5 ETF Predictions For 2020

I’m claiming five for five on my 2018 ETF predictions. Last year? Four out of five, yet I still think the one miss will pan out longer term.

So, what’s in store for 2020? I’m intentionally avoiding the obvious topics in my five predictions, but for those who are curious: Nontransparent ETFs will be met with a lukewarm reception, a bitcoin ETF is finally approved later this year, and ESG ETFs continue garnering more media attention than assets (I also think we’ll see a shakeout in ESG ETFs as the market is already becoming saturated with “me too” ESG products).

With that, my 2020 ETF predictions:

More ETF Issuers Embrace Self-Indexing

The majority of ETFs track benchmarks from one of three index providers: S&P Dow Jones Indices, MSCI and FTSE Russell. ETF issuers pay licensing fees for the privilege of using these benchmarks.

With the ETF fee war still raging (Vanguard savagely chopped fees on Christmas Eve), fund companies are looking everywhere to chop back-end expenses to help them lower front-end costs. Licensing fees paid to index providers are low-hanging fruit. How many investors can name the index providers behind their ETFs? How many care?

For a larger view, please click on the image above.

Investors expect fund companies to do their homework and deliver on the investment experience promised. When FTSE accidently included gun stocks in the index underlying a Vanguard ESG ETF, guess who took the blame? Vanguard, not FTSE.

Add in the growth of smart beta stock and bond ETFs—which I expect to continue—and there’s plenty of incentive for ETF issuers to take index construction in-house, where they have full control over the process and the intellectual property.

While there is a case for having independent third parties calculate indexes (regulators have expressed concerns over potential conflicts of interest, and running indexes in-house has a cost), I expect more ETF issuers to pursue self-indexing in 2020.

Increased Scrutiny Of ETF Issuer Conflicts Of Interest

While nearly every ETF issuer is seeking to cut costs, distribution remains king. The first zero and negative(!) fee ETFs came to market in 2019, yet failed to gain traction. Why? Lack of distribution. Many of the largest ETF issuers have built-in distribution, where their proprietary ETFs are:

Heavily marketed on their own platforms (think Schwab or Vanguard)

Predominately used in “robo advisory” offerings (again, think Schwab or Vanguard)

Distributed via asset management or advisory channels (Bloomberg’s Eric Balchunas calls this “BYOA” or “bring your own assets”; think J.P. Morgan wealth managers using J.P. Morgan ETFs)

Held in model portfolios offered to advisors (think iShares offering model portfolios via Envestnet that are loaded up with iShares ETFs)

Larger, vertically integrated firms have numerous ways to make money, from cash sweeps to selling order flow to investment advice. This affords them the ability to, say, offer free model portfolios and make money off the underlying ETFs—their own ETFs.

This raises potential conflicts of interest. A simple way to think about this: “Is an ETF issuer acting as a fiduciary if their robo advisor is stuffed with their own ETFs?”

Do you think individual investors considering/using robo advisory service or financial advisors considering/using 3rd party model portfolios should be concerned if the provider (i.e. fund company) utilizes predominantly their own mutual funds & ETFs?

— Nate Geraci (@NateGeraci) July 26, 2019

As many of those larger, vertically integrated asset managers continue scaling in 2020, I expect more questions will be raised regarding conflicts of interest.

Liquid Alternative ETFs Gather Steam

ETFs offering alternative exposure, such as mimicking hedge fund strategies, have been slow to catch on. ETF.com currently shows 55 alternative ETFs with approximately $5 billion in assets, led by the IQ Merger Arbitrage ETF (MNA), which has a little less than $1 billion ($5 billion is a rounding error in the $4.4 trillion ETF space). The basic idea of liquid alt ETFs is to offer risk/return profiles different than stocks and bonds: Add diversification or portfolio insurance. Dampen volatility. Enhance overall returns.

I believe there are three primary reasons demand has been slow to develop for alternative ETFs:

Stocks and bonds have essentially gone straight up. It simply hasn’t paid to allocate to alts.

Education. Liquid alts are more complicated, and a growing number of investors have (correctly) adopted the mantra of, “If I don’t understand it, I don’t invest in it.”

Cost. Liquid alts are more expensive, which isn’t exactly a recipe for success when investors are gravitating toward to the lowest-cost ETFs.

My prediction is based more on No. 1 (and investor psychology), but I have a hunch that investors are concerned the bull market may be nearing its end and/or that interest rates will rise, hurting bonds. That will lead investors to pursue alternative sources of returns. Enter liquid alt ETFs.

While the ETF wrapper isn’t perfect for every type of alternative strategy, ETFs are helping democratize a space that was previously inaccessible to investors.

Last year, Quadratic Capital’s Nancy Davis offered one of her flagship hedge fund strategies in an ETF wrapper, the Quadratic Interest Rate Volatility and Inflation Hedge ETF (IVOL). It has quickly gathered more than $80 million. Nancy told Bloomberg: “We really want to ETF the whole [hedge fund] business. I see this as a better technology to deliver the exact same strategy to our clients.”

ETFs can provide access to hedge fund strategies at a lower cost, and with liquidity and transparency. With the traditional hedge fund space flailing, and investors wary of future returns from stocks and bonds, I predict liquid alts will gather steam in 2020.

‘Game On’ For Video Gaming & eSports ETFs

I don’t make market calls, and this is not investment advice. However, I think 2020 is the year video gaming and eSports ETFs go primetime.

In 2019, we witnessed a 16-year-old winning $3 million playing Fortnite! Further, 64% of adults played video games in the past three months. More people watch video games than Netflix, HBO, ESPN and Hulu combined! The video gaming and eSports industry is already bigger than the movie and music industries—again, combined! If you haven’t been following this space, FYI, it isn’t the Pacman or Mario Brothers of your childhood.

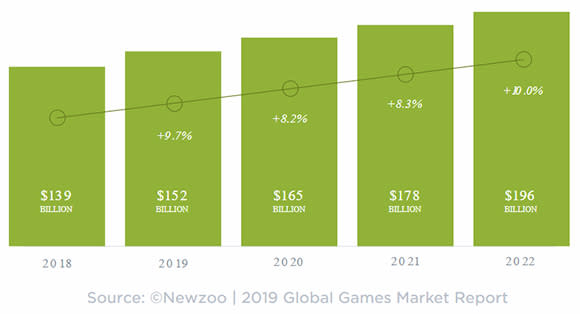

Video games are now produced with technology and budgets that make Hollywood movie producers envious. eSports, where professional video gamers compete in front of audiences, are rivaling traditional professional sports leagues in TV viewership and prize money. Video games and eSports are become ingrained in pop culture, which is why global gaming revenues are expected to eclipse $190 billion by 2022.

I believe the case for gaming is intriguing enough, but if investors are becoming wary of the broad stock market bull run, they’ll be looking for specific areas that can potentially provide better returns. Could that be video games and eSports?

Even if the bull market continues … well, sure, investing in the S&P 500 is great. But that’s no fun to talk about at cocktail parties! I think investors have been somewhat dismissive of this space because video gaming feels childish or unsophisticated. I predict that narrative changes in 2020, and that investors plunk real money into video game ETFs.

ETF Tax ‘Loophole’ Called Into Question

2020 is an election year (cringe), and the cantankerous political environment has candidates seeking any edge they can find. With legitimate concerns around wealth inequality and a growing federal deficit, I have a sneaking suspicion some enterprising candidate will broach the topic of ETF taxation.

Compared to actively managed mutual funds, ETFs offer investors significantly more control over when they realize taxes. This provides the opportunity for investment returns to compound within taxable accounts (to understand why, see here). The bottom line is mutual funds issue significantly more (and larger) capital gains distributions, which are taxable if the funds are held in nonqualified accounts.

For a larger view, please click on the image above.

And, clearly, some view the current situation as unfair, which are topics politicians love to grab onto.

Do ETFs have an *unfair* tax advantage over mutual funds?

Would love any comments on why/why not…

— Nate Geraci (@NateGeraci) December 19, 2019

I believe ETFs offer a fairer approach. With ETFs, you decide when to pay taxes. With mutual funds, you’re at the mercy of other shareholders, along with mutual fund manager decisions.

It seems the best answer might be to level the playing field, pushing mutual fund capital gains realization to end investors. However, that doesn’t help the federal deficit, which is why this topic will get some run in 2020.

Follow Nate Geraci on Twitter @nategeraci

Recommended Stories