5 HMO Stocks to Watch Amid Growing Premiums & Membership

The U.S. health insurance industry, commonly called Health Maintenance Organization (HMO), is likely to benefit from growing membership that gives rise to a steady flow of premiums. Contract wins from federal or state authorities expand geographic presence and fetch premiums to the industry participants. An aging population may sustain solid demand for health insurers’ Medicare plans. An active merger and acquisition (M&A) strategy enables them to bolster capabilities. Technology advancements are meant to boost operational efficiencies. Companies like UnitedHealth Group Incorporated UNH, The Cigna Group CI, Humana Inc. HUM, Centene Corporation CNC and Molina Healthcare, Inc. MOH are well-placed to gain from the industry’s encouraging growth prospects.

About the Industry

The Zacks HMO industry consists of entities (either private or public) that take care of subscribers’ basic and supplemental health services. Companies in this space primarily assume risks and assign health and medical insurance policy premiums. Industry participants also provide administrative and managed-care services for self-funded insurance. Services are generally provided by a network of approved care providers (called in-network), which include primary care physicians, clinical facilities, hospitals and specialists. However, out-of-network exceptions are made during emergencies or when it is medically necessary. Health insurance plans can be availed through private purchases, social insurance or social welfare programs.

4 Trends Influencing the HMO Industry's Fate

Expanding Customer Base: Industry players distribute cost-effective health insurance plans across different U.S. communities and make efforts to upgrade such plan offerings from time to time. The strength of these plans fetches numerous contract wins and renewed agreements from federal or state authorities. This, in turn, results in growing membership, and the resultant benefit emerges in the form of improved premiums, the most significant contributor to a health insurer’s top line. However, the COVID-19 pandemic led to millions of elective procedures being deferred. UnitedHealth Group official's announcement of their expected resumption is a cause of concern for health insurers. An increase in elective surgeries implies elevated medical costs for health insurers, which they must bear by exhausting premiums. However, the solid financial position and diversified operations empower industry participants to counter such headwinds.

An Aging U.S. Population: The Medicare plans, primarily intended for people aged 65 or above, are administered by the Centers for Medicare & Medicaid Services, an agency of the United States Department of Health and Human Services (HHS). The demand for such plans is expected to remain solid in the days ahead, considering the rising aging population throughout the United States. According to the U.S. Census Bureau, the period between 2010 and 2020 registered the fastest population growth in the age group of 65 years and above since 1880-1890. According to Statista, the leading market and consumer data provider, around 16.9% of Americans were 65 years or above in 2020. The percentage is anticipated to reach 22% by 2050. The industry participants can capitalize on the diversified health needs of a medically vulnerable population through their vast array of Medicare plans or even opening senior-focused centers for delivering quality care services.

Pursuit of M&A Strategy: Players in the HMO industry resort to an M&A strategy that aims to enhance capabilities, expand their global presence and widen their customer base. The primary aim behind these deals is to enhance the quality of care and bring diversification benefits, enabling it to attain a competitive edge over industry peers. However, interest rate hikes by the Fed to tame inflation suggest higher borrowing costs, creating a headwind for the industry participants to opt for loans to finance M&A deals.

Technological Advancements: Health insurers pursue significant technology investments to stay up-to-date with the ongoing trend to go digital, showing no mood for slowing down. One such investment relates to devising virtual healthcare solutions, more commonly referred to as telehealth services that individuals can opt for within the comfort of their homes. These services render seamless delivery of healthcare services and are cost-effective. Though the investments might result in escalating costs for health insurers, the telehealth services continue to fetch a steady revenue stream, boost operational efficiencies and drive margins in the long term.

Zacks Industry Rank Instills Optimism

The group’s Zacks Industry Rank, which is the average of the Zacks Rank of all-member stocks, indicates bright near-term prospects. The Zacks Medical-HMOs industry, which is housed within the broader Zacks Medical sector, currently carries a Zacks Industry Rank #48, which places it at the top 20% of more than 250 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1. The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of a positive earnings outlook for the constituent companies in aggregate.

Before we present a few stocks you may want to buy or retain in your portfolio, let’s look at the industry’s recent stock-market performance and valuation picture.

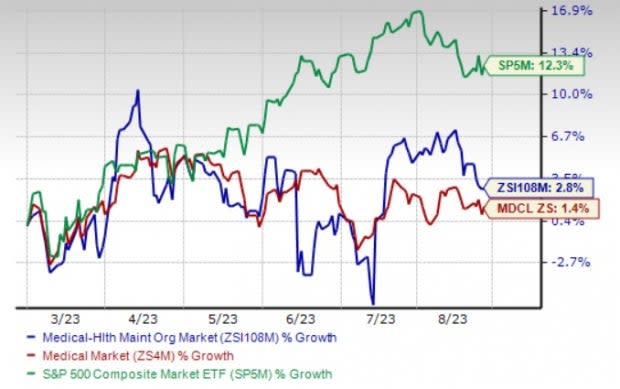

Industry Outperforms Sector But Lags S&P 500

The Zacks Medical-HMO industry has outperformed the Medical sector but fell short of the Zacks S&P 500 composite in the past six months.

In the said time frame, the industry has gained 2.8% compared with the Medical sector’s rally of 1.4%. The Zacks S&P 500 composite has gained 12.3% in the past six months.

Six-Month Price Performance

Image Source: Zacks Investment Research

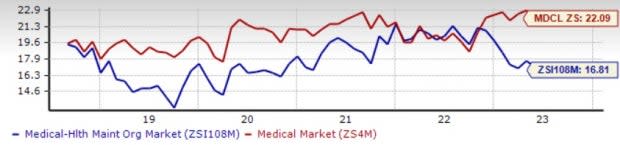

Industry's Current Valuation

Based on the forward 12-month price-to-earnings (P/E) ratio, which is commonly used for valuing medical stocks, the industry trades at 16.81X compared with the S&P 500’s 19.07X and the sector’s 22.09X.

Over the past five years, the industry has traded as high as 21.49X and as low as 12.93X, with the median being at 17.43X, as the chart below shows.

Forward 12-Month Price/Earnings (P/E) Ratio

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

5 Stocks to Keep a Close Eye On

We present five stocks from the space either carrying a Zacks Rank #2 (Buy) or #3 (Hold). Considering the current industry scenario, it might be prudent for investors to buy or retain these stocks in their portfolio, as these are well-placed to generate growth in the long haul.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

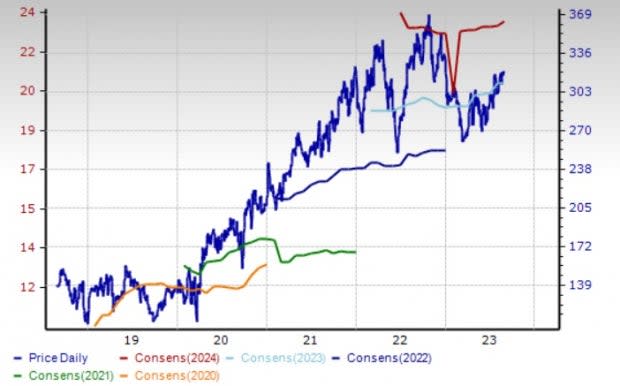

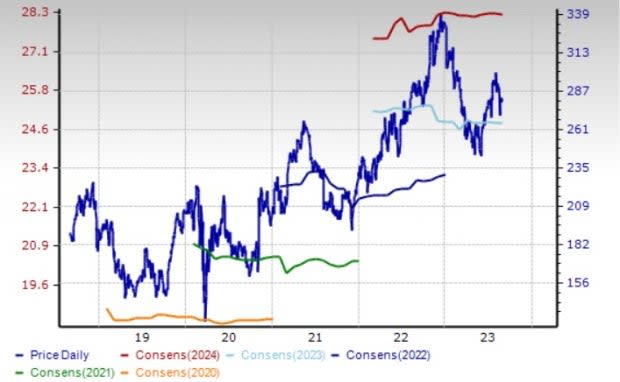

Molina Healthcare: This California-based health insurer gains on improved premium revenues and a growing customer base, resulting from well-devised Medicare and Medicaid plans. Several contract wins and renewals are likely to drive membership growth in the days ahead. This August, the Zacks Rank #2 company received a Medicaid contract from the New Mexico Human Services Department. MOH also resorts to acquisitions to solidify and expand the geographical presence of the business. Contract wins and numerous acquisitions make management optimistic about achieving long-term premium revenue growth in the 13-15% range.

The Zacks Consensus Estimate for Molina Healthcare’s 2023 earnings is pegged at $20.66 per share, indicating a 15.3% rise from the year-ago reported figure. The consensus mark for current-year revenues stands at $33.1 billion, which hints at a 3.4% improvement from the year-ago actual. MOH’s earnings beat estimates in each of the last four quarters, the average being 7.18%. Its shares have gained 19% in the past three months.

Price & Consensus: MOH

Image Source: Zacks Investment Research

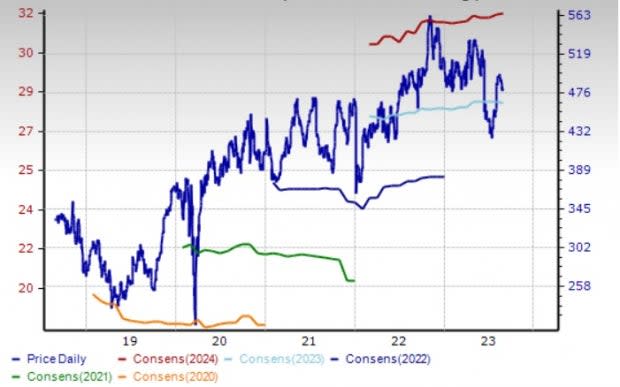

UnitedHealth Group: The Minnesota-based health insurer is aided by solid contributions from the UnitedHealthcare and Optum businesses. Both units strive to offer patient-focused healthcare services at affordable costs across several U.S. communities and pursue the strategy of teaming up with well-established care systems. The Optum unit continues to benefit from numerous buyouts and utilization of advanced technology, market-leading health analytics and modern care delivery. A strong financial position provides a cushion for uninterrupted business investments. This Zacks Rank #3 company has resorted to developing efficient telehealth services.

The Zacks Consensus Estimate for UnitedHealth Group’s 2023 earnings is pegged at $24.83 per share, indicating a 11.9% rise from the year-ago reported figure. The consensus mark for current-year revenues is pegged at $367.8 billion, suggesting 13.5% growth from the year-ago actual. UNH’s earnings beat estimates in each of the last four quarters, the average being 3.39%. Its shares have gained 2.4% in the past three months.

Price & Consensus: UNH

Image Source: Zacks Investment Research

Cigna: Based in Connecticut, Cigna gains from the robust performances of its two well-positioned growth platforms, namely Evernorth and Cigna Healthcare. This Zacks Rank #3 health insurer continues to benefit from a well-performing Government business, which is driven by continuous product expansions, rising membership and new collaborations or contract extensions with renowned healthcare systems. CI places intensified focus on launching cost-effective Medicare Advantage plans, which come with several bundled benefits and improved care coordination. The financial strength can be leveraged to undertake uninterrupted growth-related initiatives.

The Zacks Consensus Estimate for Cigna’s 2023 earnings is pegged at $24.80 per share, implying 6.6% growth from the prior-year reported figure. The consensus mark for current-year revenues stands at $191.6 billion, suggesting a 6.1% improvement from the year-ago actual. CI’s earnings outpaced estimates in each of the last four quarters, the average being 3.60%. Its shares have gained 16% in the past three months.

Price & Consensus: CI

Image Source: Zacks Investment Research

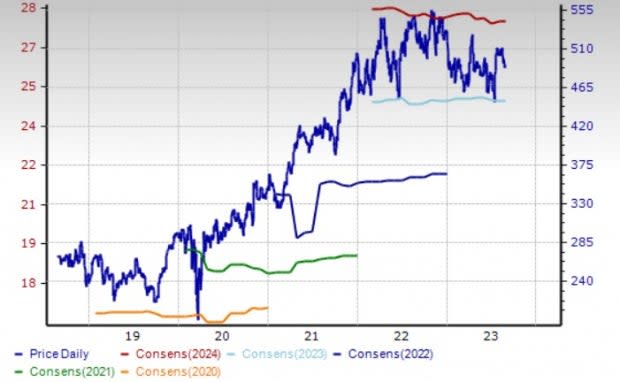

Humana: Headquartered in Kentucky, revenues of Humana benefits on the back of higher premiums and an expanding customer base across its Medicaid and Medicare businesses. HUM resorts to collaborations with well-reputed organizations to launch new plans. Management estimates individual Medicare Advantage membership to witness a minimum membership growth of 825,000 in 2023. A series of acquisitions undertaken over the years has enhanced the capabilities of the Zacks Rank #3 health insurer.

The Zacks Consensus Estimate for Humana’s 2023 earnings is pegged at $28.25 per share, indicating an 11.9% improvement from the year-ago reported figure. The consensus mark for current-year revenues stands at $102 billion, suggesting 9.9% growth from the year-ago actual. HUM’s earnings surpassed estimates in each of the last four quarters, the average being 5.78%. Even though its shares have declined 2.9% in the past three months, solid fundamentals will likely help shares bounce back in the days ahead.

Price & Consensus: HUM

Image Source: Zacks Investment Research

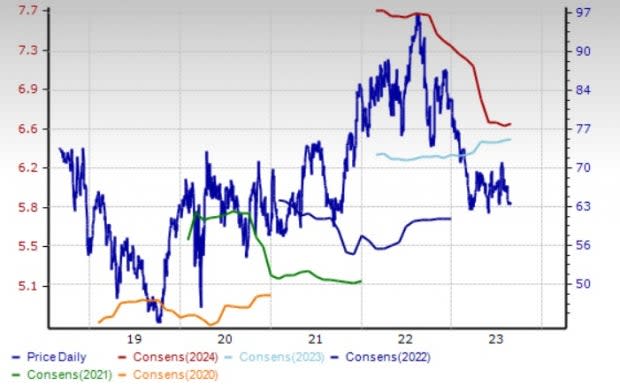

Centene: Based in Missouri, CNC boasts solid Medicare and Medicaid businesses, through which it has been devising cost-effective health plans and bolstering reach across inaccessible regions. The strength in its Medicaid business stems from provider collaborations and significant investments. An aging U.S. population is likely to continue driving solid demand for CNC’s Medicare plans. It resorts to buyouts for expanding its capabilities and customer base. A well-diversified healthcare suite have fetched numerous contract wins for the Zacks Rank #3 health insurer.

The Zacks Consensus Estimate for Centene’s 2023 earnings is pegged at $6.46 per share, which suggests an 11.8% rise from the year-ago reported figure. The consensus mark for current-year revenues stands at $147.9 billion, suggesting a 2.4% growth from the year-ago actual. CNC’s earnings outpaced estimates in two of the last four quarters and missed the mark twice, the average being 0.62%. Its shares have rallied 3.3% in the past three months.

Price & Consensus: CNC

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

Humana Inc. (HUM) : Free Stock Analysis Report

Molina Healthcare, Inc (MOH) : Free Stock Analysis Report

Cigna Group (CI) : Free Stock Analysis Report

Centene Corporation (CNC) : Free Stock Analysis Report