5 Biotech Stocks to Buy as New Drug Approvals Drive Industry Prospects

After a decent performance in the first half of 2023, the outlook for the second half of 2023 for the biotech industry looks upbeat as the world cautiously wades through an uncertain macroeconomic environment. Most companies in the sector posted better-than-expected second-quarter performance. Moreover, the outlook provided by the companies indicates bright prospects now on the back of new drug approvals and positive pipeline updates. With the pandemic behind us, biotech companies are looking to bolster their product portfolios and pipeline through collaborations and buyouts. Hence, M&A is back in the spotlight. Given the continuous need for innovative medical treatments, irrespective of the state of the economy, the biotech industry can be a haven despite the inherent volatility and uncertain macroeconomic environment.

Biotech companies like Exelixis, Inc EXEL, Dynavax DVAX, Arcellx, Inc. ACLX, ANI Pharmaceuticals, Inc. ANIP and Vanda Pharmaceuticals, Inc. VNDA are well-poised to outperform the volatile sector.

Industry Description

The Zacks Biomedical and Genetics industry includes biopharmaceutical and biotechnology companies that develop high-profile drugs using path-breaking technology. These biologically processed drugs, which address virology, neuroscience, metabolism and rare diseases, are manufactured using live organisms. As technology becomes paramount to improving global health, the main goal of biotech companies is to use innovative technology to create breakthrough treatments. Quite a few companies in this space are developing vaccines as well as using modern technology. Given the dynamic and evolving nature of technology, the sector is perceived to be riskier than the more stable large-cap pharma or drug industry.

4 Trends Shaping the Future of the Biotech Industry

Innovation, Execution Hold the Key: As only a few companies in this industry have approved drugs in their portfolio, the focus is primarily on the performance of high-profile drugs and pipeline development. Most companies spend millions and billions to create a drug with path-breaking technology, which leads to significant research and development expenditure. Hence, it takes several years before a biotech company turns profitable. Additionally, successful commercialization is the key to higher drug uptake, as smaller biotechs generally lack the funds and expertise to reach the targeted population. This, in turn, prompts collaboration deals with either pharma or biotech bigwigs, wherein sales are shared or royalties are received. Moreover, it may take quite a few years for any newly-approved drug to contribute significantly to its company’s top line.

M&A in Spotlight: Consolidation has always taken center stage in the biotech industry. This is because leading pharma/biotech companies look to diversify their revenue base in the face of dwindling sales of high-profile drugs. While the scale and pace of M&A activity have slowed down over the last couple of years, pharma and pharma/biotech bigwigs are looking to bolster their portfolios. The influx of cash from big pharma further propels the biotech sector. Novartis recently acquired Chinook Therapeutics. Biogen recently announced that it will acquire Reata Pharmaceuticals, Inc. for $7.3 billion. While oncology and immuno-oncology are the key focus areas, treatments for obesity, rare diseases and gene-editing companies also hold potential, making them lucrative investment areas. An attractive pipeline candidate is the key lure for these companies. Cost synergies in research and development are added benefits, as quite a few smaller biotech companies are using innovative technologies to develop drugs and treatments.

New Drug Approvals Boost Prospects: With the pandemic creating havoc and the focus mostly on coronavirus treatments in the last couple of years, the industry saw a slowdown in new drug approvals for other diseases. Nevertheless, with increasing R&D spend and most companies looking to diversify, new drug approvals are likely to see an acceleration going forward.

Pipeline Setbacks & Competition Hurt: Pipeline setbacks are key deterrents for biotech companies, given the exorbitant cost of developing drugs using expensive technology. Most drugs/therapies take years to gain a regulatory nod. An unfavorable outcome from a crucial trial on a promising candidate is a huge setback, particularly for smaller biotechs, which are mostly one-trick ponies. The leading biotechs face other headwinds, including declining sales of high-profile drugs due to intensifying competition.

Zacks Industry Rank Indicates Decent Prospects

The group’s Zacks Industry Rank is basically the average of the Zacks Rank of all the member stocks.

The Zacks Biomedical and Genetics industry currently carries a Zacks Industry Rank #93, which places it among the top 37% of more than 252 Zacks industries. The rank mirrors a bright outlook for the space, probably due to the consistent demand for better medical drugs/treatments. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

Before we present a few biotech stocks that are well-positioned to beat the industry based on a strong portfolio/pipeline, let’s take a look at the industry’s stock market performance and current valuation.

Industry Versus S&P 500 & Sector

The Zacks Biomedical and Genetics industry is a 481-stock group within the broader Zacks Medical sector. It has underperformed the S&P 500 composite and the Zacks Medical sector year to date.

The stocks in this industry have declined 11.8% compared with the Zacks Medical sector decline of 3.7% and against the S&P 500 composite’s rise of 18.6%.

Year-to-Date Price Performance

Industry's Current Valuation

Since most companies in the biotech sector do not have approved drugs, valuing these companies becomes a complex process. On the basis of the trailing 12-month price-to-sales ratio (P/S TTM), which is commonly used for valuing biotech companies with approved portfolios of drugs, the industry is currently trading at 2.37X compared with the S&P 500’s 3.85 and the Zacks Medical sector's 2.79.

Over the last five years, the industry has traded as high as 3.46X, as low as 1.82X and at a median of 2.64X, as the chart below shows.

Price/Sales TTM

5 Biotech Stocks Worth Buying

Vanda’s commercial portfolio comprises two products — Hetlioz for the treatment of non-24-hour sleep-wake disorder and nighttime sleep disturbances in Smith-Magenis Syndrome and Fanapt for the treatment of schizophrenia. While the Hetlioz franchise is facing the risk of generic launches, the company is working to expand the label of the approved drugs to combat these challenges. Moreover, it has a deep and promising pipeline and successful development will provide a boost to the company.

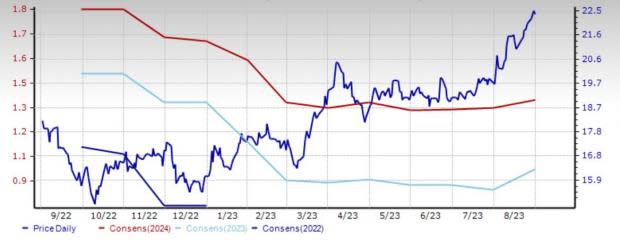

Vanda currently sports a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for loss per share has narrowed by 44 cents in the past 60 days for 2023 and by 78 cents for 2024. You can see the complete list of today’s Zacks #1 Rank stocks here.

Price and Consensus: VNDA

ANI Pharmaceuticals is a diversified biopharmaceutical company developing, manufacturing, and marketing high-quality branded and generic prescription pharmaceutical products. The established and the generic segments continue to perform well. The launch of Purified Cortrophin Gel has been strong on the back of a record number of new patient starts and new cases initiated. The company is looking to increase the scope and scale of its Rare Disease portfolio through M&A and in-licensing. Concurrent with the second-quarter earnings, the company raised its annual guidance.

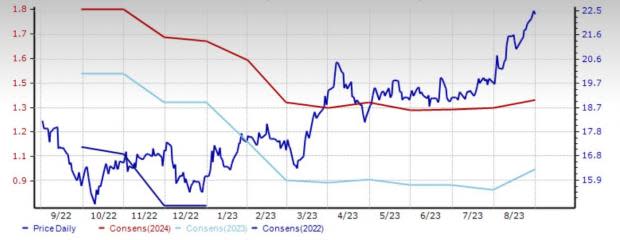

ANIP’s shares have gained 60.1% so far this year. Earnings estimates for 2023 have risen by 34 cents in the past 30 days to $3.73 and by 23 cents to $4.35 for 2024. ANIP currently carries a Zacks Rank #2 (Buy).

Price and Consensus: ANIP

Dynavax, a commercial-stage biopharmaceutical company, is developing and commercializing innovative vaccines against infectious diseases. It has two commercial products, HEPLISAV-B vaccine (Hepatitis B Vaccine [Recombinant], Adjuvanted), which is approved in the United States and the European Union for the prevention of infection caused by all known subtypes of hepatitis B virus in adults 18 years of age and older, and CpG 1018 adjuvant, currently used in multiple adjuvanted COVID-19 vaccines.

HEPLISAV-B continued to maintain a strong market share and the company is also working to expand its label.

Dynavax is also advancing CpG 1018 adjuvant as a premier vaccine adjuvant through global research collaborations and partnerships focused on adjuvanted vaccines for COVID-19, seasonal influenza, universal influenza, plague, shingles and Tdap.

Loss estimates for 2023 have narrowed to 24 cents from 51 cents for 2023 while the earnings estimate for 2024 currently stands at 2 cents per share. The company currently has a Zacks Rank #2.

Price and Consensus: DVAX

Exelixis, an oncology-focused company, maintains momentum on the back of its lead drug Cabometyx (cabozantinib). Cabozantinib tablets are approved in the United States under the brand name Cabometyx for the treatment of patients with advanced renal cell carcinoma (RCC) and hepatocellular carcinoma who have been previously treated with sorafenib and for patients with advanced RCC as a first-line treatment in combination with Opdivo. Cabometyx maintained its status as the leading tyrosine kinase inhibitor for the treatment of RCC, driven by its use in combination with Opdivo in the first-line setting. Exelixis is also making efforts to develop the drug for additional indications and develop additional drugs as well.

Shares of EXEL have gained 39.6% year to date. Earnings estimates for 2023 have risen by 9 cents in the past 60 days to 98 cents. The company currently carries a Zacks Rank #2.

Price and Consensus: EXEL

Arcellx, a clinical-stage biotechnology company, is engineering innovative immunotherapies for patients with cancer and other incurable diseases. These therapies hold potential, given their innovation. Its lead product candidate, CART-ddBCMA, is being developed to treat relapsed or refractory multiple myeloma (rrMM). Arcellx is also advancing its dosable and controllable CAR-T therapy, ARC-SparX, through two clinical-stage programs — a phase I study of ACLX-001 for rrMM, initiated in the second quarter of 2022, and ACLX-002 in relapsed or refractory acute myeloid leukemia and high-risk myelodysplastic syndrome. The company also has a partnership agreement with Kite, a Gilead company for CART-ddBCMA.

Arcellx carries a Zacks Rank #2. Shares of the company have risen 15.7% so far this year.

Price and Consensus: ACLX

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exelixis, Inc. (EXEL) : Free Stock Analysis Report

Dynavax Technologies Corporation (DVAX) : Free Stock Analysis Report

Vanda Pharmaceuticals Inc. (VNDA) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

Arcellx, Inc. (ACLX) : Free Stock Analysis Report