5 Large-Cap Stocks to Buy Ahead of Q3 Earnings Next Week

The third-quarter 2023 earnings season has gathered momentum this week. Next week will be the first big week of this reporting cycle with 954 companies slated to release their quarterly financial numbers.

The season has begun with weak expectations as the market’s benchmark — the S&P 500 Index — is likely to witness the fourth consecutive quarter of earnings decline. As of Oct 18, 53 companies have reported results. Total earnings of these companies are up 6% year over year on 6.6% higher revenues, with 84.9% beating EPS estimates and 67.9% beating revenue estimates.

For third-quarter 2023, total earnings of the S&P 500 companies are currently expected to be down -1.1% year over year on 0.8% higher revenues. However, our current projection has shown that this reporting cycle is expected to be the last period of declining earnings for the S&P 500 Index, with positive growth resuming from the fourth quarter. In this regard, the guidance given by management will be of utmost importance.

Meanwhile, we have selected five large-cap (market capital > $10 billion) stocks with a favorable Zacks Rank that are set to beat on third-quarter earnings this week. The combination of a favorable Zacks Rank and possible earnings beat is likely to drive stock prices in the near future.

Our Top Picks

We have narrowed our search to five large-cap stocks that are set to declare earnings results next week. Each of our picks carries a Zacks Rank #2 (Buy) and has a positive Earnings ESP. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Our research shows that for stocks with the combination of a Zacks Rank #3 (Hold) or better and a positive Earnings ESP, the chance of an earnings beat is as high as 70%. These stocks are anticipated to appreciate after their earnings release. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

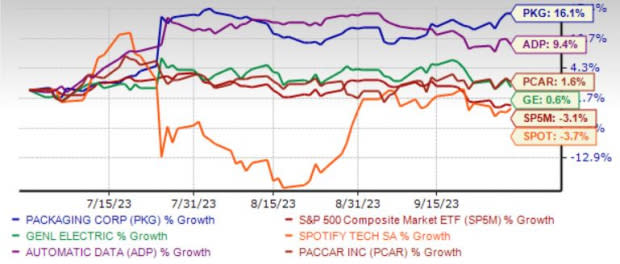

The chart below shows the price performance of our five picks in the last quarter.

Image Source: Zacks Investment Research

Packaging Corporation of America PKG is poised to gain from the growth in e-commerce activities that will continue to support demand for packaging. Also, stable demand for food, beverages, medication, and other consumer products bodes well for the Packaging segment. The conversion of the No. 3 paper machine at PKG’s Jackson, AL-based mill to liner board in a phased manner will aid growth.

Packaging Corporation of America has an Earnings ESP of +1.35%. PKG recorded earnings surprises in three out of the last four reported quarters, with an average beat of 5.1%. The company is set to release earnings results on Oct 23, after the closing bell.

General Electric Co. GE has been benefiting from the strong performance of the Aerospace unit, driven by commercial aerospace strength, significant growth in LEAP engine deliveries and higher defense engine orders.

With strength in GE Gas Power services and growth at Grid business and Onshore Wind in North America, signs of improvement in GE Vernova (the combined operations of GE Power and Renewable) hold promise. Due to these tailwinds, GE has raised its 2023 guidance.

General Electric has an Earnings ESP of +1.93%. The Zacks Consensus Estimate for current-year earnings has improved 2.2% over the last 30 days. GE recorded earnings surprises in three out of the last four reported quarters, with an average beat of 35.4%. The company is set to release earnings results on Oct 24, before the opening bell.

Spotify Technology S.A. SPOT provides audio streaming services worldwide. SPOT operates through two segments, Premium and Ad-Supported. The Premium segment offers unlimited online and offline streaming access to its catalog of music and podcasts without commercial breaks to its subscribers.

The Ad-Supported segment provides on-demand online access to its catalog of music and unlimited online access to the catalog of podcasts to its subscribers on their computers, tablets, and compatible mobile devices. SPOT also offers sales, distribution and marketing, contract research and development, and customer support services.

Spotify Technology has an Earnings ESP of +48.11%. The Zacks Consensus Estimate for current-year earnings has improved 0.6% over the last 30 days. SPOT is set to release earnings results on Oct 24, before the opening bell.

PACCAR Inc. PCAR is one of the leading names in the trucking business, with reputed brands like Kenworth, Peterbilt and DAF. The new DAF lineup, comprising the XF, XG and XD models, augurs well. Accelerated efforts toward electrification, connected vehicle services and advanced driver-assistance system options are set to bolster PCAR’s prospects.

PACCAR has an Earnings ESP of +1.18%. It has an expected earnings growth rate of 49.22% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.2% over the last seven days.

PACR recorded earnings surprises in the last four reported quarters, with an average beat of 15.2%. The company is set to release earnings results on Oct 24, before the opening bell.

Automatic Data Processing Inc. ADP continues to enjoy a dominant position in the human capital management market through strategic buyouts like Celergo, WorkMarket, Global Cash Card and The Marcus Buckingham Company.

ADP has a strong business model, high recurring revenues, good margins, robust client retention and low capital expenditure. Further, ADP continues to innovate, improve operations, and invest in its ongoing transformation efforts.

Automatic Data Processing has an Earnings ESP of +1.35%. It has an expected earnings growth rate of 11.1% for the current year (ending June 2024). The Zacks Consensus Estimate for current-year earnings has improved 1.8% over the last 60 days.

ADP recorded earnings surprises in the last four reported quarters, with an average beat of 3.1%. The company is set to release earnings results on Oct 25, before the opening bell.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Electric Company (GE) : Free Stock Analysis Report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

PACCAR Inc. (PCAR) : Free Stock Analysis Report

Packaging Corporation of America (PKG) : Free Stock Analysis Report

Spotify Technology (SPOT) : Free Stock Analysis Report