5 Bargain Stocks With High Profitability

Companies that have positive and steady net margins and operating margins are often good investments because they can return a solid profit to investors.

According to the GuruFocus discounted cash flow calculator as of July 30, the following undervalued companies have a high margin of safety and have grown their margins over a 10-year period.

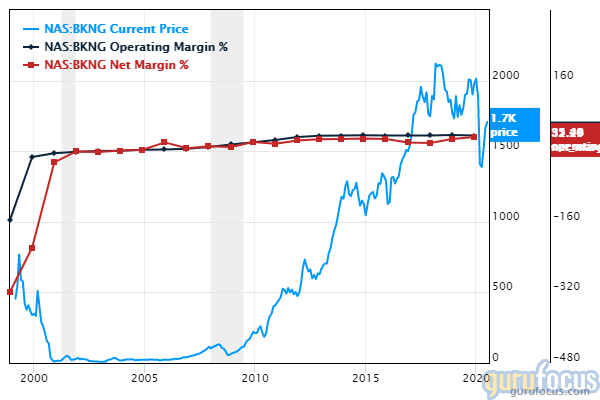

Booking Holdings

Booking Holdings Inc.'s (BKNG) net margin and operating margin have grown 27.25% and 35.50% per annum, respectively, over the past 10 years.

According to the DCF calculator, the stock is undervalued with a 23.81% margin of safety at $1,707.54 per share. The price-earnings ratio is 21.68. The share price has been as high as $2,094 and as low as $1,107 in the last 52 weeks; it is currently 32.38% below its 52-week high and 65.59% above its 52-week low.

The online travel agency has a market cap of $169.89 billion and an enterprise value of $71.69 billion.

The company's largest guru shareholder is Dodge & Cox with 4.18% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 0.59% and First Eagle Investment (Trades, Portfolio) with 0.57%.

VMware

The net margin of VMware Inc. (VMW) has grown 16.68% per annum over the past decade. The operating margin has grown 18.83% per annum over the past decade.

According to the DCF calculator, the stock is undervalued with a 67.28% margin of safety at $139.83 per share. The price-earnings ratio is 9.30. The share price has been as high as $206.8 and as low as $86 in the last 52 weeks; it is currently 32.38% below its 52-week high and 65.59% above its 52-week low.

The software provider has a market cap of $58.60 billion and an enterprise value of $61.17 billion.

The company's largest guru shareholder is PRIMECAP Management (Trades, Portfolio) with 0.25% of outstanding shares, followed by Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.18% and Dodge & Cox with 0.11%.

Ulta Beauty

Ulta Beauty Inc. (ULTA) has grown its net margin and operating margin by 12.95% and 23.22% per year, respectively, over the past 10 years.

According to the DCF calculator, the stock is undervalued with a 5.04% margin of safety at $203.02 per share. The price-earnings ratio is 27.03. The share price has been as high as $368.83 and as low as $124.05 in the last 52 weeks; it is currently 44.96% below its 52-week high and 63.66% above its 52-week low.

The American beauty retailer has a market cap of $11.43 billion and an enterprise value of $13.07 billion.

The company's largest guru shareholder is Pioneer Investments (Trades, Portfolio) with 0.37% of outstanding shares, followed by Louis Moore Bacon (Trades, Portfolio) with 0.14%, PRIMECAP Management (Trades, Portfolio) with 0.12% and the Smead Value Fund (Trades, Portfolio) with 0.08%.

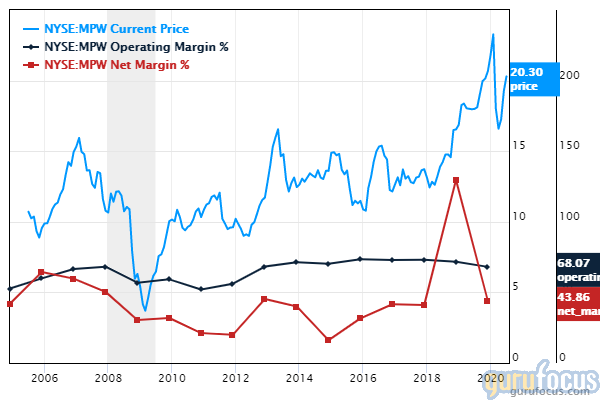

Medical Properties Trust

The net margin of Medical Properties Trust Inc. (MPW) has grown 40.56% per annum over the past decade. The operating margin has grown 70.79% annually over a 10-year period.

According to the DCF calculator, the stock is undervalued with an 11.97% margin of safety at $20.30 per share. The price-earnings ratio is 25.06. The share price has been as high as $24.29 and as low as $12.35 in the last 52 weeks; it is currently 16.43% below its 52-week high and 64.37% above its 52-week low.

The healthcare facility REIT has a market cap of $10.73 billion and an enterprise value of $17.19 billion.

The company's largest guru shareholder is Pioneer Investments (Trades, Portfolio) with 0.12% of outstanding shares.

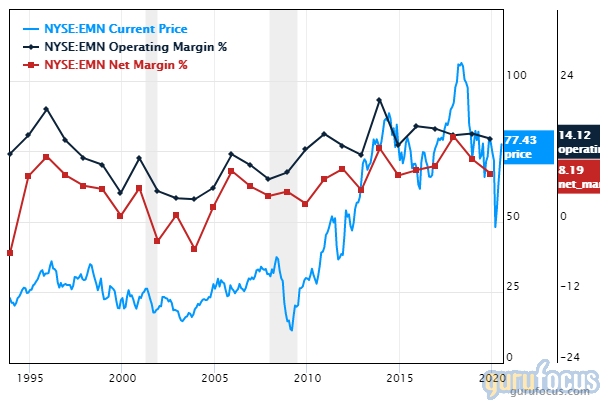

Eastman Chemical

Eastman Chemical Co.'s (EMN) net margin and operating margin have grown 8.90% and 14.84% per year, respectively, over the past 10 years.

According to the DCF calculator, the stock is undervalued with a 37.10% margin of safety at $77.43 per share. The price-earnings ratio is 13.21. The share price has been as high as $86.18 and as low as $34.44 in the last 52 weeks; it is currently 10.15% below its 52-week high and 124.83% above its 52-week low.

The chemicals producer has a market cap of $10.52 billion and an enterprise value of $16.21 billion.

With 0.09% of outstanding shares, Pioneer Investments (Trades, Portfolio) is the company's largest guru shareholder, followed by Joel Greenblatt (Trades, Portfolio)'s Gotham Asset Management with 0.09% and Robert Olstein (Trades, Portfolio) with 0.09%.

Disclosure: I do not own any stocks mentioned.

Read more here:

5 Undervalued Insurance Stocks Boosting Earnings

5 Stocks Expanding Book Value

5 Guru Stocks Predicted to Expand Earnings

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.