5 Financial Companies Expanding Book Value

According to the GuruFocus All-in-One Screener, a Premium feature, the following financial companies have grown their book value per share over the past decade through July 7.

Book value per share is calculated as total equity minus preferred stock, divided by shares outstanding. Theoretically, it is what shareholders would receive if a company is liquidated. Total equity is a balance sheet item and is equal to total assets minus total liabilities.

Since the book value per share may not reflect the company's true value, some investors check the tangible book value to confirm their investment ideas.

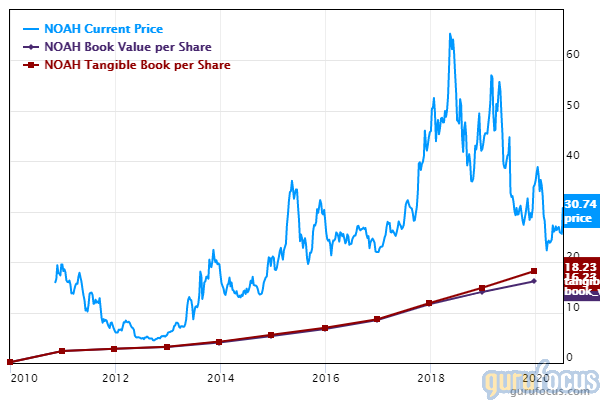

Noah Holdings

The book value per share of Noah Holdings Ltd. (NOAH) has grown 39.9% over the past 10 years. The price-book ratio and the price-tangible book ratio are both 2.03.

The provider of wealth management services has a market cap of $1.8 billion and an enterprise value of $1.35 billion.

According to the discounted cash flow calculator, the stock is undervalued and is trading with a 40.58% margin of safety at $30.74. The share price has been as high as $57.63 and as low as $20.42 in the last 52 weeks. As of Tuesday, the stock was trading 46.66% below its 52-week high and 50.54% above its 52-week low. The price-earnings ratio is 16.92.

With 1.48% of outstanding shares, Chris Davis (Trades, Portfolio) is the company's largest guru shareholder, followed by Ray Dalio (Trades, Portfolio)'s Bridgewater Associates with 0.01%.

First American Financial

First American Financial Corp.'s (FAF) book value per share has grown 7.4% over the past decade. The price-book ratio is 1.21 and the price-tangible book ratio is 1.90.

The insurance services provider has a market cap of $5.2 billion and an enterprise value of $5.39 billion.

According to the DCF calculator, the stock is undervalued and is trading with a 68.68% margin of safety at $47.53. The share price has been as high as $66.78 and as low as $29.36 in the last 52 weeks. As of Tuesday, the stock was trading 28.83% below its 52-week high and 61.89% above its 52-week low. The price-earnings ratio is 8.18.

With 2.9 % of outstanding shares, John Rogers (Trades, Portfolio) is the company's largest guru shareholder, followed by Ken Fisher (Trades, Portfolio) with 0.95% and Steven Cohen (Trades, Portfolio)'s Point72 Asset Management with 0.66%.

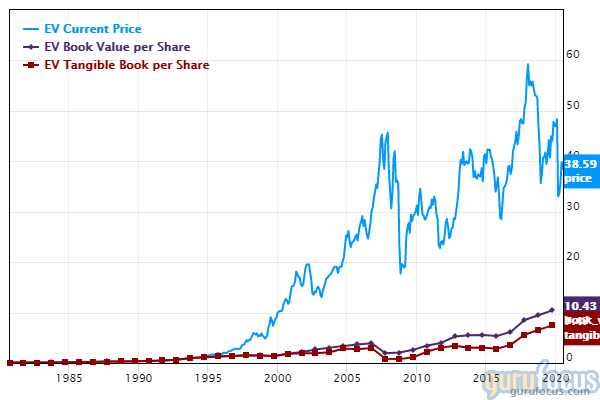

Eaton Vance

Eaton Vance Corp.'s (EV) book value per share has grown 13.10% over the past decade. The price-book ratio is 3.46.

The provider of asset-management services has a market cap of $4.4 million and an enterprise value of $5.48 billion.

According to the DCF calculator, the stock is undervalued and is trading with a 24.98% margin of safety at $38.59. The share price has been as high as $51.79 and as low as $23.59 in the last 52 weeks. As of Tuesday, the stock was trading 25.49% below its 52-week high and 63.59% above its 52-week low. The price-earnings ratio is 11.28.

Pioneer Investments (Trades, Portfolio) and Point72 Asset Management are the company's largest guru shareholders with 0.03% of outstanding shares each.

Encore Capital

The book value per share of Encore Capital Group Inc. (ECPG) has grown 9.9% over the past 10 years. The price-book ratio is 1.19.

The specialty finance company has a market cap of $1 billion and an enterprise value of $4.29 billion.

According to the DCF calculator, the stock is undervalued and is trading with a 32.69% margin of safety at $24.28. The share price has been as high as $40.16 and as low as $15.27 in the last 52 weeks. As of Tuesday, the stock was trading 14.64% below its 52-week high and 124.49% above its 52-week low. The price-earnings ratio is 9.99.

With 0.61% of outstanding shares, Jeremy Grantham (Trades, Portfolio) is the company's largest guru shareholder, followed by Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.20%.

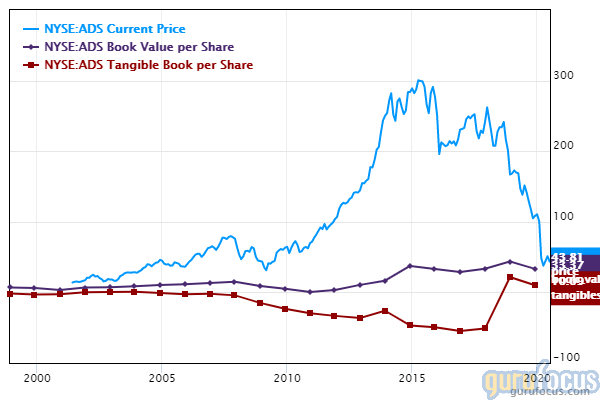

Alliance Data Systems

Alliance Data Systems Corp.'s (ADS) book value per share has grown 40% over the past decade. The price-book ratio is 1.92 and price-tangible book ratio is 73.02.

The provider of marketing and loyalty programs has a market cap of $2 billion and an enterprise value of $7.37 billion.

According to the DCF calculator, the stock is undervalued with a 76.06% margin of safety at $43.81. The share price has been as high as $166.89 and as low as $20.51 in the last 52 weeks. As of Tuesday, the stock was trading 73.75% below its 52-week high and 113.60% above its 52-week low. The price-earnings ratio is 11.59.

Cohen's firm is the biggest guru shareholder of the company with 2.92% of outstanding shares, followed by the Parnassus Endeavor Fund (Trades, Portfolio) with 2.88%.

Disclosure: I do not own any stocks mentioned.

Read more here:

6 Yield-Paying Stocks Trading at Cheap Prices

5 Utilities Trading With Low Price-Earnings Ratios

5 Undervalued Stocks With Profitable Business

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.