5 Guru Stocks Trading Below Peter Lynch Value

Several gurus are focusing on stocks whose Peter Lynch fair values are above their current prices, according to the GuruFocus All-in-One Screener. As of Tuesday, the following companies are trading with wide margins of safety and have had positive performances over the last 12 months.

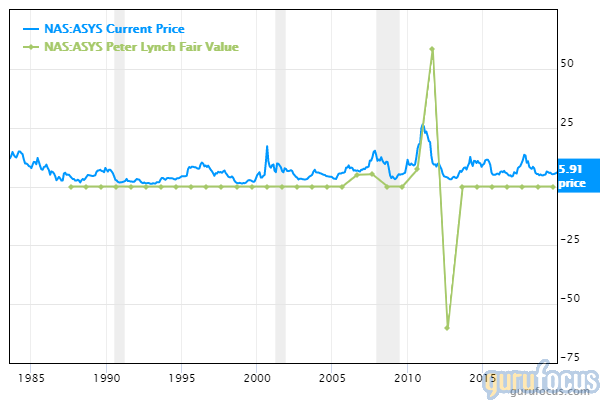

Amtech Systems Inc. (NASDAQ:ASYS) is trading around $6.24 per share. The Peter Lynch value gives the stock a fair price of $10.6, which suggests it is undervalued with a 92% margin of safety. Over the past three months, the stock has registered a positive performance of 17.67%.

The company, which provides solar and semiconductor production and automation systems, has a market cap of $86.47 million and an enterprise value of $39.04 million.

The stock is trading with a forward price-earnings ratio of 43.29, which is lower than 88% of companies in the semiconductors industry. The share price is currently 15.60% below its 52-week high and 50.37% above its 52-week low. The price-book ratio is 1.01.

The company's largest guru shareholder is Chuck Royce (Trades, Portfolio) with 5.55% of outstanding shares.

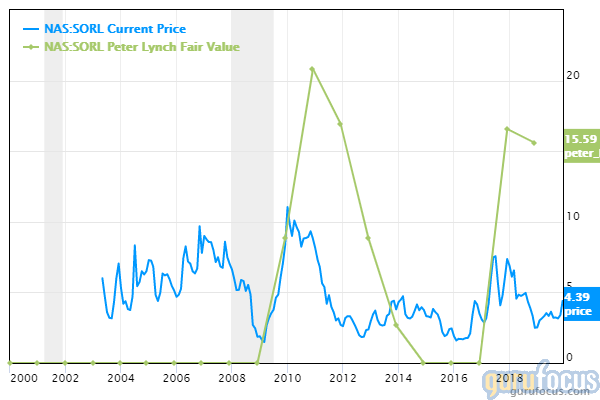

SORL Auto Parts Inc. (NASDAQ:SORL) is trading around $4.4 per share. The Peter Lynch value gives the stock a fair price of $28.47, which suggests it is undervalued with an 85% margin of safety. The stock registered a positive three-month performance of 34.97%.

The company, which provides automotive brake systems, has a market cap of $84.94 million and an enterprise value of $327.87 million.

The stock is trading with a price-earnings ratio of 3.87, which is higher than 96% of companies in the vehicles and parts industry. The share price is currently 0.90% below its 52-week high and 148.59% above its 52-week low. The price-book ratio is 0.45.

Mario Gabelli (Trades, Portfolio) is the company's largest guru shareholder with 0.49% of outstanding shares.

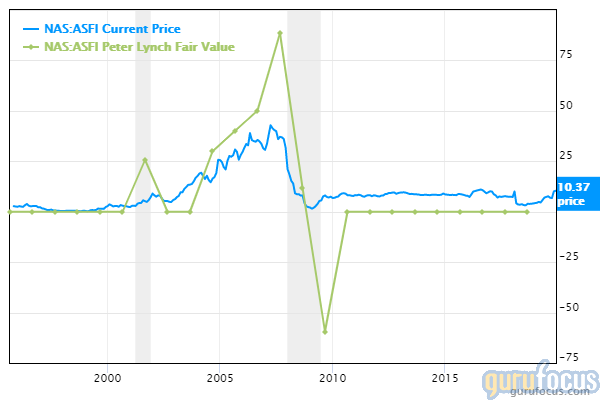

Asta Funding Inc. (NASDAQ:ASFI) is trading around $10.36 per share. The Peter Lynch value gives the stock a fair price of $11.94, which suggests it is undervalued with a 13% margin of safety. Over the past three months, the stock has risen 47.47%.

The company has a market cap of $68.05 million and an enterprise value of $14.87 million.

The stock is trading with a price-earnings ratio of 7.55, which is higher than 66% of companies in the credit services industry. The share price is currently 0.77% below its 52-week high and 186.98% above its 52-week low. The price-book ratio is 0.77.

The company's largest guru shareholder is Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.32% of outstanding shares.

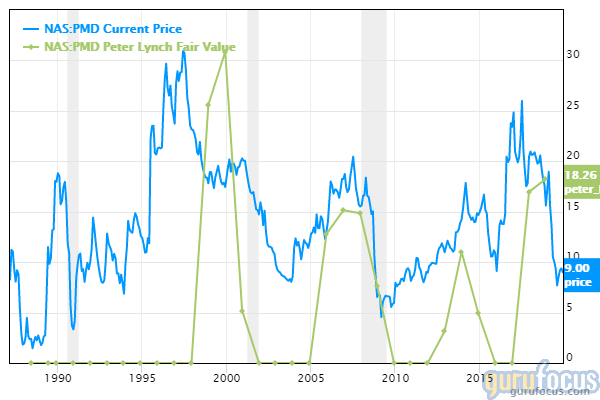

Psychemedics Corp. (NASDAQ:PMD) is trading around $9 per share. The Peter Lynch value gives the stock a fair price of $11.98, which suggests it is undervalued with a 25% margin of safety. Over the past three months, the stock has registered a positive performance of 11.21%.

The company, which provides services for the detection of drugs of abuse, has a market cap of $49.38 million and an enterprise value of $47.74 million.

The stock is trading with a price-earnings ratio of 16.89, which is higher than 80% of companies in the medical diagnostics and research industry. The share price is currently 54.43% below its 52-week high and 25.70% above its 52-week low. The price-book ratio is 2.73.

Simons' firm is the company's largest guru shareholder with 8.20% of outstanding shares, followed by Royce with 0.68%.

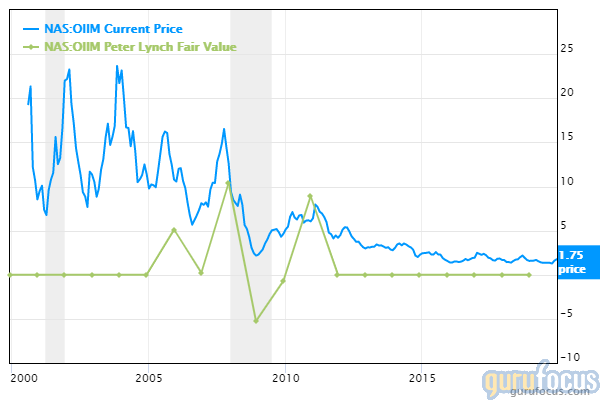

O2Micro International Ltd. (NASDAQ:OIIM) is trading around $1.74 per share. The Peter Lynch value gives the stock a fair price of $5.85, which suggests it is undervalued with a 70% margin of safety. Over the past three months, the stock has risen 33.54%.

The provider of various mixed-signal chips has a market cap of $45.81 million and an enterprise value of $10.28 million.

The stock is trading with a price-book ratio of 0.63, which is higher than 87% of companies in the hardware industry. The share price is currently 11.88% below its 52-week high and 49.66% above its 52-week low.

The company's largest guru shareholder is Simons' firm with 7.57% of outstanding shares.

Disclosure: I do not own any stocks mentioned in this article.

Read more here:

6 Companies With High Dividend Yields

5 Companies Boosting Book Value

6 Predictable Guru Stocks

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.