5 Home Builders to Buy on Solid Housing Market Data

The housing sector has been witnessing a solid revival in 2023. On Jun 19, the National Association of Home Builders//Wells Fargo preliminary Housing Market Index (HMI) for June came in at 55, marking the sixth straight month of increase in home builders’ confidence. For the first time the confidence level has crossed the mid-point 50 mark to enter positive territory since July 2022.

On Jun 20, the U.S. Census Bureau and the U.S. Department of Housing and Urban Development jointly announced that the privately-owned housing starts in May jumped 21.7% month-over-month to 1.631 million units, surpassing the consensus estimate of 1.4 million units. However, April’s data was revised downward to 1.34 million units from 1.401 million units reported earlier. Year over year, housing starts grew 5.7% in May.

Privately-owned building permits in May surged 5.2% month-over-month to 1.491 million units, outpacing the consensus estimate of 1.41 million units. April’s data was revised marginally upward to 1.417 million units from 1.416 million units reported earlier. However, year over year, building permits fell 12.7% in May.

The housing market is likely to remain buoyant as the Fed paused its interest rate hike in the June FOMC meeting. At this stage, it will be prudent to invest in building construction stocks with a favorable Zacks Rank.

Our Top Picks

We have narrowed our search to five home builders that have seen positive earnings estimate revisions for 2023 in the last seven days. This indicates that market participants are expecting to do solid business in the near-term. Each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

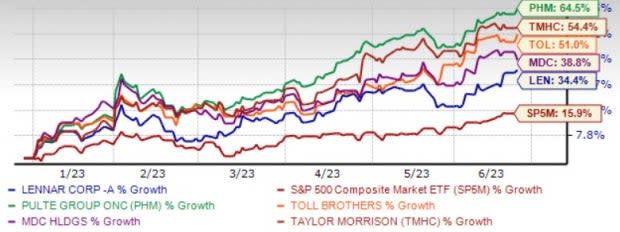

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

PulteGroup Inc. PHM has been benefiting from robust land acquisition and operational strategic initiatives. PHM expects the land acquisition and development investment in 2023 to range from $3.5-$4 billion, up from the previously considered value of $3.3 billion. This is attributed to strong buyer demand and an increase in its construction activities. Earnings estimates for 2023 have increased to $2.43 per share from $2.41 in the past 30 days, reflecting analysts’ optimism over PHM’s prospect.

The Zacks Consensus Estimate for current-year earnings of this Zacks Rank #1 company has improved 1% over the last seven days.

Toll Brothers Inc. TOL has seen stabilized mortgage rates and improved buyer confidence, resulting in higher demand for homes. This, combined with its policy of boosting its supply of spec homes into the spring selling season and focus on operational efficiency, has helped TOL to deliver solid results.

TOL’s build-to-order approach and solid backlog level as well as lack of competition in the luxury housing market are encouraging. Toll Brothers plans to drive shareholder value by returning cash to shareholders through share repurchases and dividend payments, highlighting its stable financial position.

The Zacks Consensus Estimate for current-year earnings of this Zacks Rank #1 company has improved 2.4% over the last seven days.

M.D.C. Holdings Inc. MDC is benefiting from the Build-to-Order process, which provides it a competitive edge over its peers. This approach helps reduce inventory risk, enhances efficiencies in construction and provides predictability on future deliveries.

In a bid to stay competitive in the current market condition, MDC is offering great opportunities for build-to-order buyers, such as long-term interest rate lock programs and other special incentives. Land acquisition strategies and high liquidity add to MDC’s growth.

The Zacks Consensus Estimate for current-year earnings of this Zacks Rank #1 company has improved 4.7% over the last seven days.

Lennar Corp. LEN has been benefiting from effective cost control measures and higher operating leverage. LEN is using its dynamic pricing model, which enables it to set prices according to evolving market conditions. Courtesy of this strategy, Lennar had earlier taken advantage of the strong demand trend, which helped it to maximize cash flow and return on inventory.

LEN has increasingly integrated its marketing strategy via digital channels. It strategically invests in companies involved in technology initiatives, which help it in enhancing the homebuying experience, reducing SG&A expenses and boosting innovation. LEN’s proprietary DIGITS platform provides digital marketing insights, and analytics and guides for better execution while maximizing prices.

The Zacks Consensus Estimate for current-year earnings of this Zacks Rank #2 company has improved 1.4% over the last seven days.

Taylor Morrison Home Corp. TMHC operates as a public homebuilder in the United States. TMHC designs, builds, and sells single and multi-family detached and attached homes, and develops lifestyle and master-planned communities.

TMHC also develops and constructs multi-use properties consisting of commercial space, retail, and multi-family properties under the Urban Form brand name; and offers title insurance and closing settlement services, as well as financial services.

The Zacks Consensus Estimate for current-year earnings of this Zacks Rank #2 company has improved 1.2% over the last seven days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

Toll Brothers Inc. (TOL) : Free Stock Analysis Report

Lennar Corporation (LEN) : Free Stock Analysis Report

M.D.C. Holdings, Inc. (MDC) : Free Stock Analysis Report

Taylor Morrison Home Corporation (TMHC) : Free Stock Analysis Report