5 Construction Stocks Wall Street Analysts Think Will Rally in 2024

The construction sector is set for a promising 2024, buoyed by improvements in the residential market backdrop and the U.S. administration's emphasis on infrastructure development.

Per the National Association for Home Builders (NAHB), recent macroeconomic indicators suggest favorable conditions for home construction. Simultaneously, heightened infrastructure investment, a dedicated emphasis on digital initiatives, and the push for renewable energy present the broader construction sector with the potential for additional momentum in 2024.

Insights Into 2024 Sector Prospects

Interest rates have retreated in the past few weeks, in line with market expectations of a dovish Federal Reserve announcement in December. The Federal Reserve not only maintained its pause on the federal funds rate, last raised in July, but also disclosed its projection of three anticipated rate cuts for 2024.

These events elicited a favorable response from long-term interest rates. The 10-year Treasury bond is now hovering around a 3.9% rate, while mortgage rates have dipped below 7% for the first time since mid-August. Additionally, inflation seems to be trending positively, with the Consumer Price Index showing growth of 3.1% in November.

Amidst the rising tide of positive macroeconomic developments, builder sentiment has taken a positive turn. Although it remains more subdued than the current market conditions, the NAHB/Wells Fargo Housing Market Index saw a three-point increase in December, reaching a level of 37. The NAHB anticipates ongoing improvements in the near future.

Simultaneously, the progress and implementation of technological solutions throughout the comprehensive range of decarbonization initiatives, encompassing all aspects of infrastructure for delivering carbon-free energy solutions, have been advantageous for companies within the construction sector. These industry players are anticipated to gain from robust global trends in infrastructure modernization, the transition to clean energy, national security considerations, and a potential super-cycle in global supply-chain investments.

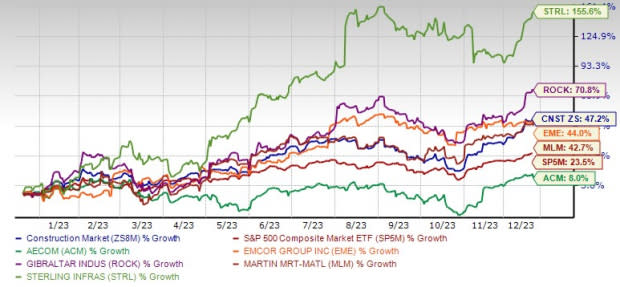

With the Zacks Construction sector registering a notable 47.2% gain over the past year, we expect the momentum to continue in 2024, given the above-mentioned tailwinds. Notably, the broader sector has outperformed the 23.6% rise registered by the Zacks S&P 500 Composite over the same period.

Given these optimistic trends, let's explore some construction stocks that analysts believe will experience a surge in 2024. The importance of this increased attention from analysts is evident in the wealth of valuable data it provides to investors. Analysts have access to crucial information that plays a pivotal role in guiding well-informed investment decisions.

5 Construction Stocks Worth Considering

We have shortlisted five construction stocks with the help of the Zacks Stock Screener that currently has a Zacks Rank #1 (Strong Buy) or 2 (Buy). More than 70% of brokers recommend these stocks as a strong buy or moderate buy. Our research shows such stocks offer good investment opportunities. The Zacks Rank is a reliable tool that helps you trade confidently regardless of your trading style and risk tolerance. To learn more about how to use this proven system for market-beating gains, visit Zacks Rank Education.

With the help of Zacks Stock Screener, we have zeroed in on five construction stocks — EMCOR Group, Inc. EME, Sterling Infrastructure, Inc. STRL, Gibraltar Industries, Inc. ROCK, Martin Marietta Materials, Inc. MLM and AECOM ACM— which look promising based on the above criteria.

Image Source: Zacks Investment Research

The suggested stocks might have showed tepid share price performance over the past year due to the macroeconomic challenges but have solid prospects and are expected to perform well in 2024.

EMCOR: Headquartered in Norwalk, CT, this heavy construction company provides electrical and mechanical construction and facilities services in the United States. EMCOR has been benefiting from solid execution in the U.S. Construction segment — comprising the U.S. Mechanical and Electrical Construction units — as well as disciplined cost control. Also, accretive buyouts have been strengthening its overall results by adding new markets, opportunities and capabilities.

EME, currently carrying a Zacks Rank #1, has gained 44% over the past year. The 2024 earnings per share (EPS) estimate has increased to $12.56 from $11.66 over the past 60 days. Earnings for 2024 are expected to grow 1.5%. It currently holds a VGM Score of A. This helps to identify stocks with the most attractive value, growth and momentum. You can see the complete list of today’s Zacks #1 Rank stocks here.

Sterling Infrastructure: This company operates through subsidiaries within segments specializing in E-Infrastructure, Building and Transportation Solutions, which aid in developing large-scale site development systems and services projects, residential and commercial concrete foundation projects, and infrastructure and rehabilitation projects for highways, roads and bridges, to name a few.

STRL, currently carrying a Zacks Rank #2, has gained 155.6% over the past year. The 2024 EPS estimate has increased to $4.74 from $4.68 over the past 30 days. Earnings for 2024 are expected to grow 13.1%. It currently carries a VGM Score of A.

Gibraltar: This civil infrastructure company has also been riding high on the back of solid demand for infrastructure services throughout end markets in both private and public sectors.

ROCK, currently carrying a Zacks Rank #2, has gained 70.8% over the past year. The 2024 EPS estimate has increased to $4.63 from $4.51 over the past 60 days. Earnings for 2024 are expected to grow 12.1%. It currently carries a VGM Score of A.

Martin Marietta: Based in Raleigh, NC, aggregates and other heavy building materials supplier has been benefiting from solid pricing across businesses amid low volume. Also, the business-mix portfolio, its discreetly curated coast-to-coast footprint and its prime focus on value-over-volume commercial strategy are commendable.

MLM, currently carrying a Zacks Rank #2, has gained 42.7% over the past year. The 2024 EPS estimate has increased to $21.02 from $20.12 over the past 60 days. Earnings for 2024 are expected to grow 14%. It currently carries a VGM Score of A.

AECOM: This leading solutions provider for supporting professional, technical and management solutions for diverse industries is capitalizing on increased infrastructure spending and a committed focus on digital initiatives, leading to a substantial rise in net service revenues and the growth of its backlog.

ACM, currently carrying a Zacks Rank #2, has gained 8% over the past year. The 2024 EPS estimate has increased to $4.36 from $4.26 over the past 60 days. Earnings for 2024 are expected to grow 17.5%. It currently carries a VGM Score of A.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AECOM (ACM) : Free Stock Analysis Report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

Martin Marietta Materials, Inc. (MLM) : Free Stock Analysis Report

Gibraltar Industries, Inc. (ROCK) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report