5 Impressive MedTech Industry Growth Stocks to Buy for 2024

The MedTech industry has managed to showcase a decent rally through 2023 despite several financial and external shocks. While many major sectors failed to report a positive return in the face of a record level of inflation, labor shortages and supply-chain issues, the Dow Jones U.S. Select Medical Equipment Index grew nearly 3% during this period. This was primarily led by groundbreaking innovations of AI-based technology, transactions that unite strategic visions of companies, updated business models and new remote health solutions.

Further, with the rising prevalence of chronic conditions like diabetes and renal and cardiovascular diseases, there has been an increased use of medical technology to manage and prevent these health issues. Also, in the post-COVID-19 era, health-conscious consumers are opting for more personalized healthcare, creating opportunities for emerging MedTech companies to address these growing demands.

With new regulatory measures aimed at reducing healthcare costs and the Fed’s possible multiple rate cuts set to boost consumer spending on healthcare services, investors are likely to find medical device stocks more appealing in 2024.

According to the latest FMI report, the MedTech market is expected to be worth $503.2 billion in 2023 and witness an estimated CAGR of 4.4% through 2033. Against this backdrop, stocks like Insulet PODD, Cardinal Health CAH, Haemonetics HAE, Penumbra PEN and Exact Sciences EXAS are expected to continue their strong performance in 2024.

3 Major Areas of Growth

Enhancements in Precision Medicine: Poised to play a crucial role on a global scale, precision medicine allows healthcare providers to deliver personalized care based on the patient's genes, proteins and other substances. According to the MarketandMarkets’ analysis, genetic testing is growing due to the availability of cancer screening, prenatal screening and direct-to-consumer testing.

Its role also remains vital in designing companion diagnostics (CDx) medical tests, which identify patients who are most likely to derive benefit from a specific therapeutic treatment. These tests allow the selection of individualized treatment, supporting the growth of precision medicine adoption.

In the third quarter of 2023, there was a 33% surge in precision and personalized medicine-related patent applications compared to Q3 2022, according to a report based on GlobalData’s research. The increase indicates a competitive landscape where several companies are competing to protect intellectual property rights for their innovative ideas.

Wearable Tech Gaining Importance: GlobalData forecasts suggest that the wearable technology market in the medical sector is set to cross the $100 billion mark in 2023, with an estimated CAGR of 15% by 2030. These devices are often widely utilized in remote patient monitoring and telehealth services to track and monitor vital signs, such as heart rate, glucose levels and blood pressure.

Simultaneously, healthcare applications are also on the rise, extending beyond monitoring and tracking health parameters to predict outcomes based on observations and provide valuable insights to medical professionals. Among the notable advancements, H2o Therapeutics introduced an application designed for monitoring Parkinson's disease symptoms through the Apple Watch.

Application of AI: The role of AI in the medical industry has been a widely discussed topic in recent times. GlobalData research projects AI in the medical device market to increase at a CAGR of 29.1% through 2023-2027. The market’s growth will be propelled by the growing demand for healthcare systems to reduce time and costs and improve detection capabilities, particularly when diagnosing a growing number of patients with complex profiles.

One common application of AI has been in diagnostic settings, where it quickly and precisely detects image abnormalities that might be challenging for the human eye to spot. This allows for the examination of more patient profiles and reduces the risk of misdiagnoses. Several companies are also exploring the application of AI and deep learning to improve medical imaging. Medtronic’s expanded partnership with Cosmo Intelligent Medical Devices — a subsidiary of Cosmo Pharmaceuticals — represents a significant leap in incorporating AI into endoscopic care.

Top 5 Impressive Growth Stocks

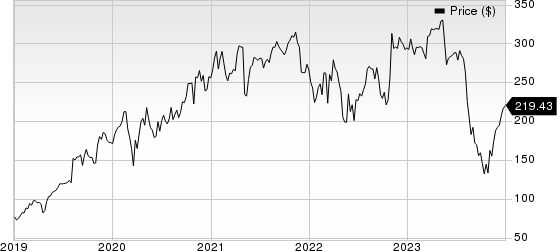

The medical device company, Insulet, has achieved several strategic milestones this year and currently basks in the immense success of its lead offering, the Omnipod 5 automated insulin delivery system. Insulet is also making strides in its innovation pipeline, including Omnipod GO, the iOS option in Omnipod 5 and the integrated Omnipod 5 with DexCom’s G7.

Presently sporting a Zacks Rank #1 (Strong Buy), Insulet’s earnings per share (EPS) has historically grown by a remarkable 71.5% compared to the industry’s 3.1%. The company’s expected 2024 EPS growth rate is 29.8% compared to the industry’s 21.8%.

Insulet Corporation Price

Insulet Corporation price | Insulet Corporation Quote

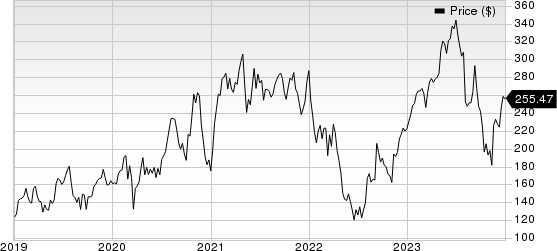

The global healthcare services company, Cardinal Health, had a strong start to fiscal 2024. The company is working on solutions that strategically support community oncologists by addressing their clinical and operational needs. Across Medical, Cardinal Health is utilizing a balanced portfolio approach and has introduced key line extensions in its core products to address critical gaps in the distribution offering.

The Zacks Rank #2 (Buy) stock has an expected EPS growth rate of 18.9% for fiscal 2024 (ending Jun 30, 2024) compared to the industry’s 5%. In the trailing four quarters, the company delivered an average earnings surprise of 15.7%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Cardinal Health, Inc. Price

Cardinal Health, Inc. price | Cardinal Health, Inc. Quote

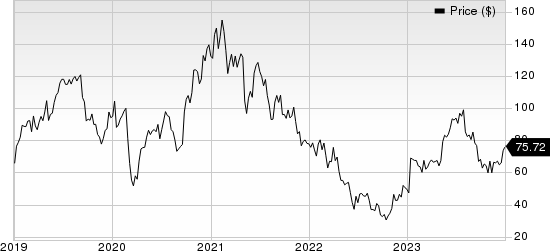

Haemonetics is currently engaged in multiple R&D initiatives, which are helping it hold strong momentum in the highly competitive plasma market. The company prioritizes high-growth, high-margin products and is moving forward with several portfolio rationalization initiatives. Moreover, the company is bolstering its presence in interventional cardiology, which will further propel revenue growth and margin expansion.

The Zacks Rank #2 stock has an expected earnings growth rate of 28.4% for fiscal 2024 (ending Mar 31, 2024) compared to the S&P 500’s 14.2%. In the trailing four quarters, the company delivered an average earnings surprise of 16.1%.

Haemonetics Corporation Price

Haemonetics Corporation price | Haemonetics Corporation Quote

Renowned in the thrombectomy market, Penumbra developed proprietary computer-assisted vacuum thrombectomy products that optimize the three most important elements of clot removal — safety, speed and simplicity. Currently, the company’s momentum is being driven by Lightning Flash, Bolt and RED 72 SENDit. With these products being offered in the United States, the company projects the thrombectomy business to generate nearly 67% of domestic revenues in 2023 and is forecasted to exceed 70% in 2024.

The Zacks Rank #2 stock has a projected 2024 EPS growth rate of 40.2% compared to the industry’s 22%. In the trailing four quarters, the company delivered an average earnings surprise of 55.7%.

Penumbra, Inc. Price

Penumbra, Inc. price | Penumbra, Inc. Quote

The leading cancer diagnostics company, Exact Sciences, made progress in the three most impactful areas — colon cancer screening, molecular residual disease and multi-cancer screening. The company's flagship screening product, the Cologuard test, is estimated to have identified pre-cancerous polyps and early-stage cancer in almost half a million people over the last decade. Also, strategic investments made in the core business are garnering sustainable revenue growth and margin expansion for the company.

This Zacks Rank #2 stock has an expected 2024 EPS growth rate of 17.6% compared with the S&P 500’s 11.1%. In the trailing four quarters, the company delivered an average earnings surprise of 44.2%.

Exact Sciences Corporation Price

Exact Sciences Corporation price | Exact Sciences Corporation Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report

Exact Sciences Corporation (EXAS) : Free Stock Analysis Report

Penumbra, Inc. (PEN) : Free Stock Analysis Report