5 Japanese Leisure Companies to Consider as Tokyo Olympics Is Postponed

In light of the International Olympics Committee postponing the Tokyo Olympics to 2021 amid the coronavirus outbreak, five Japanese leisure companies that have high financial strength and Piotroski F-scores are Tamron Co. Ltd. (TSE:7740), People Co. Ltd. (TSE:7865), Yamaha Corp. (TSE:7951), Kawai Musical Instruments Manufacturing Co. Ltd. (TSE:7952) and Goldwin Inc. (TSE:8111) according to All-in-One Screener results, a GuruFocus Premium feature.

Japanese government agrees to Olympics postponement

The IOC and Japanese Prime Minister Shinzo Abe said on Tuesday in a joint statement that the Games of the XXXII Olympiad in Tokyo must be rescheduled to a date beyond 2020 but before the summer of 2021 to "safeguard the health of the athletes," everyone involved and the international community. The leaders also mentioned that the Games will stay in Japan and keep the "Tokyo 2020" branding to bring out a "beacon of hope to the world during these troubled times."

The IOC's stakeholder consultations also shared their views regarding the postponement and offered support for the Games. European Olympic Committees President Janez Kocijancic said that the European committee will continue supporting the NOCs of Europe and its athletes and hopes that Europeans will "return even stronger" in the years to come.

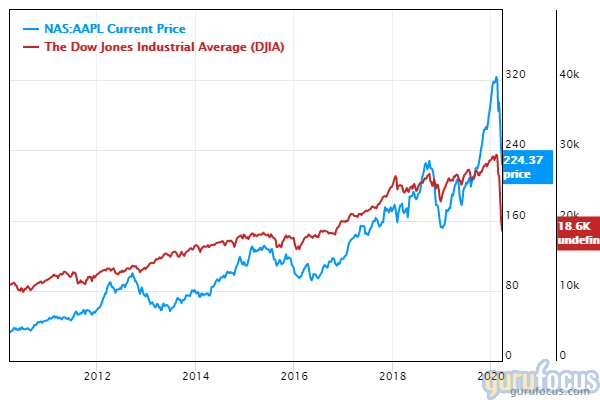

Leisure industry receives major boost on U.S. Senate stimulus bill hopes

U.S. leisure stocks like Norwegian Cruise Line Holdings Ltd. (NYSE:NCLH) and MGM Resorts International (NYSE:MGM) are trading over 30% higher on hopes that a U.S. Senate stimulus bill, which Congress announced it is "closing in" on, will include bailouts for industries hit hard by the virus outbreak. The Dow Jones Industrial Average closed at 20,704.91, up 2,112.98 points or 11.37% from Monday's close of 18,591.93, the best day since 1933.

During the Olympic postponement period, investors might find opportunities in Japanese leisure companies as Japan seeks alternative ways to entertain people around the globe.

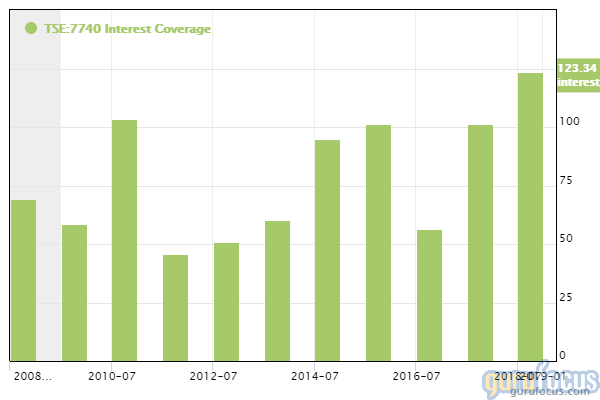

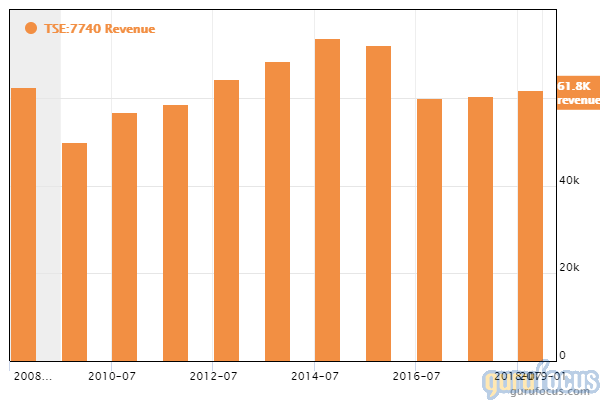

Tamron

Tamron manufactures photographic products, optical components and commercial / industrial-use optics. GuruFocus ranks the company's financial strength 9 out of 10 on several positive investing signs, which include interest coverage and debt ratios that outperform over 86% of global competitors.

Tamron's profitability and valuation both rank 7 out of 10: Other positive investing signs include a return on assets that outperforms 83% of global competitors and price-earnings and price-book ratios near 10-year lows. Despite this, Tamron's three-year revenue decline rate of 4.3% underperforms 75.71% of global travel and leisure companies.

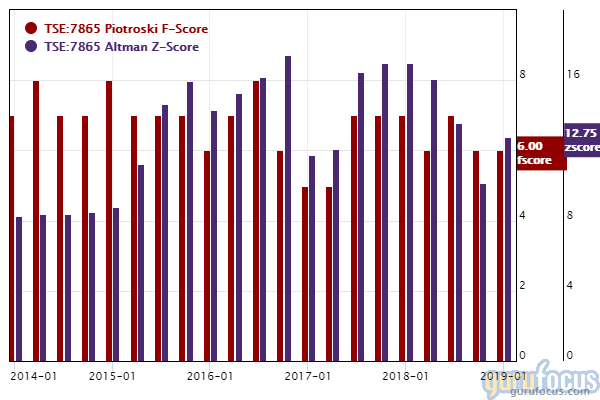

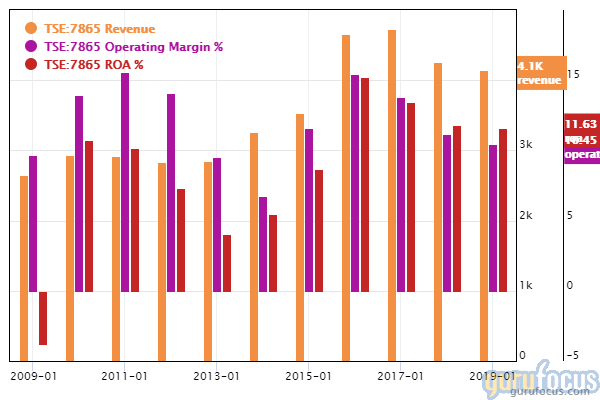

People

People Co. engages in the planning, development and sales of toys, playthings, bicycles, furniture and consigned production. GuruFocus ranks the company's financial strength 10 out of 10 on several positive investing signs, which include no long-term debt and a strong Altman Z-score of 8.93.

The company's profitability ranks 8 out of 10 on the back of expanding operating margins and returns on assets outperforming over 92% of global peers, partially offset by a three-year revenue decline rate that underperforms 74.72% of global competitors.

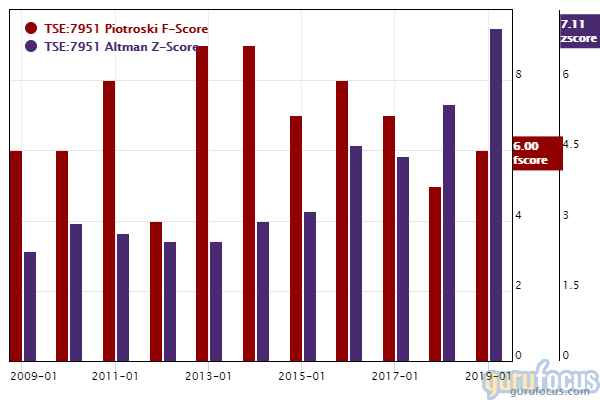

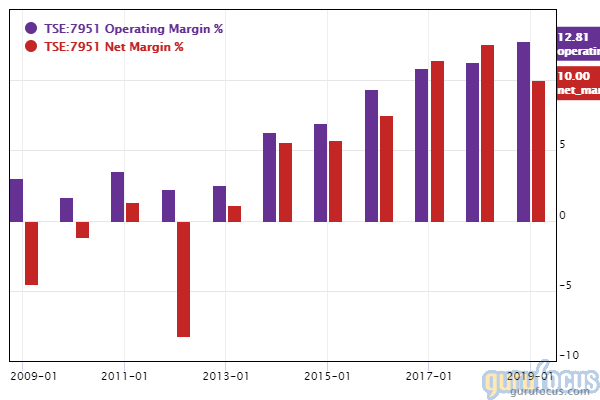

Yamaha

Yamaha manufactures a wide range of musical instruments, audio equipment and electronics. GuruFocus ranks the piano manufacturer's financial strength 8 out of 10 on several positive investing signs, which include a solid Altman Z-score of 4.86 and debt ratios that are outperforming over 80% of global competitors.

Yamaha's profitability ranks 7 out of 10. While operating margins are expanding, they outperform just 64.95% of global competitors.

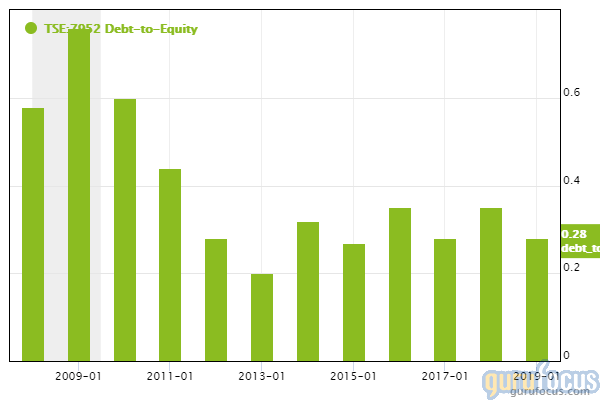

Kawai Musical Instruments

Like Yamaha, Kawai also manufactures musical instruments like pianos. GuruFocus ranks Kawai's financial strength 7 out of 10: Despite a moderately weak Altman Z-score of 2.83, the company's debt ratios are outperforming over 65% of global competitors while interest coverage tops 83.23% of global peers.

Goldwin

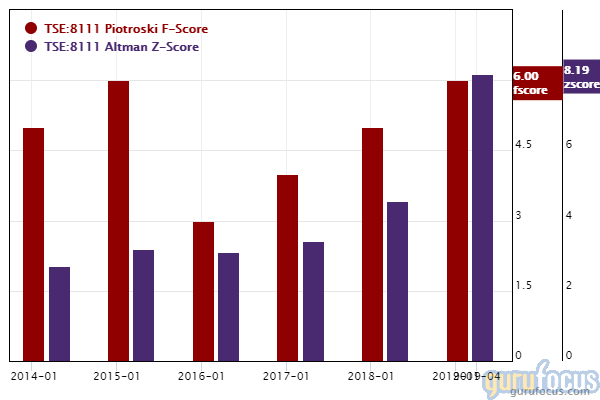

Goldwin manufactures a wide range of sports products, with brands ranging from Goldwin and Speedo to Ellesse and Danskin. GuruFocus ranks the company's financial strength and profitability 8 out of 10 on several positive investing signs, which include expanding operating margins, a high Piotroski F-score of 7, a solid Altman Z-score of 6.77 and interest coverage that outperforms 88.18% of global competitors.

Disclosure: No positions.

Read more here:

3 Medical Companies With the Strength to Weather Coronavirus Fears

5 Buffett-Munger Stocks to Spring Toward in 2nd Quarter

5 Dividend Growth Stocks Hedge Fund Gurus Own

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.