5 High-Flying Mid-Cap Stocks to Buy for Sparkling Returns

U.S. markets have moved mostly sideways so far in March after rallying strongly in the first two months of 2024. Market participants are waiting for the Fed FOMC meeting to be held on Mar 19-20. Although no rate cut is expected, investors will keenly watch the Fed Chairman’s post-FOMC statements.

Large-cap stock indexes such as the Dow, the S&P 500 and the Nasdaq Composite have shown mixed performance so far in March. Month to date, the mid-cap benchmark — the S&P 400 Index — is up 2.2%.

Investment in mid-cap stocks is often recognized as a good portfolio diversification strategy. These stocks combine the attractive attributes of both small and large-cap stocks. Top-ranked, mid-cap stocks have a high potential to enhance their profitability, productivity and market share. These may also become large caps over time.

If economic growth slows down due to any unforeseen internal or external disturbance, mid-cap stocks will be less susceptible to losses than their large-cap counterparts owing to less international exposure.

On the other hand, if the economy continues to thrive, these stocks will gain more than small caps due to established management teams, a broad distribution network, brand recognition and ready access to capital markets.

Our Top Picks

We have narrowed our search to five mid-caps (market capital > $5 billion, < $10 billion) that have strong potential for 2024. These stocks have seen positive earnings estimate revisions in the past 60 days. Each of our picks sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

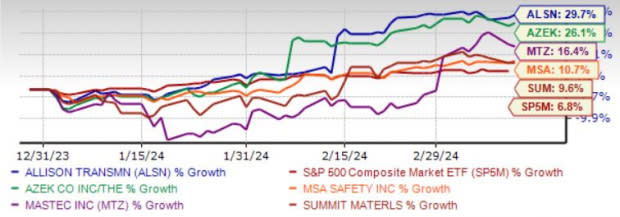

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

MSA Safety Inc. MSA is engaged in the development, manufacture and supply of safety products that protect people and facility infrastructures. MSA’s core product lines include self-contained breathing apparatus, fixed gas and flame detection systems, handheld gas detection instruments, industrial and fire service head protection products and fall protection devices. MSA serves a broad range of industries, including the oil, gas and petrochemical industry, the fire service, construction, mining and general industry.

MSA Safety has an expected revenue and earnings growth rate of 5.1% and 10%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 4.3% over the past 30 days.

Allison Transmission Holdings Inc. ALSN achieved record sales in 2023 primarily on robust demand from the North America On-Highway end market. ALSN expects strong results from the unit this year as well. For the full year, Allison Transmission envisions record total sales in the range of $3.05-$3.15 billion, up from $3.03 billion generated in 2023.

The strategic buyouts of Walker Die, C&R Tool & Engineering, Vantage Power, the Off-Highway transmission portfolio of AVTEC and AxleTech’s electric vehicle system division are set to boost ALSN’s long-term prospects. Regular product launches including FracTran, TerraTran and the 3414 Regional Haul Series fully automatic transmission bode well. ALSN’s electric solutions promise growth opportunities.

Allison Transmission has an expected revenue and earnings growth rate of 2.1% and 3.2%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 9.6% over the past 30 days.

The AZEK Co. Inc. AZEK is a manufacturer of residential and commercial building products. AZEK is engaged in the design, manufacturing, and selling of building products for residential, commercial, and industrial markets in the United States and Canada. AZEK operates through two segments: Residential and Commercial.

The AZEK Co. has an expected revenue and earnings growth rate of 3.3% and 52.7%, respectively, for the current year (ending September 2024). The Zacks Consensus Estimate for current-year earnings has improved 1.8% over the past 30 days.

Summit Materials Inc. SUM operates as a vertically integrated construction materials company in the United States and Canada. SUM operates in three segments: West, East, and Cement. SUM offers aggregates, cement, ready-mix concrete, asphalt paving mixes, and concrete products, as well as plastic components.

SUM also provides asphalt paving and related services. In addition, SUM operates municipal waste, construction, and demolition debris landfills; and liquid asphalt terminals. SUM serves the public infrastructure, and residential and non-residential end markets.

Summit Materials has an expected revenue and earnings growth rate of 80.2% and 53.2%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 15.8% over the past 30 days.

MasTec Inc. MTZ is benefiting from solid accretive buyouts. MTZ completed four acquisitions in 2023. Also, the continued demand for wireline services bodes well. Robust demand for MTZ’s services suggests the potential for double-digit revenues and earnings growth in 2025 and beyond. For 2024, MTZ expects to generate revenues of nearly $12.5 billion, up 4% year over year.

MasTec has an expected revenue and earnings growth rate of 3.8% and 35.5%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 9.9% over the past seven days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report

MasTec, Inc. (MTZ) : Free Stock Analysis Report

MSA Safety Incorporporated (MSA) : Free Stock Analysis Report

Summit Materials, Inc. (SUM) : Free Stock Analysis Report

The AZEK Company Inc. (AZEK) : Free Stock Analysis Report