5 Biotech Stocks to Buy as Industry Prospects for 2H23 Look Good

Things are looking better for the biotech industry in the second half of 2023 after a ho-hum performance in the first half and a bumpy ride in 2022 as the world cautiously wades through an uncertain macroeconomic environment. The outlook provided by most companies indicates better prospects due to new drug approvals and positive pipeline updates, which should help combat a recession. Meanwhile, most companies are looking to bolster their product portfolios through collaborations and buyouts. Hence, M&A is back in the spotlight. Given the persistent need for innovative medical treatments, the biotech industry can be a haven despite the inherent volatility and uncertain macroeconomic environment.

Biotech companies like Vaxcyte, Inc. PCVX, Protagonist Therapeutics, Inc. PTGX, Ligand Pharmaceuticals, Inc. LGND, Mesoblast Limited MESO and Puma Biotechnology, Inc. PBYI are well-poised to outperform the volatile sector.

Industry Description

The Zacks Biomedical and Genetics industry includes biopharmaceutical and biotechnology companies that develop high-profile drugs using path-breaking technology. These biologically processed drugs, which address virology, neuroscience, metabolism and rare diseases, are manufactured using live organisms. As technology becomes paramount to improving global health, the main goal of biotech companies is to use innovative technology to create breakthrough treatments. Quite a few companies in this space are developing vaccines as well using modern technology. Given the dynamic and evolving nature of technology, the sector is perceived to be riskier than the more stable large-cap pharma or drug industry.

4 Trends Shaping the Future of the Biotech Industry

Innovation, Execution Hold the Key: As only a few companies in this industry have approved drugs in their portfolio, the focus is primarily on the performance of high-profile drugs and pipeline development. Most companies spend millions and billions to create a drug with path-breaking technology, which leads to significant research and development expenditure. Hence, it takes several years before a biotech company turns profitable. Additionally, successful commercialization is the key to higher drug uptake, as smaller biotechs generally lack the funds and expertise to reach the targeted population. This, in turn, prompts collaboration deals with either pharma or biotech bigwigs, wherein sales are shared or royalties are received. Moreover, it may take quite a few years for any newly-approved drug to contribute significantly to its company’s top line.

M&A in Spotlight: Consolidation has always taken center stage in the biotech industry. It has been an important trend as leading pharma/biotech companies look to diversify their revenue base in the face of dwindling sales of high-profile drugs. After a slowdown in the scale and pace of M&A activity over the last couple of years, things are picking up as pharma and pharma/biotech bigwigs are evidently on the lookout to bolster their portfolios. The influx of cash from big pharma further propels the biotech sector. Pfizer is set to acquire Seagen Inc. Novartis recently announced that it will acquire Chinook Therapeutics. While oncology and immuno-oncology are the key focus areas, treatments for rare diseases and gene-editing companies also hold potential, making them lucrative investment areas. An attractive pipeline candidate is the key lure for these companies. Cost synergies in research and development are added benefits, as quite a few smaller biotech companies are using innovative technologies to develop drugs and treatments.

New Drug Approvals Boost Prospects: With the pandemic creating havoc and the focus mostly on coronavirus treatments in the last couple of years, the industry saw a slowdown in new drug approvals for other diseases. Nevertheless, with increasing R&D spend and most companies looking to diversify, new drug approvals are likely to see an acceleration going forward.

Pipeline Setbacks & Competition Hurt: Pipeline setbacks are key deterrents for biotech companies, given the exorbitant cost of developing drugs using expensive technology. Most drugs/therapies take years to gain a regulatory nod. An unfavorable outcome from a crucial trial on a promising candidate is a huge setback, particularly for smaller biotechs, which are mostly one-trick ponies. The leading biotechs face other headwinds, including declining sales of high-profile drugs due to intensifying competition.

Zacks Industry Rank Indicates Decent Prospects

The group’s Zacks Industry Rank is basically the average of the Zacks Rank of all the member stocks.

The Zacks Biomedical and Genetics industry currently carries a Zacks Industry Rank #112, which places it among the top 45% of more than 251 Zacks industries. The rank mirrors a decent outlook for the space, probably due to the consistent demand for better medical drugs/treatments. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

Before we present a few biotech stocks that are well-positioned to beat the industry based on a strong portfolio/pipeline, let’s take a look at the industry’s stock market performance and current valuation.

Industry Versus S&P 500 & Sector

The Zacks Biomedical and Genetics industry is a 493-stock group within the broader Zacks Medical sector. It has underperformed both the S&P 500 composite and the Zacks Medical sector in the year so far.

The stocks in this industry have declined 7.3% compared with the Zacks Medical sector decline of 3.2%. The S&P 500 composite has gained 14.1% during this time frame.

Year-to-Date Price Performance

Industry's Current Valuation

Since most companies in the biotech sector do not have approved drugs, valuing these companies becomes a complex process. On the basis of the trailing 12-month price-to-sales ratio (P/S TTM), which is commonly used for valuing biotech companies with approved portfolios of drugs, the industry is currently trading at 2.47X compared with the S&P 500’s 3.77 and the Zacks Medical sector's 2.67.

Over the last five years, the industry has traded as high as 3.41X, as low as 1.78X and at a median of 2.69X, as the chart below shows.

Price/Sales TTM

5 Biotech Stocks Worth Buying

Ligand’s business model creates value for stockholders by providing a diversified portfolio of biotech and pharmaceutical product revenue streams that are supported by an efficient and low corporate cost structure. Ligand’s Captisol technology has resulted in partnerships with several leading drug companies, providing it with funds through milestone and royalty payments. The spin-off of its OmniAb business into a separate entity is expected to accelerate growth and improve cost structure. Concurrent with the first-quarter results, the company increased its guidance for 2023 (previously provided in February).

Ligand currently sports a Zacks Rank #1 (Strong Buy).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

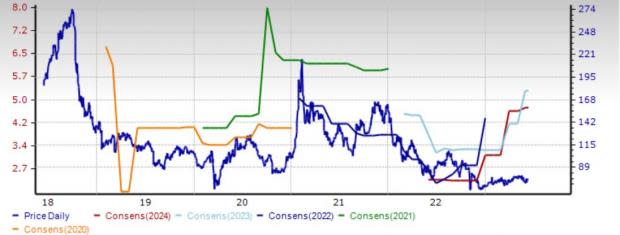

The Zacks Consensus Estimate for 2023 earnings per share has increased 46 cents to $5.25. Earnings estimates for 2024 have jumped from $4.58 per share to $4.69 over the same timeframe. Ligand’s shares have gained 10.8% in the year so far.

Price and Consensus: LGND

Puma Biotechnology is an oncology-focused biopharmaceutical company The company’s only marketed product, Nerlynx (neratinib) was launched in the United States in 2017 for the treatment of early-stage HER2-positive breast cancer. In September 2022, Puma entered into an exclusive license agreement for the development and commercialization of the anti-cancer drug alisertib, a selective, small molecule, orally administered inhibitor of aurora kinase A. Puma intends to focus on the development of alisertib on the treatment of small cell lung cancer and breast cancer. Alisertib, if developed for the abovementioned indications, has the potential to boost the company’s position in the anti-cancer drug market.

PBYI’s shares have gained 41.8% in the past three months. Earnings estimates for 2023 have risen by 10 cents in the past 60 days to 59 cents. Puma Biotechnology currently carries a Zacks Rank #1.

Price and Consensus: PBYI

Vaxcyte, a clinical-stage vaccine innovation company, is developing broad-spectrum conjugate and novel protein vaccines to prevent or treat bacterial infectious diseases. Vaxcyte’s lead candidate, VAX-24, is a 24-valent, broad-spectrum, carrier-sparing pneumococcal conjugate vaccine being developed for the prevention of invasive pneumococcal disease (IPD).

The FDA has also granted Breakthrough Therapy designation to VAX-24 for the prevention of IPD in adults. The recently announced positive results from the phase II study in adults aged 65 and older confirm the potential of its lead vaccine candidate in the adult population and the data supports the potential best-in-class profile for VAX-24. The company is planning to discuss phase II program results with regulators as it advances toward a phase III pivotal study for VAX-24.

Vaxcyte currently carries a Zacks Rank #2 (Buy). Loss estimates for 2023 have narrowed to $2.98 from $3.67 in the past 60 days and to $3.28 from $3.87 for 2024. Shares of the company have risen 8.2% in the year so far.

Price and Consensus: PCVX

Protagonist Therapeutics is a biopharmaceutical company with peptide-based new chemical entities rusfertide and JNJ-2113 (formerly PN-235) in advanced stages of clinical development. Positive top-line data readout for JNJ-2113, an oral first-in-class peptide developed in partnership with Janssen Pharmaceutical Companies of Johnson & Johnson for the treatment of moderate-to-severe plaque psoriasis, as well as strong phase I data from the randomized withdrawal portion of the phase II REVIVE study of its wholly-owned asset, rusfertide boosted investor sentiment. Rusfertide is now being evaluated in a phase III study in polycythemia vera.

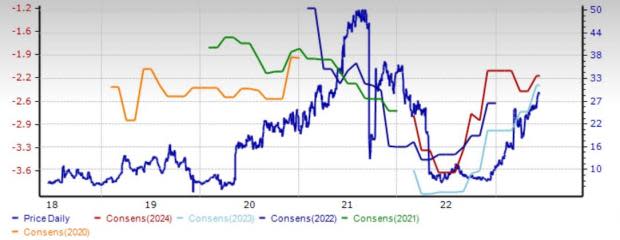

Shares of Protagonist have skyrocketed 165.6% in the year so far. The company currently carries a Zacks Rank #2. Loss estimates for 2023 have narrowed by 35 cents to $2.34 in the past 30 days and by 19 cents to $2.21 for 2024.

Price and Consensus: PTGX

Mesoblast Limited is developing allogeneic (off-the-shelf) cellular medicines for the treatment of severe and life-threatening inflammatory conditions. The recent pipeline progress has been encouraging. Mesoblast resubmitted its biologics license application (BLA) filing for remestemcel-L for the treatment of children with steroid-refractory graft versus host disease (SR-aGVHD) to the FDA. The regulatory body has accepted the filing as being complete and set a target action date of Aug 2, 2023. The resubmission contains new information developed since the complete response letter received in September 2020, including the generation of new data and analyses, which Mesoblast believes provide substantial evidence of remestemcel-L’s effectiveness in pediatric SR-aGVHD.

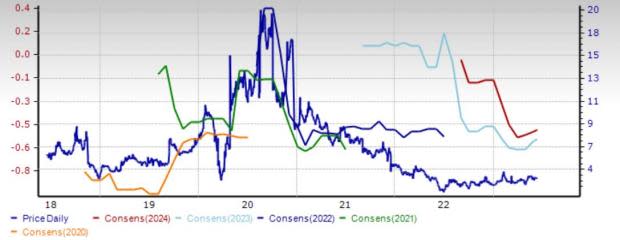

As part of its ongoing review of the BLA, FDA has now conducted the pre-license inspection of the manufacturing process for remestemcel-L.

Mesoblast currently carries a Zacks Rank #2. Loss estimates for 2023 have narrowed by 6 cents to 58 cents in the past 30 days and by 4 cents to 51 cents for 2024. Shares have surged 23.4% in the year so far.

Price and Consensus: MESO

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vaxcyte, Inc. (PCVX) : Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

Puma Biotechnology, Inc. (PBYI) : Free Stock Analysis Report

Mesoblast Limited (MESO) : Free Stock Analysis Report

Protagonist Therapeutics, Inc. (PTGX) : Free Stock Analysis Report