5 Companies Growing Book Value

- By Tiziano Frateschi

According to the GuruFocus All-In-One Screener, the following companies have grown their book value per share (BV/S) over the past decade.

BV/S is calculated as total equity minus preferred stock, divided by shares outstanding. Theoretically, it is what shareholders will receive if a company is liquidated. Total equity is a balance sheet item and equal to total assets minus total liabilities. Since the BV/S may not reflect the company's true value, some investors check the tangible book value to confirm their investment ideas.

Warning! GuruFocus has detected 2 Warning Sign with ATVI. Click here to check it out.

The intrinsic value of ATVI

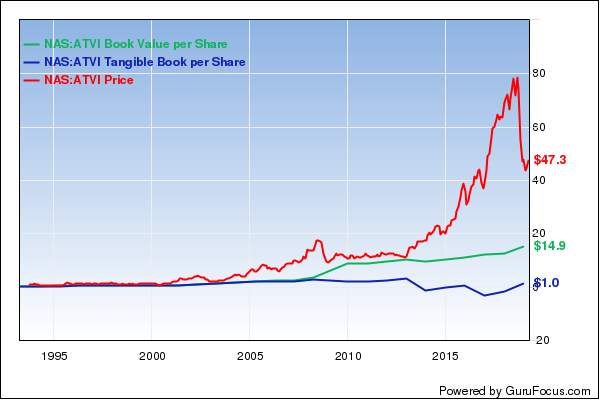

The BV/S of Activision Blizzard Inc. (ATVI) has grown 9.90% over the last 10 years. The price-book ratio is 3.2 and the price to tangible book value is 3.19.

The company, which produces video games, has a $36 billion market cap.

According to the discounted cash flow calculator, the stock is undervalued with a 19% of margin of safety at $47. The share price has been as high as $84.68 and as low as $39.85 in the last 52 weeks. As of Monday, the stock was trading 44.15% below its 52-week high and 18.67% above its 52-week low. The price-earnings ratio is 20.14.

Steve Mandel (Trades, Portfolio) is the company's largest guru shareholder with 2.05% of outstanding shares, followed by Philippe Laffont (Trades, Portfolio) with 1.18%, PRIMECAP Management (Trades, Portfolio) with 1.07% and Frank Sands (Trades, Portfolio) with 0.80%.

Nutrien Ltd.'s (NTR) BV/S has grown 10% over the past decade. The price-book ratio is 1.34 and the price to tangible book value is 3.02.

The company, which provides crop nutrients, inputs and services, has a market cap of $32.42 billion.

The share price has been as high as $58.99 and as low as $43.96 in the last 52 weeks. As of Monday, the stock was trading 8.34% below its 52-week high and 23.0% above its 52-week low. The price-earnings ratio is 9.29.

With 3.84% of outstanding shares, First Eagle Investment (Trades, Portfolio) is the company's largest guru shareholder, followed by Dodge & Cox with 1.36% and Pioneer Investments (Trades, Portfolio) with 0.17%.

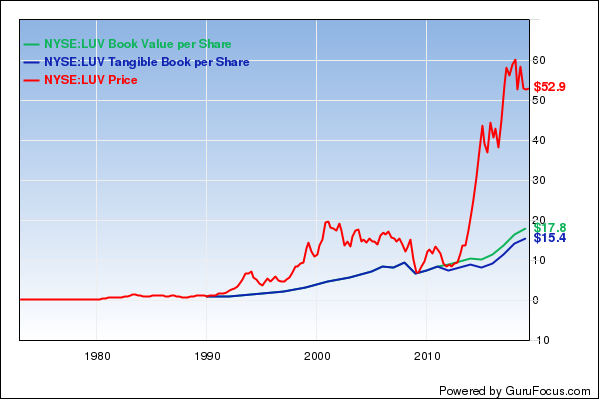

Southwest Airlines Co.'s (LUV) BV/S has grown 9.60% over the last 10 years. The price-book ratio is 2.98 and the price to tangible book value is 3.47.

The airline has a market cap of $29.43 billion.

According to the DCF calculator, the stock is undervalued and is trading with a 56% margin of safety at $52. The share price has been as high as $64.02 and as low as $44.28 in the last 52 weeks. As of Monday, the stock was trading 16.82% below its 52-week high and 20.26% above its 52-week low. The price-earnings ratio is 12.39.

With 13.35% of outstanding shares, PRIMECAP Management is the company's largest guru shareholder, followed by Warren Buffett ( Trades , Portfolio ) with 9.92% and Barrow, Hanley, Mewhinney & Strauss with 0.42%.

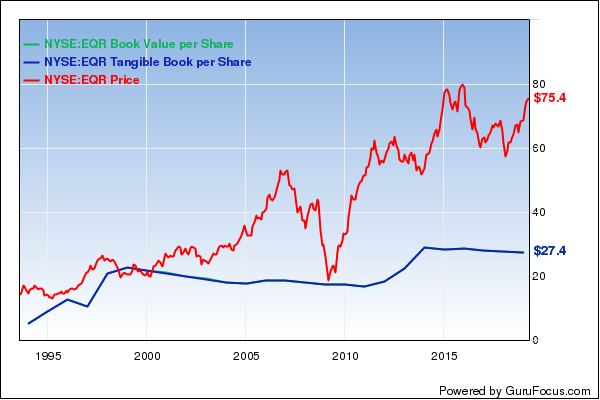

The BV/S of Equity Residential (EQR) has grown 6.30% over the last 10 years. The price-book ratio and the price to tangible book value are both 2.76.

The real estate investment trust has a market cap of $27.97 billion.

According to the DCF calculator, the stock is overpriced by 299% at $75.61. The share price has been as high as $75.88 and as low as $59.29 in the last 52 weeks. The stock is currently trading 0.36% below its 52-week high and 27.53% above its 52-week low. The price-earnings ratio is 42.62.

With 0.70% of outstanding shares, the T Rowe Price Equity Income Fund (Trades, Portfolio) is the company's largest guru shareholder, followed by Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.23% and Pioneer Investments with 0.11%.

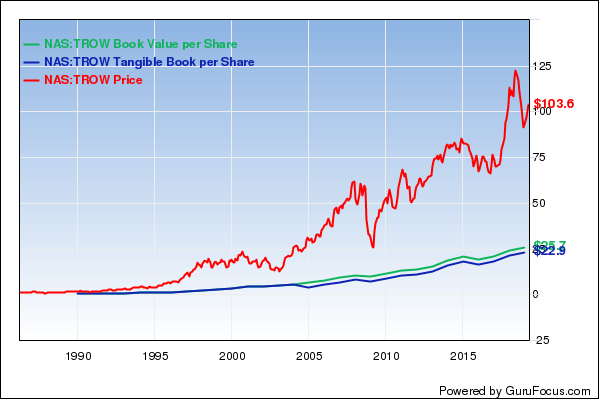

T. Rowe Price Group Inc.'s (TROW) BV/S has grown 6.80% over the past decade. The price-book ratio is 4.07 and the price to tangible book value is 1.93.

The asset management company has a market cap of $24.72 billion.

According to the DCF calculator, the stock is undervalued with a 29% margin of safety at $104. The share price has been as high as $127.43 and as low as $84.59 in the last 52 weeks. The stock is currently trading 18.04% below its 52-week high and 23.47% above its 52-week low. The price-earnings ratio is 14.41.

Simons' firm is the company's largest guru shareholder with 0.38% of outstanding shares, followed by Pioneer Investments with 0.30% and Ron Baron (Trades, Portfolio) with 0.15%.

Disclosure: I do not own any stocks mentioned.

Read more here:

Largest Insider Trades of the Week

6 Cheap Stocks With Low Price-Earnings Ratios

6 Companies Growing Earnings Per Share

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 2 Warning Sign with ATVI. Click here to check it out.

The intrinsic value of ATVI