if Symbotic's systems become commonplace in the global economy.

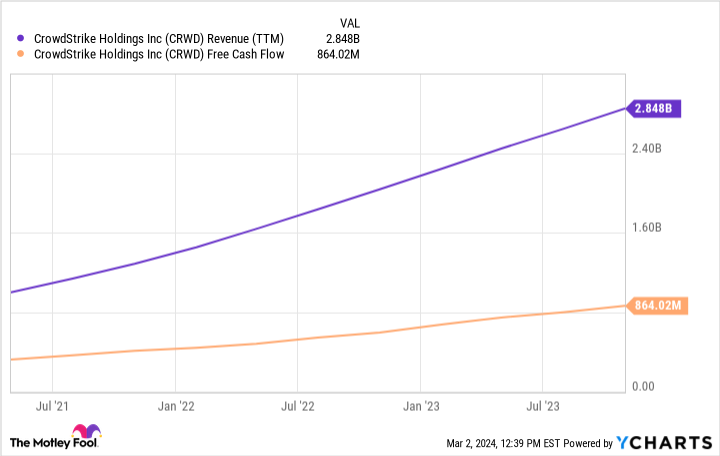

4. CrowdStrike

Cybersecurity company CrowdStrike (NASDAQ: CRWD) has emerged as a leader in next-generation technology, using AI to identify and address threats proactively. The company has expanded beyond endpoint security to grow its addressable market to $100 billion. As you can see below, CrowdStrike is still theoretically very early in its growth journey at less than $3 billion in annual sales.

Cybersecurity is fragmented and competitive, a mix of next-generation players and older, legacy companies from the industry's early years. CrowdStrike's impressive growth over the past few years signals that the business could continue taking market share, and investors are poised to benefit. It's the most prominent company on this list at $75 billion, but decades of growth could be ahead.

5. UiPath

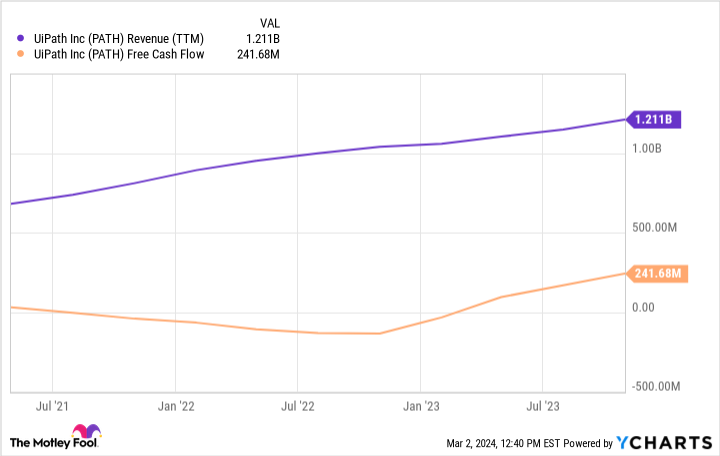

Software automation is still relatively foreign to most companies, but UiPath (NYSE: PATH) could change that. The company's software can observe, learn, and replicate simple computer tasks like filling out forms and organizing data. It's a real-world scenario of automating humans out of simple jobs. Importantly, UiPath is the widely recognized industry leader, according to Gartner.

The company already generates a lot of cash flow, and the stock market cap is only $13 billion. Automating office work could appeal to many companies worldwide, giving the stock potentially lucrative long-term return potential from its currently modest size.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 26, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends CrowdStrike, Palantir Technologies, Target, UiPath, and Walmart. The Motley Fool recommends Gartner and Super Micro Computer. The Motley Fool has a disclosure policy.

5 Artificial Intelligence (AI) Stocks That Could Make You a Millionaire was originally published by The Motley Fool