5 Growth Stocks to Buy That Are Poised to Beat on Earnings

We are in the first leg of the fourth-quarter 2023 earnings season. The results have so far shown stability, mostly in line with expectations. The earnings results and management guidance will be crucial for market participants to gauge the health of the U.S. economy.

Q4 Earnings So Far

As of Jan 26, 124 companies on the S&P 500 Index have reported their financial numbers. Total earnings for these 52 index members are down 0.4% from the same period last year on 3.4% higher revenues, with 79% beating EPS estimates and 69.4% beating revenue estimates.

At present, total earnings of the S&P 500 Index in fourth-quarter 2024 are expected to be up 1.1% on 2.4% higher revenues. This follows the 3.8% earnings growth on 2% higher revenues in the third quarter and three back-to-back quarters of declining earnings before that.

Q4 2023 At a Glance

The last quarter was an impressive one for Wall Street. The three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — rallied 13.6%, 12.5% and 11.2%, respectively. Investors’ confidence in risky assets like equities was boosted as the Fed indicated in its December FOMC meeting that the interest rate-hike regime might have come to an end, and rate cuts could be expected as early as in first-quarter 2024. U.S. stock markets, especially the growth sectors, regained pace after a brief halt from August to October.

Our Top Picks

We have narrowed our search to five growth stocks that are poised to beat on earnings results next week. Each of these stocks carries a Zacks Rank #2 (Buy) and has a positive Earnings ESP. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here. These stocks also carry a Growth Score of A or B.

Our research shows that for stocks with the combination of a Zacks Rank #3 (Hold) or better and a positive Earnings ESP, the chance of an earnings beat is as high as 70%. These stocks are anticipated to appreciate after their earnings release. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

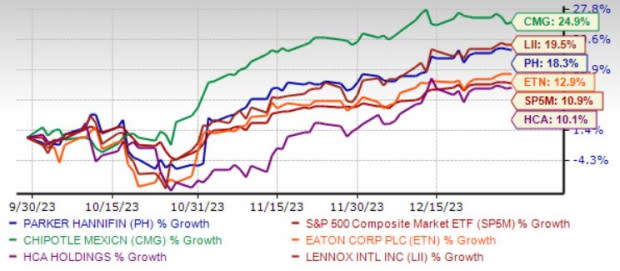

The chart below shows the price performance of our five picks in the last quarter.

Image Source: Zacks Investment Research

Parker-Hannifin Corp. PH is benefiting from higher demand from distributors and end users across the oil and gas, material handling, cars and light trucks, and farm and agriculture markets in the North American region within the Diversified Industrial segment.

Higher volume across all businesses, especially the commercial and military aftermarket businesses bolstered PH’s Aerospace Systems unit. Synergies from the Meggitt buyout are also aiding PH. Benefits from the Win strategy are driving PH’s margins.

Parker-Hannifin has an Earnings ESP of +0.58%. It has an expected earnings growth rate of 7.8% for the current year (ending June 2024). The Zacks Consensus Estimate for current-year earnings has improved 0.1% over the last seven days.

Parker-Hannifin recorded earnings surprises in the last four reported quarters, with an average beat of 11.3%. The company is set to release earnings results on Feb 1, before the opening bell.

Chipotle Mexican Grill Inc. CMG benefits from its digital efforts, Chipotlane add-ons and marketing initiatives. This along with strength in digital sales, rise in menu prices, and new restaurant openings have been driving CMG. Also, a strong comparable restaurant sales growth bodes well. Going forward, CMG continues to focus on the stage gate process and on leveraging digital programs to expand access as well as convenience.

Chipotle Mexican Grill has an Earnings ESP of +1.30%. It has an expected earnings growth rate of 19.6% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.2% over the last seven days.

Chipotle Mexican Grill recorded earnings surprises in three out of the last four reported quarters, with an average beat of 5.8%. The company is set to release earnings results on Feb 6, after the closing bell.

Eaton Corp. plc ETN will benefit from improving end-market conditions and contribution from its organic assets which will assist it in retaining a strong market position. ETN is expanding via strategic acquisitions and its rising backlog shows strong demand for its products. ETN’s strategy to manufacture in the zone of sale has helped it to cut costs.

Eaton has an Earnings ESP of +0.20%. It has an expected earnings growth rate of 10.8% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.2% over the last 30 days.

Eaton recorded earnings surprises in the last four reported quarters, with an average beat of 4.2%. The company is set to release earnings results on Feb1, before the opening bell.

HCA Healthcare Inc.’s HCA revenues remain on an uptick on the back of a surge in admissions, outpatient surgeries and other procedures. Significant growth in its Managed Medicare operations is expected to drive its performance.

Multiple buyouts of HCA aided in increasing patient volumes, enabled network expansion and added hospitals to the portfolio. HCA has been gaining from its telemedicine business line. HCA resorts to prudent capital deployment via share buybacks and dividend payments.

HCA Healthcare has an Earnings ESP of +6.39%. It has an expected earnings growth rate of 7.4% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.1% over the last seven days.

HCA Healthcare recorded earnings surprises in two out of the last four reported quarters, with an average beat of 4.8%. The company is set to release earnings results on Jan 30, before the opening bell.

Lennox International Inc. LII is a global leader in the heating, air conditioning, and refrigeration markets. LII is a leading global provider of climate control solutions. LII designs, manufactures and markets a broad range of products for the heating, ventilation, air conditioning and refrigeration markets.

Lennox International’s products are sold under brand names that include Lennox, Armstrong Air, Bohn, Larkin, Heatcraft and others. LII’s furnaces, heat pumps, air conditioners, pre-fabricated fireplaces and related products are available in a variety of designs, efficiency levels and price points that provide an extensive line of comfort systems.

Lennox International has an Earnings ESP of +0.13%. It has an expected earnings growth rate of 11.7% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.8% over the last 30 days.

Lennox International recorded earnings surprises in the last four reported quarters, with an average beat of 12.9%. The company is set to release earnings results on Jan 31, before the opening bell.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Parker-Hannifin Corporation (PH) : Free Stock Analysis Report

Eaton Corporation, PLC (ETN) : Free Stock Analysis Report

Chipotle Mexican Grill, Inc. (CMG) : Free Stock Analysis Report

Lennox International, Inc. (LII) : Free Stock Analysis Report

HCA Healthcare, Inc. (HCA) : Free Stock Analysis Report