5 High-Yielding Stocks to Buy for a Stable Portfolio

Wall Street’s solid rally since mid-May has lost momentum in the last few trading sessions. U.S. stock markets may remain rangebound in the near term. in the absence of a trigger in either direction. The second-quarter 2023 earnings season will commence from mid-July and the Fed’s next FOMC meeting will be held on Jul 25-26. These two events will be the next big catalysts.

Meanwhile, volatility may return on Wall Street at least for a short period. A series of key economic data to be released over the next three weeks may result in day-to-day market fluctuations.

At his stage, investment in high dividend paying stocks with a favorable Zacks Rank should be fruitful to stabilize your portfolio. The favorable Zacks Rank will capture the upside potential of the stock while dividends will act as income stream during the market’s downturn.

Our Top Picks

We have narrowed our search to five high dividend paying stocks with strong potential for the rest of 2023. These stocks have seen positive earnings estimate revisions in the last 60 days. Each of our picks carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

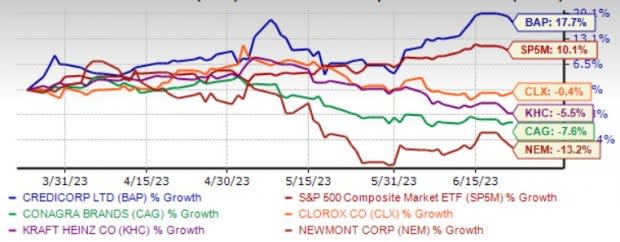

The chart below shows the price performance of our five picks in the past three months.

Image Source: Zacks Investment Research

Conagra Brands Inc. CAG has been benefiting from its robust pricing actions, which aided the top line in the first quarter of fiscal 2023. Results gained from strength in CAG’s brands, efficient pricing and the ongoing execution of the Conagra Way playbook. Conagra Brands delivered improved service and productivity amid ongoing inflationary pressures and industry-wide supply-chain hurdles.

Management expects the inflationary landscape to persist in fiscal 2023. Nonetheless, pricing and innovation are likely to aid CAG. We expect organic sales to increase 4.9% in fiscal 2023, which is at the higher end of management’s view of 4-5%.

Conagra Brands has an expected revenue and earnings growth rate of 1.6% and 3%, respectively, for the current year (ending May 2024). The Zacks Consensus Estimate for current-year earnings has improved 0.7% over the last 60 days. It has a dividend yield of 3.84%.

The Clorox Co. CLX manufactures and markets consumer and professional products worldwide. CLX benefited from solid demand, cost-saving efforts, strong execution, and pricing actions.

CLX has been on track with its IGNITE strategy and digital investments to transition to a cloud-based platform. Also, continued strength in the international segment bodes well. Fiscal 2023 organic sales are anticipated to be flat to up 3-4%, in sync with our estimate of 1.6% growth.

Clorox has an expected revenue and earnings growth rate of 2.9% and 25.8%, respectively, for the current year (June 2024). The Zacks Consensus Estimate for current-year earnings has improved 0.5% over the last 30 days. It has a dividend yield of 3.02%.

Credicorp Ltd. BAP provides various financial, insurance, and health services and products primarily in Peru and internationally. BAP’s principal objective is to coordinate and manage the business plans of its subsidiaries to implement universal banking services in Peru, while diversifying regionally.

Credicorp has an expected revenue and earnings growth rate of 4.6% and 8.1%, respectively, for the current year (June 2024). The Zacks Consensus Estimate for current-year earnings has improved 1.2% over the last 30 days. It has a dividend yield of 4.53%.

The Kraft Heinz Co. KHC has been benefiting from solid pricing initiatives. This was seen in first-quarter 2023, when the top and bottom lines rose year over year and beat the Zacks Consensus Estimate. Sales grew in North America and the International regions, and results gained from strength in foodservice, emerging markets and U.S. Retail GROW platforms.

KHC raised its adjusted EBITDA and adjusted earnings per share view for 2023. KHC has been benefiting from the strength of its operating model as well as solid transformation efforts to accelerate profit and enhance shareholders' value.

Kraft Heinz has an expected revenue and earnings growth rate of 2.6% and 3.6%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 6.3% over the last 60 days. It has a dividend yield of 4.44%.

Newmont Corp. NEM is making notable progress with its growth projects. NEM is likely to gain from a number of projects including the Tanami expansion, Yanacocha Sulfides and Ahafo north. The merger with Goldcorp is expected to be value-accretive to NEM’s cash flow.

The acquisition of Newcrest will also create an industry-leading portfolio. The union of Newmont and Newcrest is expected to deliver significant value for shareholders and generate significant synergies. NEM remains focused on improving operational efficiency.

Newmont has an expected revenue and earnings growth rate of 2.6% and 35.1%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 3.3% over the last 30 days. It has a dividend yield of 3.76%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Newmont Corporation (NEM) : Free Stock Analysis Report

The Clorox Company (CLX) : Free Stock Analysis Report

Conagra Brands (CAG) : Free Stock Analysis Report

Credicorp Ltd. (BAP) : Free Stock Analysis Report

Kraft Heinz Company (KHC) : Free Stock Analysis Report