5 Insurance Brokers to Watch on Increased Business Activity

Better pricing, prudent underwriting, rising demand for insurance products and global expansion have been driving revenues of the Zacks Insurance Brokerage industry players. Fast-paced consolidations in this traditionally fragmented industry are expected to benefit Marsh & McLennan Companies MMC, Aon plc AON, Arthur J. Gallagher & Co. AJG, Willis Towers Watson plc WTW and Brown and Brown BRO.

The increasing adoption of technology and higher spending on technology will help the industry to function smoothly.

About the Industry

The Zacks Brokerage Insurance industry comprises companies that primarily offer insurance and reinsurance products and services. Insurance brokers act on behalf of their clients and offer advice, keeping in mind clients' interests, against brokerage fees. Thus, their business is directly linked with clients’ level of business activity. Some of these companies are also involved in providing risk management, third-party administration and managed healthcare services. Per a report by Allied Market Research, the global insurance brokerage market is projected to rise to $628.3 billion by 2032 or at a nine-year (2023-2032) CAGR of 9.3%. Research Dive estimates the industry players to generate $515.3 billion in revenues by 2028 at a seven-year (2021-2028) CAGR of 5.4%. Increased digitization has been helping to improve operational performance.

3 Trends Shaping the Future of the Insurance Brokerage Industry

Increased Demand for Products to Drive Revenues: The operational results of the industry players are affected by clients’ level of business activity, which, in turn, depends on the extent of economic activity in the industries and markets they serve. Thus, the growth of insurance brokers depends on the demand for insurance products, which, in turn, is driven by increased awareness. Keeping this in mind, industry players are continually expanding globally, cross-selling products, improving pricing, tightening underwriting standards and designing products that are more appealing to customers and match their risk appetite. Better pricing ensures higher commissions for the industry players. Growth in the aging population is driving demand for retirement benefit products, while the rising population of baby boomers and millennials, as well as increasing awareness, is boosting demand for medical insurance, life insurance, accidental insurance as well as other forms of insurance.

Mergers and Acquisitions: The insurance brokerage industry is witnessing fast-paced consolidation. The industry has been traditionally fragmented, with a number of small players. One of the factors driving mergers and acquisitions is the companies’ need to become specialized in their businesses. Some other factors driving M&A are the interest shown by private equity firms in this sector, growing competition and slow organic growth.

Increased Adoption of Technology: Industry players are focused on leveraging technology and innovation, including artificial intelligence, robotics and blockchain, to simplify and improve client experience, increase efficiencies and alter business models. Accelerated digitalization has helped to curb costs, thus aiding margin expansion. Increased digitization also accelerates claims processing, drives sales and improves retention rate. However, the expenses associated with such investments increase costs and, in turn, the expense ratio. Moreover, cyber threats lurk.

Zacks Industry Rank Indicates Rosy Prospects

The Zacks Insurance - Brokerage industry is housed within the broader Zacks Finance sector. It carries a Zacks Industry Rank #68, which places it in the top 27% of more than 250 Zacks industries.

The group's Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, signifies encouraging near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the top 50% of the Zacks-ranked industries is the result of a positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are upbeat about this group’s earnings growth potential.

Before we present a few insurance broker stocks that you may want to consider for your portfolio, let's take a look at the industry's recent stock-market performance and valuation picture.

Industry Outperforms Sector but Underperforms S&P 500

The Insurance Brokerage industry has outperformed the Zacks Finance Sector over the past year but lagged the Zacks S&P 500 composite.

The industry has risen 10% compared with the S&P 500's increase of 20% and the broader sector’s increase of 8.9% in the said time frame.

One-Year Price Performance

Industry's Current Valuation

On the basis of the trailing 12-month price-to-book (P/B), which is commonly used for valuing insurance stocks, the industry is currently trading at 7.33X compared with the S&P 500's 6.25X and the sector's 3.41X.

Over the last five years, the industry has traded as high as 7.98X, as low as 4.51X and at the median of 6.31X.

Trailing 12-Month Price-to-Book (P/B) Ratio

Trailing 12-Month Price-to-Book (P/B) Ratio

5 Insurance Brokerage Stocks to Keep an Eye On

We are presenting one stock from the space currently carrying a Zacks Rank #2 (Buy) and four stocks carrying a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

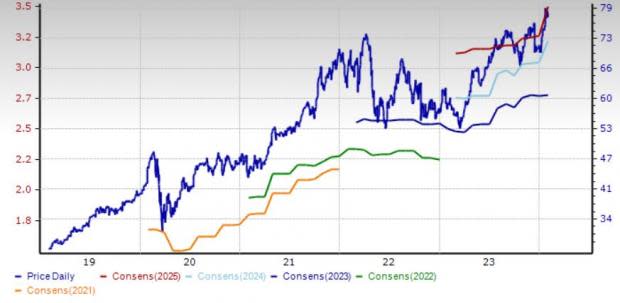

Brown and Brown: Headquartered in Daytona Beach, FL, Brown & Brown markets and sells insurance products and services primarily in the United States, as well as in London, Bermuda, and the Cayman Islands. New businesses, better customer retention, premium rate increases across the majority of business lines, strategic acquisitions and a strong financial position should continue to drive growth for this Zacks Rank #2 insurer.

The Zacks Consensus Estimate for BRO’s 2024 EPS indicates an 8.6% increase year over year. The expected long-term earnings growth rate is 10.8%, better than the industry average of 8.8%. The consensus estimate has risen 7.4% for 2024 in the past 30 days. BRO delivered a four-quarter average earnings surprise of 11.19%.

Price and Consensus: BRO

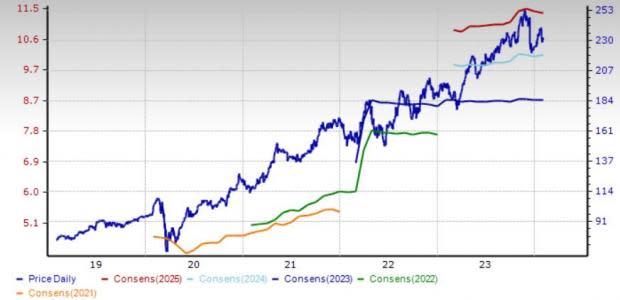

Arthur J. Gallagher & Co.: Headquartered in Itasca, IL, Arthur J. Gallagher is the world’s largest property/casualty third-party claims administrator and the fourth largest globally among insurance brokers based on revenues. This Zacks Rank #3 insurance broker is poised to benefit from the growing contribution of its Brokerage and Risk Management segments, which, in turn, are driving organic revenues.

Given the number and size of its non-U.S. acquisitions, the company expects an increase in international contribution to total revenues. New business production and retention bode well for consistent growth. AJG estimates organic growth to be between 7% and 9% in the Brokerage segment, while the same for the Risk Management segment is expected to be between 9% and 11%. Margins are expected to be around 20% in 2024.

The Zacks Consensus Estimate for AJG’s 2024 EPS indicates a 12.1% year-over-year increase. The expected long-term earnings growth rate is 10.8%, better than the industry average of 9.9%. AJG delivered a four-quarter average earnings surprise of 2.23%. It has a Growth Score of B.

Price and Consensus: AJG

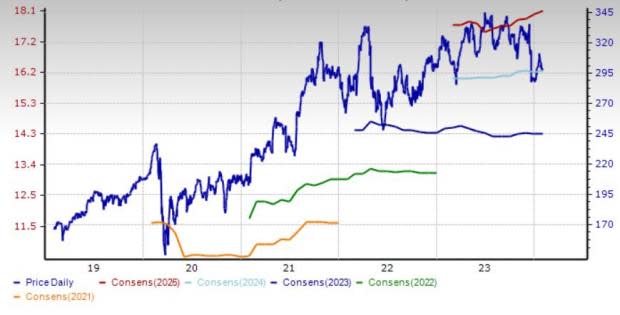

Marsh & McLennan Companies: New York-based Marsh & McLennan provides advice and solutions to clients in the areas of risk, strategy and people worldwide. This Zacks Rank #3 company is well poised to grow on significant investments and acquisitions made within its operating units, product launches, enhanced digital capabilities and new businesses.

Marsh & McLennan delivered a four-quarter average earnings surprise of 6.45%. The Zacks Consensus Estimate for 2024 earnings indicates a 9.6% year-over-year increase. The expected long-term earnings growth rate is 6.5%. It has a Growth Score of B.

Price and Consensus: MMC

Aon: Dublin, Ireland-based Aon offers risk management services, insurance and reinsurance brokerage, human resource consulting and outsourcing services worldwide. The divestiture of non-core operations to streamline its business and deepen its focus on more profitable operations generates a higher return on equity. This, along with cost-curbing measures, bodes well for growth. Aon has an impressive inorganic story. This Zacks Rank #3 insurer broker mainly looks to expand in the health and benefits business, flood insurance solutions and risk and insurance solution operations.

It delivered an average earnings surprise of 1.41% in the trailing four quarters. The Zacks Consensus Estimate for Aon’s 2024 earnings indicates a 13.6% year-over-year increase. The consensus estimate has risen 0.4% for 2024 in the past 30 days. The expected long-term growth rate is pegged at 9.1%.

Price and Consensus: AON

Willis Towers: Based in London, the United Kingdom, Willis Towers Watson plc is a leading global advisory, broking and solutions company. Growing healthcare premiums, increased consulting work and software sales, strategic buyouts and effective capital deployment bodes well for growth. Willis Towers’ growth strategy focuses on core opportunities with the highest growth and returns. The broker innovated and developed its offerings in markets and boosted its abilities in faster-growth markets.

The Zacks Consensus Estimate for 2024 earnings indicates a 14.3% year-over-year increase. The consensus estimate has risen 0.4% for 2024 in the past 30 days. The expected long-term earnings growth rate is 9.9%. It carries a Zacks Rank #3.

Price and Consensus: WTW

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marsh & McLennan Companies, Inc. (MMC) : Free Stock Analysis Report

Aon plc (AON) : Free Stock Analysis Report

Arthur J. Gallagher & Co. (AJG) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

Willis Towers Watson Public Limited Company (WTW) : Free Stock Analysis Report